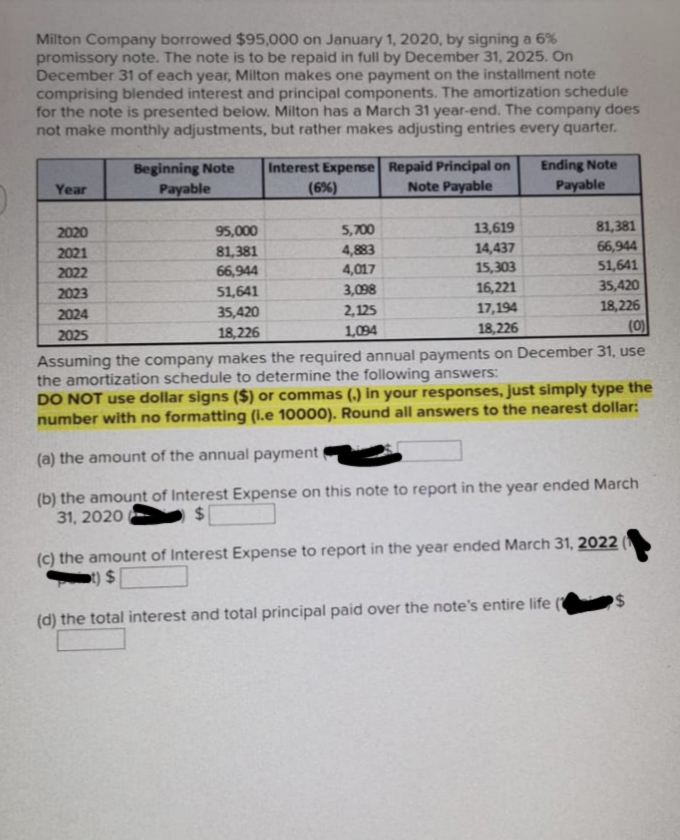

Milton Company borrowed $95,000 on January 1, 2020, by signing a 6% promissory note. The note is to be repaid in full by December 31, 2025. On December 31 of each year, Milton makes one payment on the installment note comprising blended interest and principal components. The amortization schedule for the note is presented below. Milton has a March 31 year-end. The company does not make monthly adjustments, but rather makes adjusting entries every quarter. Beginning Note Payable Interest Expense Repaid Principal on (6%) Ending Note Payable Year Note Payable 5,700 4,883 81,381 66,944 51,641 2020 95,000 13,619 14,437 15,303 2021 81,381 2022 66,944 4,017 2023 51,641 3,098 16,221 35,420 17 194 18 226

Milton Company borrowed $95,000 on January 1, 2020, by signing a 6% promissory note. The note is to be repaid in full by December 31, 2025. On December 31 of each year, Milton makes one payment on the installment note comprising blended interest and principal components. The amortization schedule for the note is presented below. Milton has a March 31 year-end. The company does not make monthly adjustments, but rather makes adjusting entries every quarter. Beginning Note Payable Interest Expense Repaid Principal on (6%) Ending Note Payable Year Note Payable 5,700 4,883 81,381 66,944 51,641 2020 95,000 13,619 14,437 15,303 2021 81,381 2022 66,944 4,017 2023 51,641 3,098 16,221 35,420 17 194 18 226

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter14: Long-term Liabilities: Bonds And Notes

Section: Chapter Questions

Problem 11E

Related questions

Question

Transcribed Image Text:Milton Company borrowed $95,000 on January 1, 2020, by signing a 6%

promissory note. The note is to be repaid in full by December 31, 2025. On

December 31 of each year, Milton makes one payment on the installment note

comprising blended interest and principal components. The amortization schedule

for the note is presented below. Milton has a March 31 year-end. The company does

not make monthly adjustments, but rather makes adjusting entries every quarter.

Beginning Note

Payable

Interest Expense Repaid Principal on

Note Payable

Ending Note

Payable

Year

(6%)

2020

95,000

5,700

13,619

81,381

66,944

14,437

15,303

2021

81,381

4,883

51,641

35,420

2022

66,944

4,017

2023

51,641

3,098

16,221

2024

35,420

2,125

17,194

18,226

18,226

(0)

2025

18,226

1,094

Assuming the company makes the required annual payments on December 31, use

the amortization schedule to determine the following answers:

DO NOT use dollar signs ($) or commas (.) in your responses, just simply type the

number with no formatting (I.e 10000). Round all answers to the nearest dollar:

(a) the amount of the annual payment

(b) the amount of Interest Expense on this note to report in the year ended March

31, 2020

$4

(c) the amount of Interest Expense to report in the year ended March 31, 2022

t) $

(d) the total interest and total principal paid over the note's entire life

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT