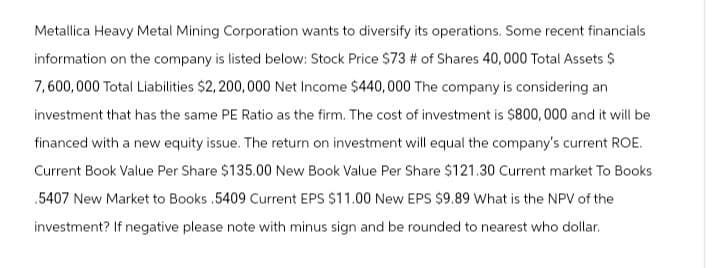

Metallica Heavy Metal Mining Corporation wants to diversify its operations. Some recent financials information on the company is listed below: Stock Price $73 # of Shares 40,000 Total Assets $ 7,600,000 Total Liabilities $2,200,000 Net Income $440,000 The company is considering an investment that has the same PE Ratio as the firm. The cost of investment is $800,000 and it will be financed with a new equity issue. The return on investment will equal the company's current ROE. Current Book Value Per Share $135.00 New Book Value Per Share $121.30 Current market To Books 5407 New Market to Books .5409 Current EPS $11.00 New EPS $9.89 What is the NPV of the investment? If negative please note with minus sign and be rounded to nearest who dollar.

Metallica Heavy Metal Mining Corporation wants to diversify its operations. Some recent financials information on the company is listed below: Stock Price $73 # of Shares 40,000 Total Assets $ 7,600,000 Total Liabilities $2,200,000 Net Income $440,000 The company is considering an investment that has the same PE Ratio as the firm. The cost of investment is $800,000 and it will be financed with a new equity issue. The return on investment will equal the company's current ROE. Current Book Value Per Share $135.00 New Book Value Per Share $121.30 Current market To Books 5407 New Market to Books .5409 Current EPS $11.00 New EPS $9.89 What is the NPV of the investment? If negative please note with minus sign and be rounded to nearest who dollar.

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:Metallica Heavy Metal Mining Corporation wants to diversify its operations. Some recent financials

information on the company is listed below: Stock Price $73 # of Shares 40,000 Total Assets $

7,600,000 Total Liabilities $2,200,000 Net Income $440,000 The company is considering an

investment that has the same PE Ratio as the firm. The cost of investment is $800,000 and it will be

financed with a new equity issue. The return on investment will equal the company's current ROE.

Current Book Value Per Share $135.00 New Book Value Per Share $121.30 Current market To Books

.5407 New Market to Books .5409 Current EPS $11.00 New EPS $9.89 What is the NPV of the

investment? If negative please note with minus sign and be rounded to nearest who dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning