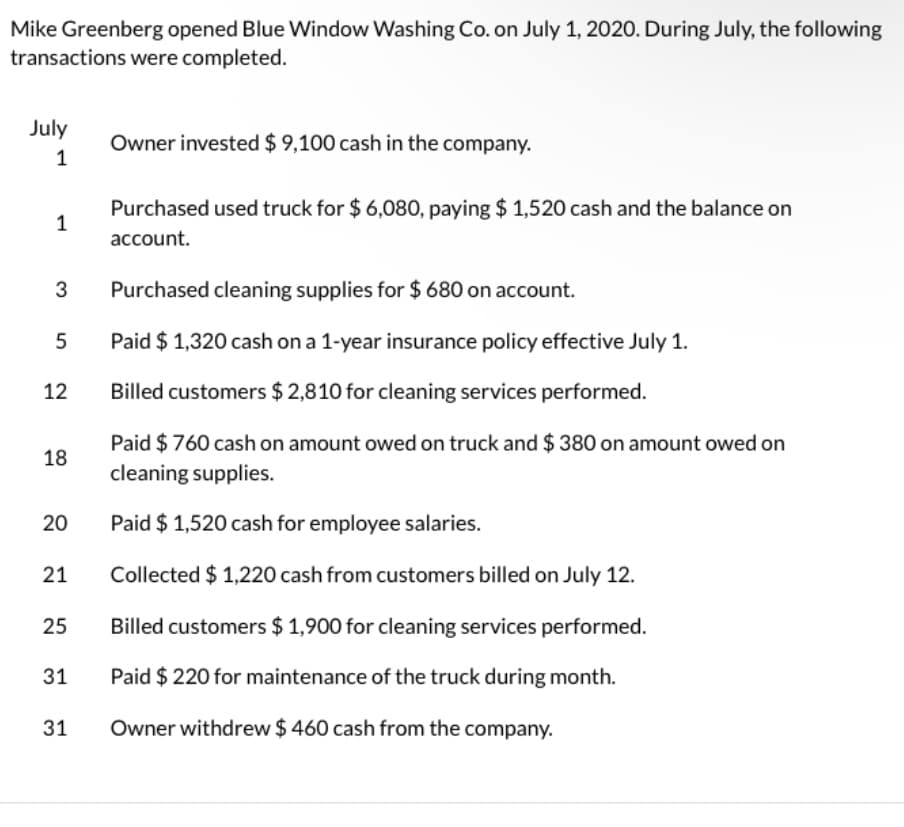

Mike Greenberg opened Blue Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July Owner invested $ 9,100 cash in the company. 1 Purchased used truck for $ 6,080, paying $ 1,520 cash and the balance on 1 account. Purchased cleaning supplies for $ 680 on account.

Q: Marjorie Knaus, an architect, organized Knaus Architects on January 1, 2018. During the month, Knaus…

A: Net income is calculated after analysing the revenue and expenses of the organisation.

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the…

A: Net income: Net income is the excess amount of revenue after deducting all the expenses of a…

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: 4. Amount of total revenue = $16,160 Amount of total expenses = $2,750 + $1,640 + $450 + $2,400 +…

Q: Lee Chang opened Cullumber's Window Washing on July 1, 2021. In July, the following transactions…

A: Journalizing is a procedure distinguishing and recording the exchanges of business in the books of…

Q: Post to the Ledger Accounts.

A:

Q: Oriole Clark opened Oriole’s Cleaning Service on July 1, 2020. During July, the following…

A: Journal entry: It is a systematic record of a financial transaction of an organization recorded in…

Q: Connie Young, an architect, opened an office on October 1, 2019. During the month, she completed the…

A: Unadjusted Trial Balance: This is the worksheet that represents all the accounts that have a…

Q: For the past several years, Jolene Upton has operated a part-time consulting business from her home.…

A: Hey, since there are multiple questions posted, we will answer first two sub-parts. If you want any…

Q: Given below are the transactions related to Abdullah Enterprises for the month of March 2019. Date…

A: The financial statements of the business include the income statement and balance sheet of the firm.…

Q: Mike Greenberg opened Flounder Window Washing Co. on July 1, 2020. During July, the following…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Journalize the July transactions.

A: Following are the journal entries for the month of July in the books of M’s: July 1 to July 15

Q: On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer De signs. During…

A: “Hey, since there are multiple questions posted, we will answer first three questions. If you want…

Q: July 1 Oriole invested $20,200 cash in the business. 1 Purchased used truck for $9,200, paying…

A: ORIOLE’S CLEANING SERVICE Post-Closing Trial Balance Account Name Debit Credit…

Q: Oriole Clark opened Oriole’s Cleaning Service on July 1, 2022. During July, the following…

A: A worksheet is a multi-column form used in financial statement preparation and adjustment.

Q: For the past several years, Jolene Upton has operated a part-time consulting business from her home.…

A: Journal entries are recording of the transaction in the accounting journal in a chronological order.…

Q: On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs.…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: Mr. Arish opened Arish’s Carpet Cleaners on March 1, 2021. During March, the following transactions…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Susie Smith opened Susie's Commerical Clearning on April 1, 2021. In Apr, the following…

A:

Q: Susie Smith opened Susie's Commerical Clearning on April 1, 2021. In Apr, the following transactions…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Marjorie Knaus, an architect, organized Knaus Architects on January 1, 2018. During the month, Knaus…

A: T-accounts refer to the ledger accounts prepared to get the transactions and balance related to a…

Q: On October 1, 20Y6, Jay Pryor established an interior decorating business, Pioneer De- signs. During…

A:

Q: Mike Greenberg opened Sheffield Window Washing Co. on July 1, 2020. During July, the following…

A: The trial balance is prepared using balances from different ledgers.

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: a.Prepare Journal entries:

Q: Oriole Clark opened Oriole’s Cleaning Service on July 1, 2020. During July, the following…

A:

Q: For the past several years, Jolene Upton has operated a part-time consulting business from her home.…

A: Since we have to answer only 3 subparts, we will answer the first three parts of this question.…

Q: Oriole Clark opened Oriole’s Cleaning Service on July 1, 2020. During July, the following…

A: Journal is a book where all the entries has been recorded in chronological order. Required journal…

Q: On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs.…

A: 1. Journalize each transaction in a two-column journal.

Q: On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs.…

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Architects completed the following transactions: A. Issued common stock to Marjorie Knaus in…

A: Step 1 Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for…

Q: aners on March 1, 2021. During March, the following transactions were completed. Mar. 1: Invested…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs.…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Mike Greenberg opened Blue Window Washing Co. on July 1, 2020. During July, the following…

A: Answer - Working Note : Calculation of Cash - Cash (9100-1520-1320-760-380-1520+1220-220-460) = $…

Q: Carma Garcia opened Shifting Sands Cleaning Service on August 1, 2019. During August, the company…

A: Hello. Since you have posted multiple questions and not specified which question needs to be solved,…

Q: For the past several years, Jolene Upton has operated a part-time consulting business from her home.…

A: Adjusted trial balance: The unadjusted trial balance is the summary of all the ledger accounts that…

Q: ase A Mr. Hamood, an architect, started to practice his profession in Ira on July 1, 2020. During…

A: The journal entries are prepared to record daily transactions of the business in journal entry form.

Q: On August 1, 2019, Rafael Masey established Planet Realty, which completed the following…

A: Since you have posted a question with multiple parts. we will be answering you first three subparts…

Q: On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs.…

A: As per authoring guidelines the first three sub-parts of question is answerd. Please repost the…

Q: Mike Greenberg opened Sheffield Window Washing Co. on July 1, 2020. During July, the following…

A: Trial Balance is a statement which contains Balances of all the Ledger. A Trial Balance have…

Q: Prepare the Income Statement for 2019 and Balance Sheet for December 31, 2019

A: Income statements and balance sheets are important financial statements that tell a lot about the…

Q: On June 1, 2019, Kris Storey established an interior decorating business, Eco-Centric Designs.…

A: Hi since you have asked a question with multiple subparts we are solving the 1st 3 subparts for…

Q: On January 1, 2019, Sharon Matthews established Tri-City Realty, which completed the following…

A: As you have posted multiple questions, the solution to the first question is being provided. Kindly…

Q: Mike Greenberg opened Monty Window Washing Co. on July 1, 2022. During July, the following…

A:

Q: Ken Jones, an architect, opened an office on April 1, 2019. During the month, he completed the…

A: 1&2

Q: Mike Greenberg opened Cheyenne Window Washing Co. on July 1, 2020. During July, the following…

A: Journal entries: Date Account journal Debit $ Credit $ July 1 Cash 9,800 Capital 9,800…

Q: Oriole Clark opened Oriole’s Cleaning Service on July 1, 2022. During July, the following…

A: Journal is the initial step in recording the financial transaction, date wise as per the dual entity…

Q: Carma Garcia opened Shifting Sands Cleaning Service on August 1, 2019. During August, the company…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Post to the ledger accounts. (Post entries in the order of journal entries presented in the previous…

A: A T-account is the graphical representation of a general ledger that records a business’…

Q: On April 5, Timothy established an interior decorating business, Tim's Design, with a cash investmen…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Domingo Company started its business on January 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $10,000 from their personal account to the business account. B. Paid rent $500 with check #101. C. Initiated a petty cash fund $500 with check #102. D. Received $1,000 cash for services rendered. E. Purchased office supplies for $158 with check #103. F. Purchased computer equipment $2,500, paid $1,350 with check #104, and will pay the remainder in 30 days. G. Received $800 cash for services rendered. H. Paid wages $600, check #105. I. Petty cash reimbursement: office supplies $256, maintenance expense $108, postage expense $77, miscellaneous expense $55. Cash on hand $11. Check #106. J. Increased petty cash by $30, check #107.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1.Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Musics checking account. 1.Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1.Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2.Received 1,000 cash from customers on account. 3.On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3.Paid 250 to creditors on account. 4.Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5.Purchased office equipment on account from Office Mart, 7,500. 8.Paid for a newspaper advertisement, 200. 11.Received 1,000 for serving as a disc jockey for a party. 13.Paid 700 to a local audio electronics store for rental of digital recording equipment. 14.Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16.Received 2,000 for serving as a disc jockey for a wedding reception. 18.Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22.Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23.Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27.Paid electric bill, 915. 28.Paid wages of 1,200 to receptionist and part-time assistant. 29.Paid miscellaneous expenses, 540. 30.Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31.Received 3,000 for serving as a disc jockey for a party. 31.Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31.Withdrew 1,250 cash from PS Music for personal use. PS Musics chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: Instructions 1. Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2019.The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.

- Consider the following situations and determine (1) which type of liability should be recognized (specific account), and (2) how much should be recognized in the current period (year). A. A business sets up a line of credit with a supplier. The company purchases $10,000 worth of equipment on credit. Terms of purchase are 5/10, n/30. B. A customer purchases a watering hose for $25. The sales tax rate is 5%. C. Customers pay in advance for season tickets to a soccer game. There are fourteen customers, each paying $250 per season ticket. Each customer purchased two season tickets. D. A company issues 2,000 shares of its common stock with a price per share of $15.Inner Resources Company started its business on April 1, 2019. The following transactions occurred during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $8,500 from their personal account to the business account. B. Paid rent $650 with check #101. C. Initiated a petty cash fund $550 check #102. D. Received $750 cash for services rendered. E. Purchased office supplies for $180 with check #103. F. Purchased computer equipment $8,500, paid $1,600 with check #104 and will pay the remainder in 30 days. G. Received $1,200 cash for services rendered. H. Paid wages $560, check #105. I. Petty cash reimbursement office supplies $200, Maintenance Expense $140, Miscellaneous Expense $65. Cash on Hand $93. Check #106. J. Increased Petty Cash by $100, check #107.Lavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.

- Hajun Company started its business on May 1, 2019. The following transactions occurred during the month of May. Prepare the journal entries in the journal on Page 1. A. The owners invested $5,000 from their personal account to the business account. B. Paid rent $400 with check #101. C. Initiated a petty cash fund $200 check #102. D. Received $400 cash for services rendered E. Purchased office supplies for $90 with check #103. F. Purchased computer equipment $1,000, paid $350 with check #104 and will pay the remainder in 30 days. G. Received $500 cash for services rendered. H. Paid wages $250, check #105. I. Petty cash reimbursement office supplies $25, Maintenance Expense $125, Miscellaneous Expense $35. Cash on hand $18. Check #106. J. Increased Petty Cash by $50, check #107.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.For each of the following situations write the principle, assumption, or concept that justifies or explains what occurred. A. A landscaper received a customers order and cash prepayment to install sod at a house that would not be ready for installation until March of next year. The owner should record the revenue from the customer order in March of next year, not in December of this year. B. A company divides its income statements into four quarters for the year. C. Land is purchased for $205,000 cash; the land is reported on the balance sheet of the purchaser at $205,000. D. Brandys Flower Shop is forecasting its balance sheet for the next five years. E. When preparing financials for a company, the owner makes sure that the expense transactions are kept separate from expenses of the other company that he owns. F. A company records the expenses incurred to generate the revenues reported.Valley Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on July 31, 2019, follows: The following business transactions were completed by Valley Realty during August 2019: Aug. 1. Purchased office supplies on account, 3,150. 2.Paid rent on office for month, 7,200. 3.Received cash from clients on account, 83,900. 5.Paid insurance premiums, 12,000. 9.Returned a portion of the office supplies purchased on August 1, receiving full credit for their cost, 400. Analyzing Transactions Aug. 17. Paid advertising expense, 8,000. 23.Paid creditors on account, 13,750. Enter the following transactions on Page 19 of the two-column journal: 29.Paid miscellaneous expenses, 1,700. 30.Paid automobile expense (including rental charges for an automobile), 2,500. 31.Discovered an error in computing a commission during July; received cash from the salesperson for the overpayment, 2,000. 31.Paid salaries and commissions for the month, 53,000. 31.Recorded revenue earned and billed to clients during the month, 183,500. 31.Purchased land for a future building site for 75,000, paying 7,500 in cash and giving a note payable for the remainder. 31.Withdrew cash for personal use, 1,000. 31.Rented land purchased on August 31 to a local university for use as a parking lot during football season (September, October, and November); received advance payment of 5,000. Instructions 1. Record the August 1 balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for August in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of August 31, 2019. 5. Assume that the August 31 transaction for Cindy Getmans cash withdrawal should have been 10,000. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?