McGraw-Hill Connect 5 Question 2 p.mheducation.com/ext/map/index.html?_con%3con&external oogleDOCS Next Next: BM Wor.. 3 Project i For each of the following separate situations, determi accounting). a. On December 7, Oklahoma City Thunder sold a $12 b. Tesla sold and delivered a $92,000 car on Deceml c. Deloitte signs a contract on December 1 to provide contract. On December 31, 75% of the services hav Situations Revenue re a. Sale of a ticket to a basketball game b. Sale of a car on credit c. Contract to provide advisory services

McGraw-Hill Connect 5 Question 2 p.mheducation.com/ext/map/index.html?_con%3con&external oogleDOCS Next Next: BM Wor.. 3 Project i For each of the following separate situations, determi accounting). a. On December 7, Oklahoma City Thunder sold a $12 b. Tesla sold and delivered a $92,000 car on Deceml c. Deloitte signs a contract on December 1 to provide contract. On December 31, 75% of the services hav Situations Revenue re a. Sale of a ticket to a basketball game b. Sale of a car on credit c. Contract to provide advisory services

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter2: Working With The Tax Law

Section: Chapter Questions

Problem 1RP

Related questions

Question

Transcribed Image Text:%23

McGraw-Hill Connect

5Question 2- Learning Unit 3 Proj X

CA 2019 CHO7 Project01 Exam x

p.mheducation.com/ext/map/index.html?_con3con&external_browser%-D0&launchUrl=https%253A%252F%252FIms.mheducation.com%252Fmghmiddl

pogleDOCS

Next Next: BM Wor.

3 Project i

es

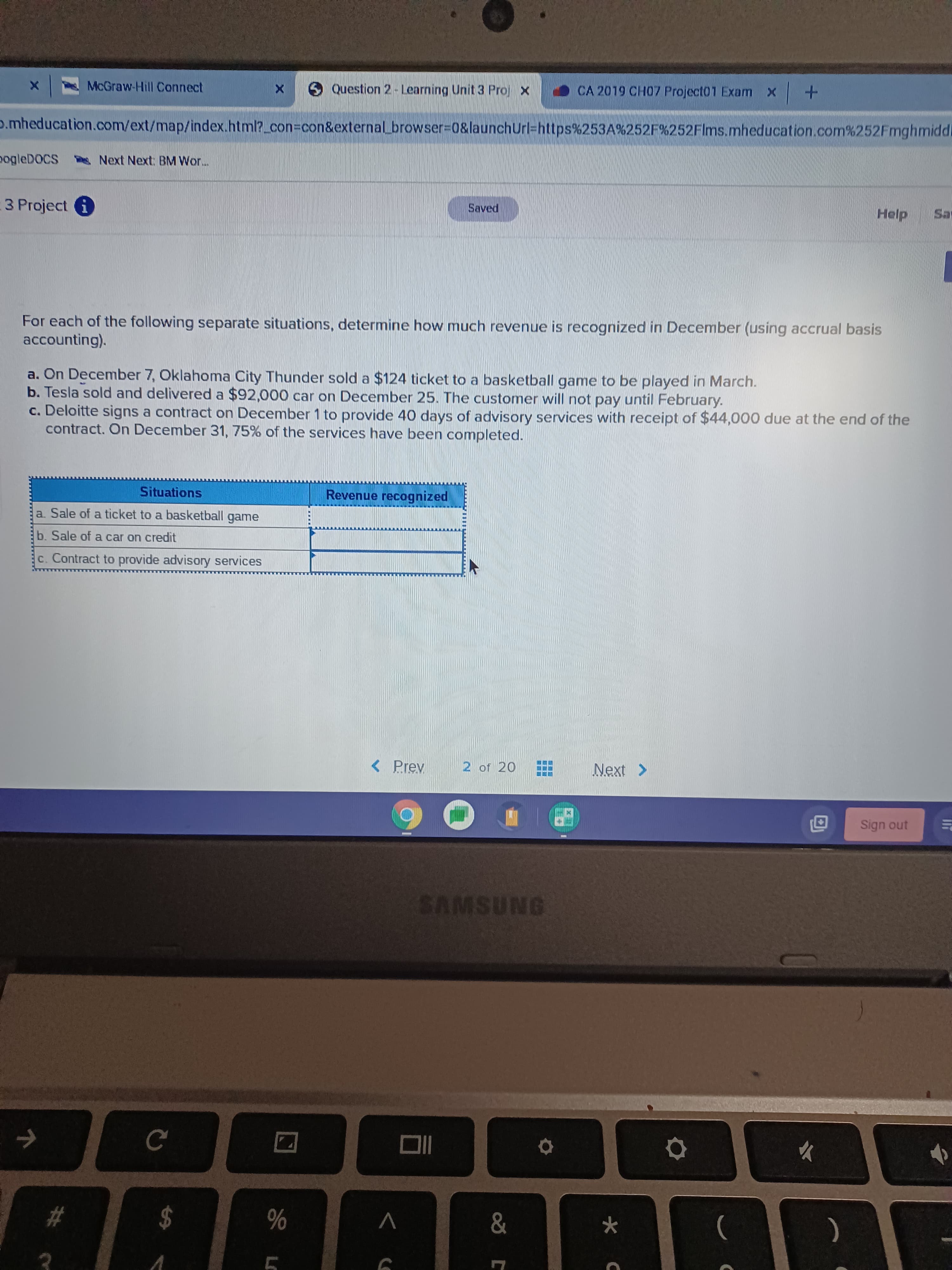

For each of the following separate situations, determine how much revenue is recognized in December (using accrual basis

accounting).

a. On December 7, Oklahoma City Thunder sold a $124 ticket to a basketball game to be played in March.

b. Tesla sold and delivered a $92,000 car on December 25. The customer will not pay until February.

c. Deloitte signs a contract on December 1 to provide 40 days of advisory services with receipt of $44,000 due at the end of the

contract. On December 31, 75% of the services have been completed.

Situations

Revenue recognized

a. Sale of a ticket to a basketball game

b. Sale of a car on credit

c. Contract to provide advisory services

< Prev

2 of 20

Next >

SAMSUNG

YA

%24

V

%

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you