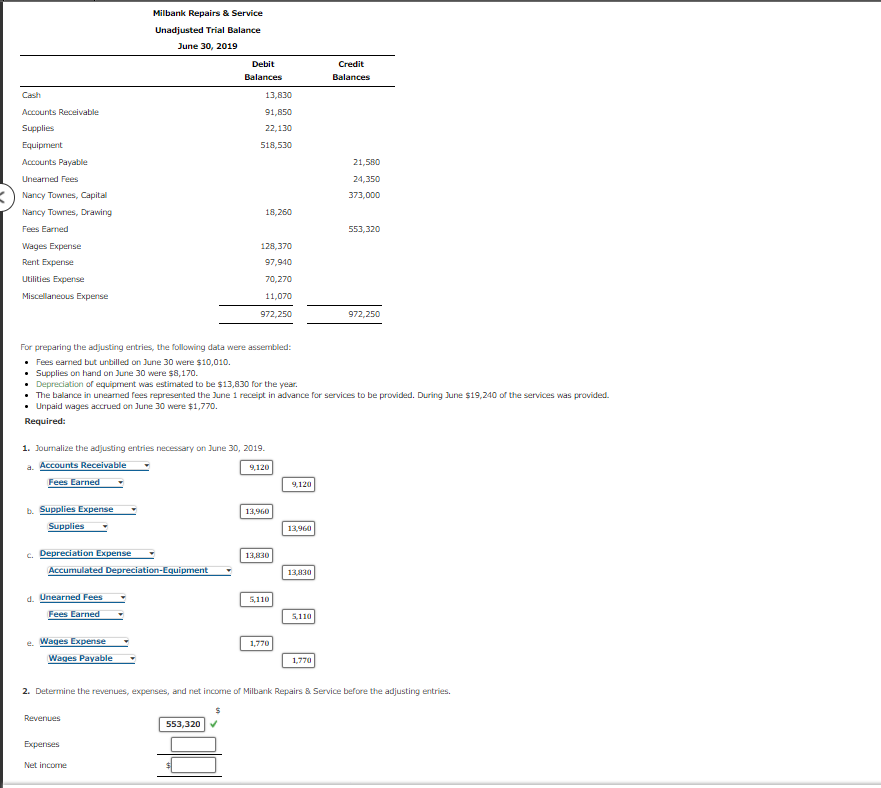

Milbank Repairs & Service Unadjusted Trial Balance June 30, 2019 Debit Credit Balances Balances Cash 13,830 Accounts Receivable 91,850 Supplies 22,130 Equipment 518,530 Accounts Payable 21,580 Uneamed Fees 24,350 Nancy Townes, Capital 373,000 Nancy Townes, Drawing 18,260 Fees Earned 553,320 Wages Expense 128,370 Rent Expense 97,940 Utilities Expense 70,270 Miscellaneous Expense 11,070 972,250 972,250 For preparing the adjusting entries, the following data were assembled: • Fees earned but unbilled on June 30 were $10,010. Supplies on hand on June 30 were $8,170. Depreciation of equipment was estimated to be $13,830 for the year. The balance in uneamed fees represented the June 1 receipt in advance for services to be provided. During June $19,240 of the services was provided. • Unpaid wages accrued on June 30 were $1,770. Required: 1. Journalize the adjusting entries necessary on June 30, 2019. a. Accounts Receivable Fees Earned 9,120 9,120 b. Supplies Expense 13,960 Supplies 13,960 c. Depreciation Expense Accumulated Depreciation-Equipment 13,830 13,830 d. Unearned Fees 5110 Fees Earned 5110 e. Wages Expense Wages Payable 1,770 1,770 2. Determine the revenues, expenses, and net income of Milbank Repairs & Service before the adjusting entries. Revenues 553,320V Expenses Net income

Milbank Repairs & Service Unadjusted Trial Balance June 30, 2019 Debit Credit Balances Balances Cash 13,830 Accounts Receivable 91,850 Supplies 22,130 Equipment 518,530 Accounts Payable 21,580 Uneamed Fees 24,350 Nancy Townes, Capital 373,000 Nancy Townes, Drawing 18,260 Fees Earned 553,320 Wages Expense 128,370 Rent Expense 97,940 Utilities Expense 70,270 Miscellaneous Expense 11,070 972,250 972,250 For preparing the adjusting entries, the following data were assembled: • Fees earned but unbilled on June 30 were $10,010. Supplies on hand on June 30 were $8,170. Depreciation of equipment was estimated to be $13,830 for the year. The balance in uneamed fees represented the June 1 receipt in advance for services to be provided. During June $19,240 of the services was provided. • Unpaid wages accrued on June 30 were $1,770. Required: 1. Journalize the adjusting entries necessary on June 30, 2019. a. Accounts Receivable Fees Earned 9,120 9,120 b. Supplies Expense 13,960 Supplies 13,960 c. Depreciation Expense Accumulated Depreciation-Equipment 13,830 13,830 d. Unearned Fees 5110 Fees Earned 5110 e. Wages Expense Wages Payable 1,770 1,770 2. Determine the revenues, expenses, and net income of Milbank Repairs & Service before the adjusting entries. Revenues 553,320V Expenses Net income

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 18E: Errors During the course of your examination of the financial statements of Burnett Co., a new...

Related questions

Question

Transcribed Image Text:Milbank Repairs & Service

Unadjusted Trial Balance

June 30, 2019

Debit

Credit

Balances

Balances

Cash

13,830

Accounts Receivable

91,850

Supplies

22,130

Equipment

518,530

Accounts Payable

21,580

Uneamed Fees

24,350

Nancy Townes, Capital

373,000

Nancy Townes, Drawing

18,260

Fees Earned

553,320

Wages Expense

128,370

Rent Expense

97,940

Utilities Expense

0,270ל

Miscellaneous Expense

11,070

972,250

972,250

For preparing the adjusting entries, the following data were assembled:

• Fees earned but unbilled on June 30 were $10,010.

• Supplies on hand on June 30 were $8,170.

• Depreciation of equipment was estimated to be $13,830 for the year.

• The balance in unearned fees represented the June 1 receipt in advance for services to be provided. During June $19,240 of the services was provided.

• Unpaid wages accrued on June 30 were $1,770.

Required:

1. Journalize the adjusting entries necessary on June 30, 2019.

Accounts Receivable

9,120

a.

Fees Earned

9,120

b. Supplies Expense

13,960

Supplies

13,960

c. Depreciation Expense

13,830

Accumulated Depreciation-Equipment

13,830

d. Unearned Fees

Fees Earned

5,110

5,110

Wages Expense

Wages Payable

e.

1,770

2. Determine the revenues, expenses, and net income of Milbank Repairs & Service before the adjusting entries.

Revenues

553,320 V

Expenses

Net income

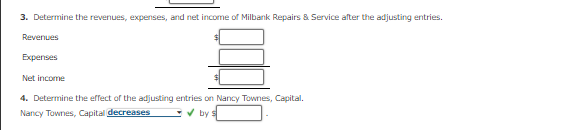

Transcribed Image Text:3. Determine the revenues, expenses, and net income of Milbank Repairs & Service after the adjusting entries.

Revenues

Expenses

Net income

4. Determine the effect of the adjusting entries on Nancy Townes, Capital.

Nancy Townes, Capital decreases

V by s

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning