Megan operates a housecleaning business as a sole proprietorship. She oversees a team of 10 cleaning personnel, markets usiness, and provides supplies and equipment. The business has been generating net taxable profits of $50,000 per year, efore considering the QBI deduction. As a sole proprietor, Megan qualifies for the 20 percent deduction, reducing taxable come from the business to $40,000. Required: . Assume that Megan's marginal tax rate on ordinary income is 35 percent and that she has no pressing need for cash flow from this business. Should Megan consider incorporating and operating the business through a C corporation? Fill the bel table to justify your answers. (Ignore any payroll or self-employment tax considerations.) Answer is complete but not entirely correct. Income tax liability if operated as a C corporation Income tax savings Should Megan consider incorporating and operating the business through a C corporation? . How would your conclusion in part (a) change if Megan's marginal tax rate were only 28 percent? X Answer is complete but not entirely correct. decrease ✓to $ 10,500X Annual tax savings will $50,000 X $ 10,500 per year Yes

Megan operates a housecleaning business as a sole proprietorship. She oversees a team of 10 cleaning personnel, markets usiness, and provides supplies and equipment. The business has been generating net taxable profits of $50,000 per year, efore considering the QBI deduction. As a sole proprietor, Megan qualifies for the 20 percent deduction, reducing taxable come from the business to $40,000. Required: . Assume that Megan's marginal tax rate on ordinary income is 35 percent and that she has no pressing need for cash flow from this business. Should Megan consider incorporating and operating the business through a C corporation? Fill the bel table to justify your answers. (Ignore any payroll or self-employment tax considerations.) Answer is complete but not entirely correct. Income tax liability if operated as a C corporation Income tax savings Should Megan consider incorporating and operating the business through a C corporation? . How would your conclusion in part (a) change if Megan's marginal tax rate were only 28 percent? X Answer is complete but not entirely correct. decrease ✓to $ 10,500X Annual tax savings will $50,000 X $ 10,500 per year Yes

Chapter13: Choice Of Business Entity—general Tax And Nontax Factors/formation

Section: Chapter Questions

Problem 47P

Related questions

Question

Transcribed Image Text:Megan operates a housecleaning business as a sole proprietorship. She oversees a team of 10 cleaning personnel, markets the

business, and provides supplies and equipment. The business has been generating net taxable profits of $50,000 per year,

before considering the QBI deduction. As a sole proprietor, Megan qualifies for the 20 percent deduction, reducing taxable

income from the business to $40,000.

Required:

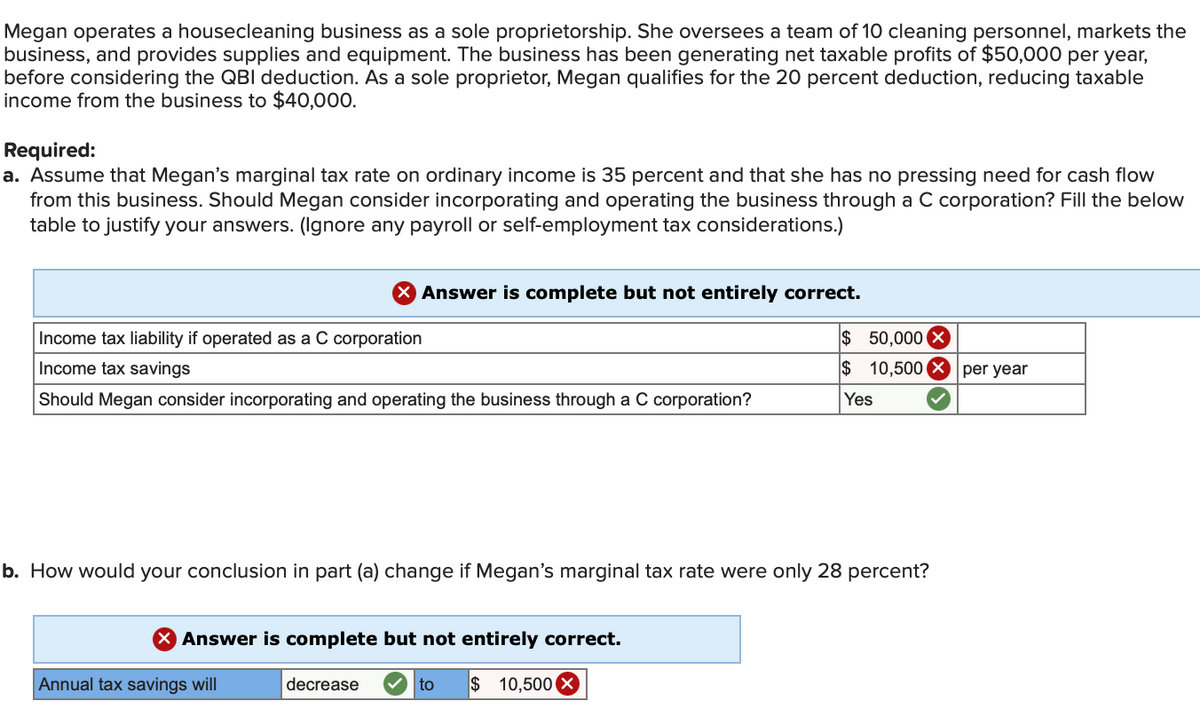

a. Assume that Megan's marginal tax rate on ordinary income is 35 percent and that she has no pressing need for cash flow

from this business. Should Megan consider incorporating and operating the business through a C corporation? Fill the below

table to justify your answers. (Ignore any payroll or self-employment tax considerations.)

Income tax liability if operated as a C corporation

Income tax savings

Should Megan consider incorporating and operating the business through a C corporation?

X Answer is complete but not entirely correct.

b. How would your conclusion in part (a) change if Megan's marginal tax rate were only 28 percent?

X Answer is complete but not entirely correct.

to $ 10,500 X

Annual tax savings will

decrease

$50,000 X

$ 10,500 per year

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT