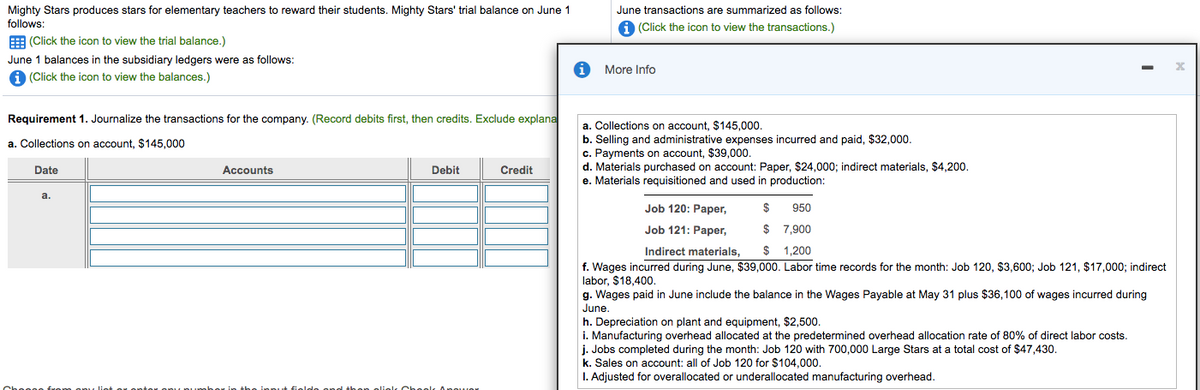

Mighty Stars produces stars for elementary teachers to reward their students. Mighty Stars' trial balance on June 1 follows: June transactions are summarized as follows: A (Click the icon to view the transactions.) E (Click the icon to view the trial balance.) June 1 balances in the subsidiary ledgers were as follows: More Info A (Click the icon to view the balances.) Requirement 1. Journalize the transactions for the company. (Record debits first, then credits. Exclude explana a. Collections on account, $145,000. b. Selling and administrative expenses incurred and paid, $32,000. c. Payments on account, $39,000. d. Materials purchased on account: Paper, $24,000; indirect materials, $4,200. e. Materials requisitioned and used in production: a. Collections on account, $145,000 Date Accounts Debit Credit a. Job 120: Paper, 950 $ 7,900 $ 1,200 Job 121: Paper, Indirect materials, f. Wages incurred during June, $39,000. Labor time records for the month: Job 120, $3,600; Job 121, $17,000; indirect labor, $18,400. g. Wages paid in June include the balance in the Wages Payable at May 31 plus $36,100 of wages incurred during June. h. Depreciation on plant and equipment, $2,500. i. Manufacturing overhead allocated at the predetermined overhead allocation rate j. Jobs completed during the month: Job 120 with 700,000 Large Stars at a total cost of $47,430. k. Sales on account: all of Job 120 for $104,000. I. Adjusted for overallocated or underallocated manufacturing overhead. 80% of direct labor costs.

Mighty Stars produces stars for elementary teachers to reward their students. Mighty Stars' trial balance on June 1 follows: June transactions are summarized as follows: A (Click the icon to view the transactions.) E (Click the icon to view the trial balance.) June 1 balances in the subsidiary ledgers were as follows: More Info A (Click the icon to view the balances.) Requirement 1. Journalize the transactions for the company. (Record debits first, then credits. Exclude explana a. Collections on account, $145,000. b. Selling and administrative expenses incurred and paid, $32,000. c. Payments on account, $39,000. d. Materials purchased on account: Paper, $24,000; indirect materials, $4,200. e. Materials requisitioned and used in production: a. Collections on account, $145,000 Date Accounts Debit Credit a. Job 120: Paper, 950 $ 7,900 $ 1,200 Job 121: Paper, Indirect materials, f. Wages incurred during June, $39,000. Labor time records for the month: Job 120, $3,600; Job 121, $17,000; indirect labor, $18,400. g. Wages paid in June include the balance in the Wages Payable at May 31 plus $36,100 of wages incurred during June. h. Depreciation on plant and equipment, $2,500. i. Manufacturing overhead allocated at the predetermined overhead allocation rate j. Jobs completed during the month: Job 120 with 700,000 Large Stars at a total cost of $47,430. k. Sales on account: all of Job 120 for $104,000. I. Adjusted for overallocated or underallocated manufacturing overhead. 80% of direct labor costs.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter16: Financial Statements And Closing Entries For A Corporation

Section16.5: Preparing A Post-closing Trial Balance

Problem 1WT

Related questions

Question

Question 7

Transcribed Image Text:June transactions are summarized as follows:

Mighty Stars produces stars for elementary teachers to reward their students. Mighty Stars' trial balance on June 1

follows:

E (Click the icon to view the trial balance.)

A (Click the icon to view the transactions.)

June 1 balances in the subsidiary ledgers were as follows:

A (Click the icon to view the balances.)

More Info

Requirement 1. Journalize the transactions for the company. (Record debits first, then credits. Exclude explana

a. Collections on account, $145,000.

b. Selling and administrative expenses incurred and paid, $32,000.

c. Payments on account, $39,000.

d. Materials purchased on account: Paper, $24,000; indirect materials, $4,200.

e. Materials requisitioned and used in production:

a. Collections on account, $145,000

Date

Accounts

Debit

Credit

а.

Job 120: Paper,

950

Job 121: Paper,

$ 7,900

Indirect materials,

$ 1,200

f. Wages incurred during June, $39,000. Labor time records for the month: Job 120, $3,600; Job 121, $17,000; indirect

labor, $18,400.

g. Wages paid in June include the balance in the Wages Payable at May 31 plus $36,100 of wages incurred during

June.

Depreciation on plant and equipment, $2,500.

i. Manufacturing overhead allocated at the predetermined overhead allocation rate of 80% of direct labor costs.

j. Jobs completed during the month: Job 120 with 700,000 Large Stars at a total cost of $47,430.

k. Sales on account: all of Job 120 for $104,000.

I. Adjusted for overallocated or underallocated manufacturing overhead.

h.

Transcribed Image Text:Question Help

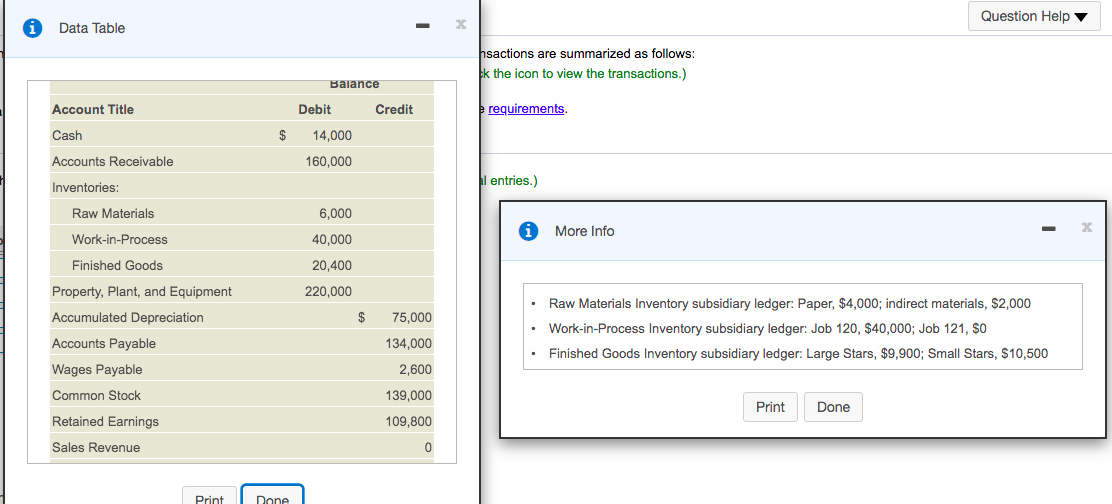

Data Table

hsactions are summarized as follows:

k the icon to view the transactions.)

Balance

Account Title

Debit

Credit

requirements.

Cash

$

14,000

Accounts Receivable

160,000

I entries.)

Inventories:

Raw Materials

6,000

i More Info

Work-in-Process

40,000

Finished Goods

20,400

Property, Plant, and Equipment

220,000

Raw Materials Inventory subsidiary ledger: Paper, $4,000; indirect materials, $2,000

Accumulated Depreciation

75,000

Work-in-Process Inventory subsidiary ledger: Job 120, $40,000; Job 121, $0

Accounts Payable

134,000

Finished Goods Inventory subsidiary ledger: Large Stars, $9,900; Small Stars, $10,500

Wages Payable

2,600

Common Stock

139,000

Print

Done

Retained Earnings

109,800

Sales Revenue

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College