mes (28) and Nadine (27) is a young married couple, with 2 children, ages 4 and 2 years old. Both are working, earning combined household income of Php 45,000.00 per month net of income taxes. They are living with relatives (rent-free), UT would like to get their own house and lot some day. Checking the real estate market at present, they estimated that a ome they wish to have would cost them Php 4M pesos in 2032 (after computing for cost adjustments). Typically, a 20% DP required in getting a property, and the remaining balance payable in 15 years. hey currently have a joint savings account of Php 600,000.00. The family expenses in a month is Php 25,000.00 with no ebts. They want to prepare for this purchase, and buy a home 10 years from now. How much is the DP and estimated monthly amortization for 15 years? (use Home Loan Calculator and select the interest rate of 6.28% fixed for 4-5 years.) Where will they put their Php600K-savings to maximize the earnings, and what can you recommend to the couple for the Php25K savings each month? After deciding on where to invest the money, how much will be the total earnings in 10 years, net of taxes (all other fees waived), assuming they will not take out any amount, and have the interest compounded as well. (You may use the simple Investment Calculator). In 2032, can they afford the DP? Amortization? Will there be any cash left for them to re-invest?

mes (28) and Nadine (27) is a young married couple, with 2 children, ages 4 and 2 years old. Both are working, earning combined household income of Php 45,000.00 per month net of income taxes. They are living with relatives (rent-free), UT would like to get their own house and lot some day. Checking the real estate market at present, they estimated that a ome they wish to have would cost them Php 4M pesos in 2032 (after computing for cost adjustments). Typically, a 20% DP required in getting a property, and the remaining balance payable in 15 years. hey currently have a joint savings account of Php 600,000.00. The family expenses in a month is Php 25,000.00 with no ebts. They want to prepare for this purchase, and buy a home 10 years from now. How much is the DP and estimated monthly amortization for 15 years? (use Home Loan Calculator and select the interest rate of 6.28% fixed for 4-5 years.) Where will they put their Php600K-savings to maximize the earnings, and what can you recommend to the couple for the Php25K savings each month? After deciding on where to invest the money, how much will be the total earnings in 10 years, net of taxes (all other fees waived), assuming they will not take out any amount, and have the interest compounded as well. (You may use the simple Investment Calculator). In 2032, can they afford the DP? Amortization? Will there be any cash left for them to re-invest?

Chapter13: Investment Fundamentals

Section: Chapter Questions

Problem 1FPC

Related questions

Question

Transcribed Image Text:Case Study:

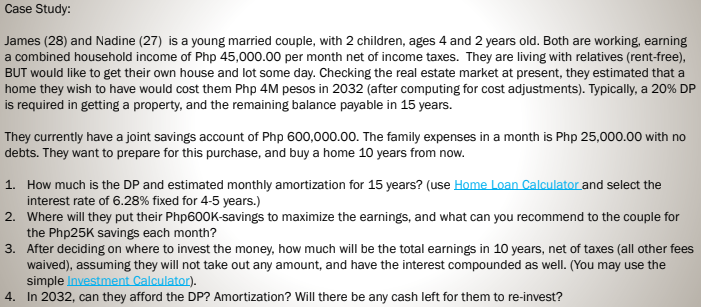

James (28) and Nadine (27) is a young married couple, with 2 children, ages 4 and 2 years old. Both are working, earning

a combined household income of Php 45,000.00 per month net of income taxes. They are living with relatives (rent-free),

BUT would like to get their own house and lot some day. Checking the real estate market at present, they estimated that a

home they wish to have would cost them Php 4M pesos in 2032 (after computing for cost adjustments). Typically, a 20% DP

is required in getting a property, and the remaining balance payable in 15 years.

They currently have a joint savings account of Php 600,000.00. The family expenses in a month is Php 25,000.00 with no

debts. They want to prepare for this purchase, and buy a home 10 years from now.

1. How much is the DP and estimated monthly amortization for 15 years? (use Home Loan Calculator and select the

interest rate of 6.28% fixed for 4-5 years.)

2. Where will they put their Php600K-savings to maximize the earnings, and what can you recommend to the couple for

the Php25K savings each month?

3. After deciding on where to invest the money, how much will be the total earnings in 10 years, net of taxes (all other fees

waived), assuming they will not take out any amount, and have the interest compounded as well. (You may use the

simple Investment Calculator).

4. In 2032, can they afford the DP? Amortization? Will there be any cash left for them to re-invest?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning