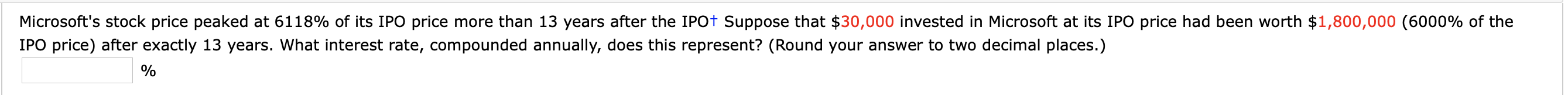

Microsoft's stock price peaked at 6118% of its IPO price more than 13 years after the IPOT Suppose that $30,000 invested in Microsoft at its IPO price had been worth $1,800,000 (6000% of the IPO price) after exactly 13 years. What interest rate, compounded annually, does this represent? (Round your answer to two decimal places.)

Microsoft's stock price peaked at 6118% of its IPO price more than 13 years after the IPOT Suppose that $30,000 invested in Microsoft at its IPO price had been worth $1,800,000 (6000% of the IPO price) after exactly 13 years. What interest rate, compounded annually, does this represent? (Round your answer to two decimal places.)

Chapter6: Exponential And Logarithmic Functions

Section6.1: Exponential Functions

Problem 68SE: An investment account with an annual interest rateof 7 was opened with an initial deposit of 4,000...

Related questions

Question

100%

Transcribed Image Text:Microsoft's stock price peaked at 6118% of its IPO price more than 13 years after the IPOT Suppose that $30,000 invested in Microsoft at its IPO price had been worth $1,800,000 (6000% of the

IPO price) after exactly 13 years. What interest rate, compounded annually, does this represent? (Round your answer to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Intermediate Algebra

Algebra

ISBN:

9781285195728

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning