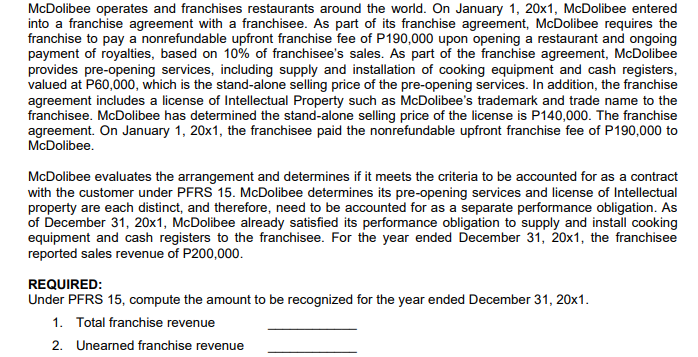

McDolibee operates and franchises restaurants around the world. On January 1, 20x1, McDolibee entered into a franchise agreement with a franchisee. As part of its franchise agreement, McDolibee requires the franchise to pay a nonrefundable upfront franchise fee of P190,000 upon opening a restaurant and ongoing payment of royalties, based on 10% of franchisee's sales. As part of the franchise agreement, McDolibee provides pre-opening services, including supply and installation of cooking equipment and cash registers, valued at P60,000, which is the stand-alone selling price of the pre-opening services. In addition, the franchise agreement includes a license of Intellectual Property such as McDolibee's trademark and trade name to the franchisee. McDolibee has determined the stand-alone selling price of the license is P140,000. The franchise agreement. On January 1, 20x1, the franchisee paid the nonrefundable upfront franchise fee of P190,000 to McDolibee. McDolibee evaluates the arrangement and determines if it meets the criteria to be accounted for as a contract with the customer under PFRS 15. McDolibee determines its pre-opening services and license of Intellectual property are each distinct, and therefore, need to be accounted for as a separate performance obligation. As of December 31, 20x1, McDolibee already satisfied its performance obligation to supply and install cooking equipment and cash registers to the franchisee. For the year ended December 31, 20x1, the franchisee reported sales revenue of P200,000. REQUIRED: Under PFRS 15, compute the amount to be recognized for the year ended December 31, 20x1. 1. Total franchise revenue 2. Unearned franchise revenue

McDolibee operates and franchises restaurants around the world. On January 1, 20x1, McDolibee entered into a franchise agreement with a franchisee. As part of its franchise agreement, McDolibee requires the franchise to pay a nonrefundable upfront franchise fee of P190,000 upon opening a restaurant and ongoing payment of royalties, based on 10% of franchisee's sales. As part of the franchise agreement, McDolibee provides pre-opening services, including supply and installation of cooking equipment and cash registers, valued at P60,000, which is the stand-alone selling price of the pre-opening services. In addition, the franchise agreement includes a license of Intellectual Property such as McDolibee's trademark and trade name to the franchisee. McDolibee has determined the stand-alone selling price of the license is P140,000. The franchise agreement. On January 1, 20x1, the franchisee paid the nonrefundable upfront franchise fee of P190,000 to McDolibee. McDolibee evaluates the arrangement and determines if it meets the criteria to be accounted for as a contract with the customer under PFRS 15. McDolibee determines its pre-opening services and license of Intellectual property are each distinct, and therefore, need to be accounted for as a separate performance obligation. As of December 31, 20x1, McDolibee already satisfied its performance obligation to supply and install cooking equipment and cash registers to the franchisee. For the year ended December 31, 20x1, the franchisee reported sales revenue of P200,000. REQUIRED: Under PFRS 15, compute the amount to be recognized for the year ended December 31, 20x1. 1. Total franchise revenue 2. Unearned franchise revenue

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:McDolibee operates and franchises restaurants around the world. On January 1, 20x1, McDolibee entered

into a franchise agreement with a franchisee. As part of its franchise agreement, McDolibee requires the

franchise to pay a nonrefundable upfront franchise fee of P190,000 upon opening a restaurant and ongoing

payment of royalties, based on 10% of franchisee's sales. As part of the franchise agreement, McDolibee

provides pre-opening services, including supply and installation of cooking equipment and cash registers,

valued at P60,000, which is the stand-alone selling price of the pre-opening services. In addition, the franchise

agreement includes a license of Intellectual Property such as McDolibee's trademark and trade name to the

franchisee. McDolibee has determined the stand-alone selling price of the license is P140,000. The franchise

agreement. On January 1, 20x1, the franchisee paid the nonrefundable upfront franchise fee of P190,000 to

McDolibee.

McDolibee evaluates the arrangement and determines if it meets the criteria to be accounted for as a contract

with the customer under PFRS 15. McDolibee determines its pre-opening services and license of Intellectual

property are each distinct, and therefore, need to be accounted for as a separate performance obligation. As

of December 31, 20x1, McDolibee already satisfied its performance obligation to supply and install cooking

equipment and cash registers to the franchisee. For the year ended December 31, 20x1, the franchisee

reported sales revenue of P200,000.

REQUIRED:

Under PFRS 15, compute the amount to be recognized for the year ended December 31, 20x1.

1. Total franchise revenue

2. Unearned franchise revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT