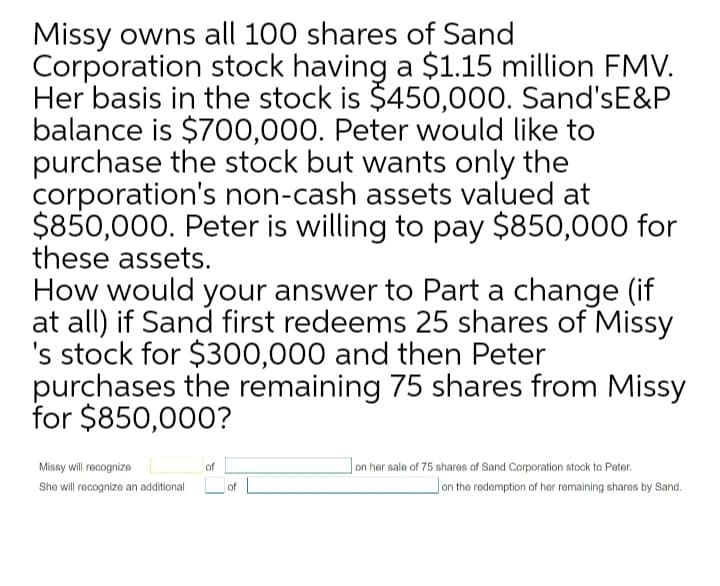

Missy owns all 100 shares of Sand Corporation stock having a $1.15 million FMV. Her basis in the stock is $450,000. Sand'sE&P balance is $700,000. Peter would like to purchase the stock but wants only the corporation's non-cash assets valued at $850,000. Peter is willing to pay $850,000 for these assets.

Missy owns all 100 shares of Sand Corporation stock having a $1.15 million FMV. Her basis in the stock is $450,000. Sand'sE&P balance is $700,000. Peter would like to purchase the stock but wants only the corporation's non-cash assets valued at $850,000. Peter is willing to pay $850,000 for these assets.

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 32P

Related questions

Question

Transcribed Image Text:Missy owns all 100 shares of Sand

Corporation stock having a $1.15 million FMV.

Her basis in the stock is $450,000. Sand'sE&P

balance is $700,000. Peter would like to

purchase the stock but wants only the

corporation's non-cash assets valued at

$850,000. Peter is willing to pay $850,000 for

these assets.

How would your answer to Part a change (if

at all) if Sand first redeems 25 shares of Missy

's stock for $300,000 and then Peter

purchases the remaining 75 shares from Missy

for $850,000?

Missy will recognize

of

on her sale of 75 sharos of Sand Corporation stock to Peter.

She will recognize an additional of

Jon the redemption of her remaining shares by Sand.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT