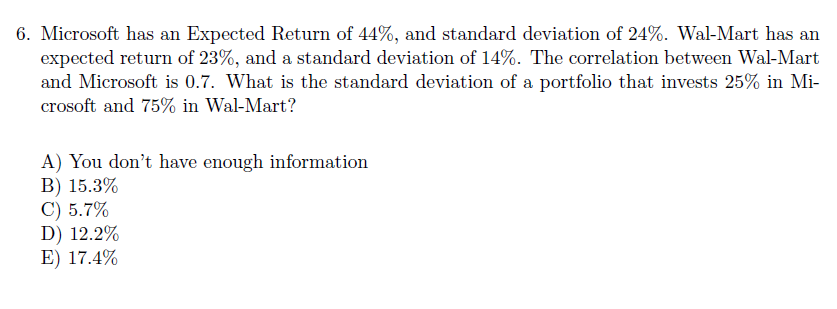

Microsoft has an Expected Return of 44%, and standard deviation of 24%. Wal-Mart has a expected return of 23%, and a standard deviation of 14%. The correlation between Wal-Ma and Microsoft is 0.7. What is the standard deviation of a portfolio that invests 25% in M crosoft and 75% in Wal-Mart? A) You don't have enough information B) 15.3% C) 5.7% D) 12.2% E) 17.4%

Q: At what per annum rate must $357 be compounded monthly for it to grow to $760 in 11 years? (Round to…

A: To calculate the annual interest rate we will use the below formula Annual interest rate =…

Q: They want to invest around $50,000 and they are expecting good growth in the next 5 years. As they…

A: Cost of Condo varies due to variety of reason like i) Location ii) Unit type, amenities and…

Q: f you issue a thrifty year fixed rate mortgage to finance the purchase of a home you are locked into…

A: Mortgage It is a type of loan where borrower pays a series of fixed periodic payment. This periodic…

Q: Monthly Income or Expense Item Allowance Video Games Babysitting Earnings Snacks Art Supplies…

A: As we are provided with the expense and income structure of both the individuals. First have to find…

Q: chemicals, and also manufactures fertilizers and food additives. Gupta has concluded that the DDM is…

A: Equity fund refers to the mutual fund schemes that are based on the investment objective of the…

Q: Jane has been given an opportunity to receive 20,000, six years from now. If she can earn 10% on her…

A: Present value is the current value of a future cash flow discounted to the present terms at a…

Q: 13. pepare an excel amortization table

A: In this problem, we must first define key concepts: ARM mortgage, interest annual cap, interest life…

Q: The economic report outlined a bullish outlook for the renewable energy industry in Malaysia. Solar…

A:

Q: A company borrowed P45,200 from a savings and loan association that charges 14% converted quarterly.…

A: Let us make an amortization table to solve the question. Please note the formula used to calculate…

Q: Market risk arises from the level or volatility of market prices of assets. It involves the exposure…

A: Market risk is the chance of suffering losses as a result of price changes that are unfavorable for…

Q: A cheese factory wants to protect their purchase price of milk so they hedge in milk futures at a…

A: Basis in futures is the difference between the futures price and the spot price.It is an important…

Q: A design studio received a loan of $9,400 at 5.90% compounded monthly to purchase a camera. If they…

A: An amortization schedule is the table of a loan's repayments schedule. It includes information like…

Q: Capital market instruments are all equity securities.

A: Capital Market: The capital market provides the funds of the investors available to the government…

Q: BBC issues $4,000,000 perpetual debt that pays 12% annual coupon. The yield of the debt is 12% now.…

A:

Q: [The following information applies to the questions displayed below.] Hult Games buys electronic…

A: Effective price refers to the price that should b come after deducting the discount. It is simply…

Q: Vickery and Vojnovic is a business partnership set up by Robin Vickery and Kaspar Vojnovic some…

A: Payback period is the amount of time required to recover the initial investment of the project.…

Q: You purchased some shares in Bandicoots R Us on 23 March 2022, at price $68.37. On 16 September 2022…

A: Data given : Purchase Price (P0) on 23 March 2022= $68.37 Received dividend on 16 September 2022…

Q: Krawczek Company will enter into a lease agreement with Heavy Equipment Co. where Krawczek will make…

A: Introduction Operating leases require lease expenses to be recognized on a straight-line basis over…

Q: How long will it take a $8,920 loan to accumulate interest of $480 if money earns 3.05% compounded…

A: We are required to calculate the number of periods that will take $8920 to become $ 9,400. 9400 =…

Q: Sam owns the bank some money at 5% per year. After half a year, he paid 15 dollars as interest. HOW…

A: The banks gives the loan to the customers but the charge the interest on the loan and customers have…

Q: Suppose that you won $1,500,000 in the Illinois state lottery. It will be paid to you over 20 years…

A: An annuity is end of year equal payments made for a fixed period of time at a specified interest…

Q: Explain why a company might issue convertible securities instead of straightforward debt or equity.…

A: Convertible security is an instrument , usually a bond or a preferred stock, that can be converted…

Q: How much will Spike have in his account if he invests $855 for 4 years, compounded semiannually at…

A: We need to use compound interest formula to calculate amount after 4 years in account. A=P(1+i)n…

Q: What does the book value of debt and equity refer to? O A. The par values of common stock and the…

A: The par value of stock is the price which is usually set at when the stock is issued. It is present…

Q: Find the amount of each payment to be made into a sinking fund so that enough will be present to…

A: As per the given information: Amount - $49,000 Rate of interest (r) - 4% compounded semiannually…

Q: Analyze the capital gains and the growth in share price for the five year period

A: Trend analysis is the change in the share price annually over a period. It helps to determine…

Q: 4) Use this week's activity to write the formula for placing $300 in a 7.5% account compounded…

A: We will use the concept of time value of money here. As per the concept of time value of money the…

Q: Q.5 What was the bond' s coupon On 11/18/2021 the China's Ministry of Finance sold the ¥2B worth of…

A: The coupon rate is the interest rate paid on bonds. It is a fixed rate paid on a periodic basis to…

Q: Eastern Auto Parts Inc. has 20 percent of its sales paid for in cash and 80 percent on credit. All…

A: Solution:- Cash receipt budget is the budget prepared to forecast the upcoming cash receipts by the…

Q: A zero coupon bond is selling for $575.04. The bond matures in 13 years and has a afce value of…

A: A zero coupon bond is usually offered at a discount price. As the name suggests, it does not pay any…

Q: The Robinson Corporation has $33 million of bonds outstanding that were issued at a coupon rate of…

A: a. Discount rate = Revised interest rate * (1-tax rate)

Q: Given the following income statement data, calculate net income: sales=$2500, cost of goods…

A: To calculate the net income we will use the below formula Net income = [Sales-Cost of goods…

Q: You've just done some analysis on a publicly traded company and some of your key findings are below.…

A: The Weighted Average Cost of capital: The weighted average cost of capital (WACC) is the sum of the…

Q: Suppose we have a bond issue currently outstanding that has 25 years left to maturity. The coupon…

A: A bond is a debt instrument that pays coupons and face value as the repayments for the debt that the…

Q: Compute the future value in year 7 of a $5,800 deposit in year 1, and another $5,300 deposit at the…

A: Cash flow at year 1 = $5,800 Cash flow at year 4 = $5,300 Interest rate = 0.08 or 8% Future value in…

Q: 1. SodaFizz has debt outstanding that has a market value of $3 million. The company's stock has a…

A: Given, The market value of debt is $3 million The market value of equity is $6 million.

Q: If BMWshares are now trading at 50 euros and expectations are that annual dividends into the…

A: The efficient market hypothesis will be advocating for full and complete discounting of adequately…

Q: What payment every year should Carie deposit to her savings account in order to save $37,100 in 11.5…

A: Given: Future value(FV) = $37,100 Years = 11.5 Interest rate = 3.19%

Q: The following data represents the prices (in R) of 50 items purchased by a shopper. Price (R)…

A: Mean, median, and mode A data set's mean (average) is calculated by adding all of the numbers in the…

Q: Suppose you sell a fixed asset for $99,000 when its book value is $75,000. If your company's…

A: The fixed assets are reflective of all such assets which are helpful for company in the deriving the…

Q: You are cautiously bullish on the common stock of the Wildwood Corporation over the next several…

A: Bull spread A bull call spread is made up of one long call at a lower strike price and one short…

Q: What is the salvage cash flow for a piece of equipment given the following information. The…

A: initial book value of equipment = $226,000 Life = 8 years Depreciation charged for 4 years Sale…

Q: A $140,000 mortgage was amortized over 25 years by monthly repayments. The interest rate on the…

A: As per the given information: Mortgage amount - $140,000 Term of the loan - 25 years Interest rate -…

Q: Based on what you have learned about the SAFE Act and the role of the NMLS, how has the SAFE Act and…

A: SAFE Act: " Secure and Fair Enforcement for Mortgage Licensing Act " The Nationwide Mortgage…

Q: Why would an entrepreneur consider selling their business

A: There could be several reasons for an entrepreneur consider selling their business.

Q: Accumulate P30,000 for 3 years and 6 months at 16% compounded semiannually.

A: Future Value = P30,000 Time Period = 3 Years and 6 Months Interest Rate = 16%

Q: ou land a job at a prominent Venture Capital firm. Your job is to think about the value of a new…

A: When you invest in the market there are risk related to the market and it depends how much is your…

Q: A firm has sales of $1220, net income of $226, net fixed assets of $544 and current assets of $300.…

A: Common size statement value of inventory can be calculated by dividing inventory value by total…

Q: José lent Antonio 10 new pens and 20 new watches on date zero, which on that date cost $50.00 and…

A: The real interest rate is the rate that is charged by the banks on borrowings. This rate is used by…

Q: What is the present value of $452,000 to be received in 6 years from today. Assume a per annum…

A: Compound interest is one of the form of interest in which interest is charged on both principal as…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 8.Suppose you invest $1,000 in Ford stock, and $3,000 in Tyco International stock. You expect a return of 10% for Ford and 16% for Tyco. The standard deviation of the return of Ford is 25% and the standard deviation of return of Tyco is 35%. The correlation between the returns of the two stocks is 0.7. The risk-free rate is 2%. What is the Sharpe Ratio of your portfolio? a.0.287b.0.404c.0.526d.0.725Here are some historical data on the risk characteristics of Ford and Harley Davidson. Ford Harley Davidson β (beta) 1.43 0.75 Yearly standard deviation of return (%) 33.3 16.9 Assume the standard deviation of the return on the market was 12.0%. a. The correlation coefficient of Ford’s return versus Harley Davidson is 0.38. What is the standard deviation of a portfolio invested half in each share? b. What is the standard deviation of a portfolio invested one-third in Ford, one-third in Harley Davidson, and one-third in risk-free Treasury bills? c. What is the standard deviation if the portfolio is split evenly between Ford and Harley Davidson and is financed at 50% margin, that is, the investor puts up only 50% of the total amount and borrows the balance from the broker? d-1. What is the approximate standard deviation of a portfolio composed of 100 stocks with betas of 1.43 like Ford? d-2. What is the approximate standard deviation of a portfolio composed of…A bank has estimated its VAR for its bond portfolio is $25,600 and for its stock portfolio, it is $33,600. The correlation coefficient between the two portfolios is -0.25. How much VAR would be reduced if they were allowed to aggregate the VAR of the two portfolios? A $36,800.00 B $59,200.00 C $10,400.00 D $22,400.00

- The rate of return on U.S. T-bills is 3.25% and the expected return on the market is 9.50%. J&X, Inc. has a beta (b) of 1.48 Which of the following is most correct? J&X has less total risk than the average firm. J&X has more systematic, or market risk than the average firm. J&X has less non-diversifiable risk than the average firm. J&X has more total risk than the average firm.Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown here, with a correlation of 20%. Calculate a. the expected return and b. the volatility(standard deviation) of a portfolio that consists of a long position of $12,000 in Johnson & Johnson and a short position of $2,000 in Walgreens. Expected Return Standard Deviation Johnson & Johnson 7.7% 16.5% Walgreens 9.4% 19.2%UPS, a delivery services company, has a beta of 1.6, and Wal-Mart has a beta of 0.9. The risk-free rate of interest is 6% and the market risk premium is 9%. What is the expected return on a portfolio with 40% of its money in UPS and the balance in Wal-Mart?

- Q1) UPS, a delivery services company, has a beta of 1.1, and Wal-Mart has a beta of 0.7. The risk-free rate of interest is 4% and the market risk premium is 7%. What is the expected return on a portfolio with 30% of its money in UPS and the rest in Wal-Mart? Q2) IBM’s σ = 0.22; Dell’s σ = 0.13. The correlation between Dell and IBM is 0.32, and the weights are 50% each. Find the portfolio volatility (standard deviation). If the weights are now 30 % and 70 % for Dell and IBM respectively, how would the volatility of portfolio change? Briefly justify your answer.Toyota Corp's stock is $32 per share. Its expected return is 25% and variance is 15%. Honda Corp's stock is $20 per share. Its expected return is 20% and variance is 7%. Benz Corp's stock is $42 per share. Its expected return is 11% and variance 7%. The covariance between Toyota and Honda is 0.03. What would be the standard deviation of a portfolio consisting of 50% Toyota and 50% ? OWL says the answer is 0.15, Please how to achieve this answer with steps in excel if possible.Berjaya Corp. has a very conservative beta of .7, while Biotech Corp. has a beta of 2.1. The T-bill rate is 5%, and the market is expected to return 15%. (i) What is the expected return of Berjaya Corp., Biotech Corp., and a portfolio composed of 60% of Berjaya Corp. and 40% Biotech Corp.?

- You are given the following information concerning Cabinet Co., NewClear Co and the market. Bear Market Normal Market Bull Market Probability 0.2 0.5 0.3 Cabinet Co. -20% 18% 50% NewClear Co. -15% 20% 10% Assume that: 1. Of your R10,000 portfolio, you invest R9,000 in Cabinet Co. and R1,000 in NewClear Co. 2. NewClear and Cabinet are perfectly negatively correlated. What is the expected return and standard deviation on your portfolio?Consider the following states of outcomes, probabilities, and expected returns on only stocks three stocks in your portfolio; X, Y, and Z. State Probability X Y Z Boom 0.1 16% 10% 22% Semi-Boom 0.15 14% 8% 18% Normal 0.55 10% 6% 14% Mild-Recession ?? 5% 4% -10% Full-Recession 0.05 -3% 2% -12% a. What is the expected return of the portfolio if $25,000 is invested in X, $35,000 in Y, and $30,000 invested in stock Z? b. What are the standard deviations of stocks X, Y, and Z?I am having trouble solving this problem. Can you please provide me with some help? Thank you. I appreciate it. You estimate that the expected return of SPY stock is 15%, and standard deviation of the stock is 35%. The expected return of GLD is -2%, and standard deviation of the stock is 10%. If the correlation between SPY returns and GLD returns is -10%, what is the expected return and standard deviation of a portfolio with $5,000 invested in NFLX and $5,000 invested in DIS?