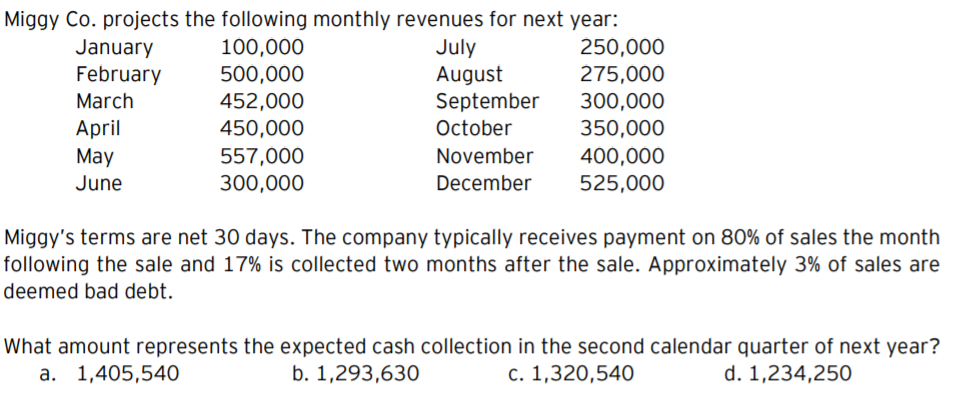

Miggy Co. projects the following monthly revenues for next year: 100,000 500,000 452,000 450,000 250,000 January February July August September 275,000 300,000 March April May October 350,000 400,000 557,000 300,000 November June December 525,000 Miggy's terms are net 30 days. The company typically receives payment on 80% of sales the month following the sale and 17% is collected two months after the sale. Approximately 3% of sales are deemed bad debt. What amount represents the expected cash collection in the second calendar quarter of next year? a. 1,405,54O b. 1,293,630 с. 1,320,540 d. 1,234,250

Miggy Co. projects the following monthly revenues for next year: 100,000 500,000 452,000 450,000 250,000 January February July August September 275,000 300,000 March April May October 350,000 400,000 557,000 300,000 November June December 525,000 Miggy's terms are net 30 days. The company typically receives payment on 80% of sales the month following the sale and 17% is collected two months after the sale. Approximately 3% of sales are deemed bad debt. What amount represents the expected cash collection in the second calendar quarter of next year? a. 1,405,54O b. 1,293,630 с. 1,320,540 d. 1,234,250

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Question

Transcribed Image Text:Miggy Co. projects the following monthly revenues for next year:

100,000

July

August

September

250,000

January

February

500,000

452,000

450,000

557,000

300,000

275,000

300,000

March

April

May

October

350,000

November

400,000

June

December

525,000

Miggy's terms are net 30 days. The company typically receives payment on 80% of sales the month

following the sale and 17% is collected two months after the sale. Approximately 3% of sales are

deemed bad debt.

What amount represents the expected cash collection in the second calendar quarter of next year?

a. 1,405,540

b. 1,293,630

с. 1,320,540

d. 1,234,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College