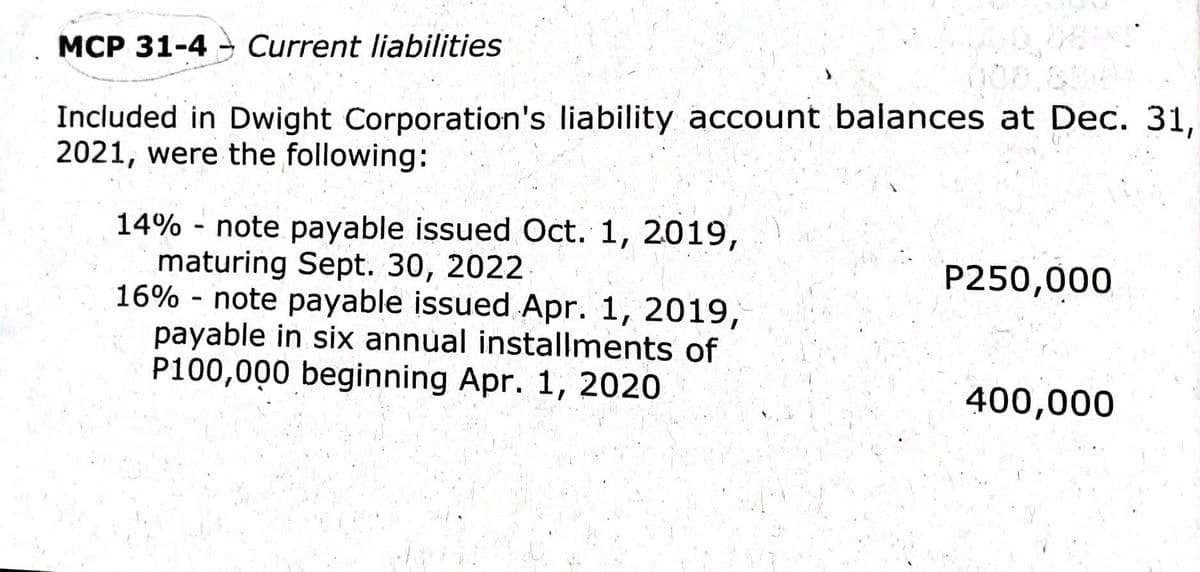

MCP 31-4 Current liabilities Included in Dwight Corporation's liability account balances at Dec. 31, 2021, were the following: 14% - note payable issued Oct. 1, 2019, maturing Sept. 30, 2022. 16% - note payable issued Apr. 1, 2019, payable in six annual installments of P100,000 beginning Apr. 1, 2020 P250,000 400,000

MCP 31-4 Current liabilities Included in Dwight Corporation's liability account balances at Dec. 31, 2021, were the following: 14% - note payable issued Oct. 1, 2019, maturing Sept. 30, 2022. 16% - note payable issued Apr. 1, 2019, payable in six annual installments of P100,000 beginning Apr. 1, 2020 P250,000 400,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 3E

Related questions

Question

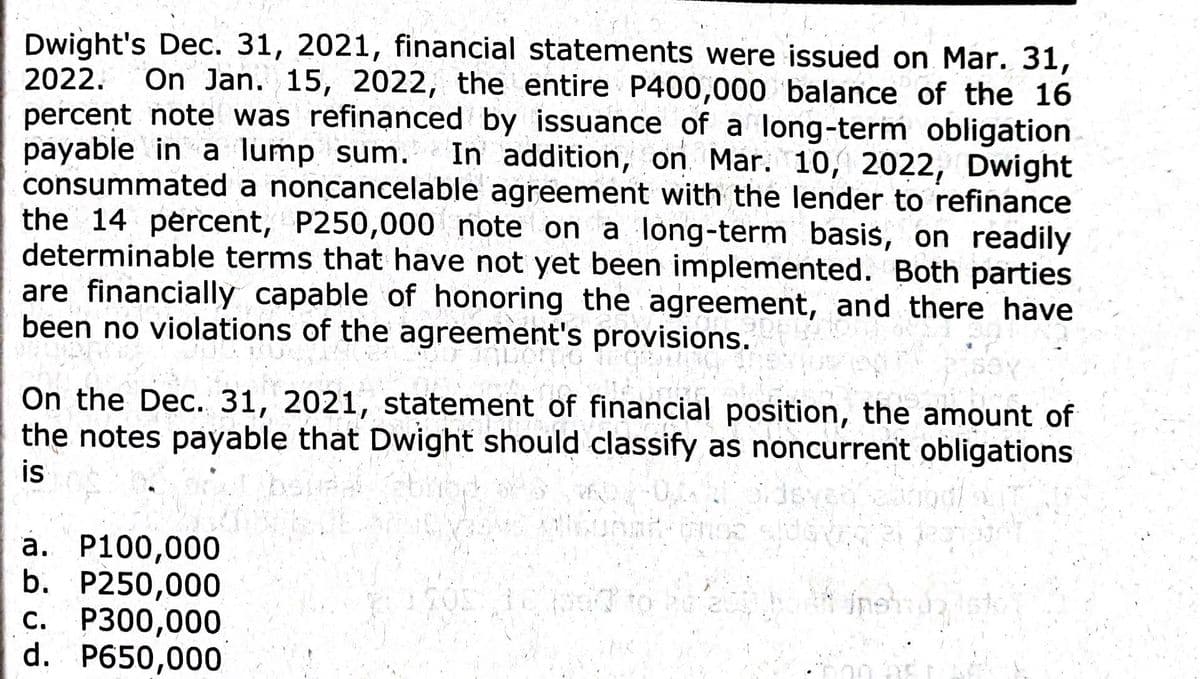

Transcribed Image Text:Dwight's Dec. 31, 2021, financial statements were issued on Mar. 31,

2022. On

On Jan. 15, 2022, the entire P400,000 balance of the 16

percent note was refinanced by issuance of a long-term obligation

payable in a lump sum. In addition, on Mar. 10, 2022, Dwight

consummated a noncancelable agreement with the lender to refinance

the 14 percent, P250,000 note on a long-term basis, on readily

determinable terms that have not yet been implemented. Both parties

are financially capable of honoring the agreement, and there have

been no violations of the agreement's provisions.

GLASSW

onio

On the Dec. 31, 2021, statement of financial position, the amount of

the notes payable that Dwight should classify as noncurrent obligations

is

a. P100,000

b. P250,000

c. P300,000

d. P650,000

10507723

og

Transcribed Image Text:MCP 31-4- Current liabilities

Included in Dwight Corporation's liability account balances at Dec. 31,

2021, were the following:

14% - note payable issued Oct. 1, 2019,

maturing Sept. 30, 2022

16% - note payable issued Apr. 1, 2019,

payable in six annual installments of

P100,000 beginning Apr. 1, 2020

P250,000

400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning