monprofit organization, on January 15, 2021. The fair value of the investmer $200,000 at the date of the gift. The donor restricts the use of the gift for re on TMJ surgical treatments. By March 31, 2021, the investment value has gr $226,000. On May 3, 2021 the Foundation sells the investments for $215,0 June 30, 2021, the Foundation had spent $175,000 on research related to T surgical treatments.

monprofit organization, on January 15, 2021. The fair value of the investmer $200,000 at the date of the gift. The donor restricts the use of the gift for re on TMJ surgical treatments. By March 31, 2021, the investment value has gr $226,000. On May 3, 2021 the Foundation sells the investments for $215,0 June 30, 2021, the Foundation had spent $175,000 on research related to T surgical treatments.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 39P

Related questions

Question

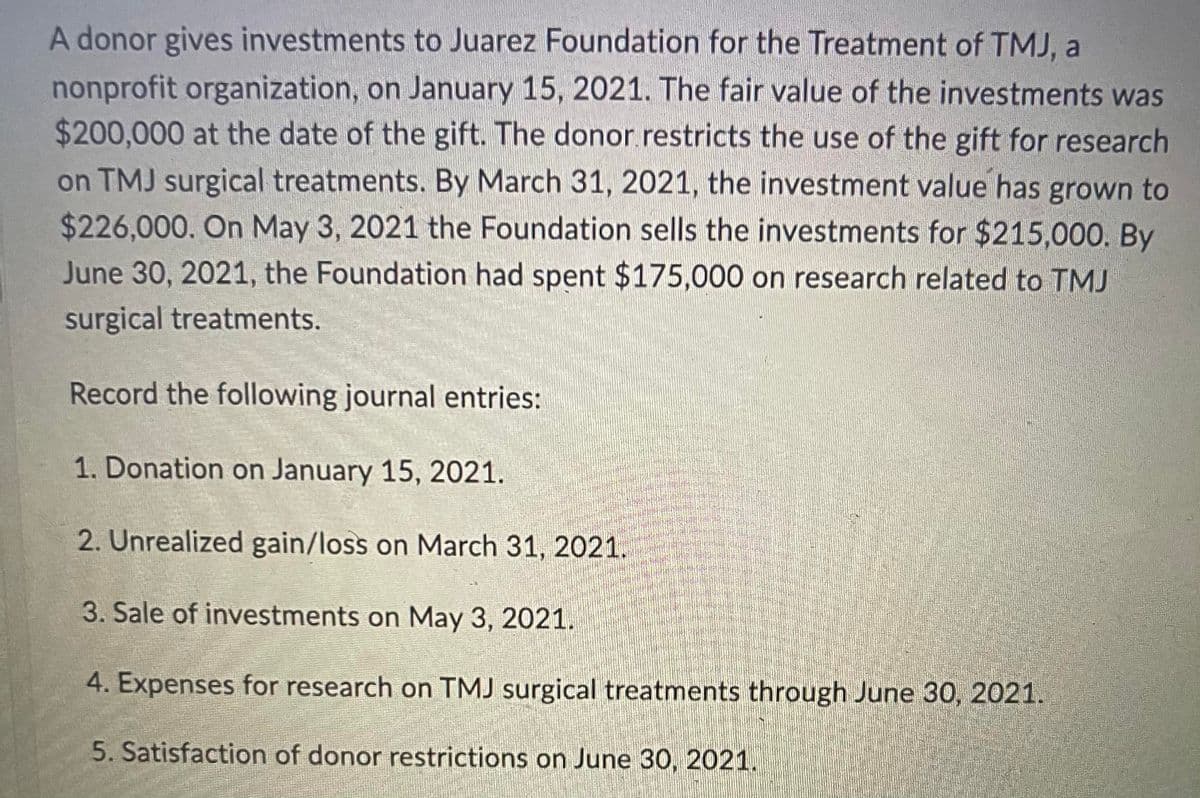

Transcribed Image Text:A donor gives investments to Juarez Foundation for the Treatment of TMJ, a

nonprofit organization, on January 15, 2021. The fair value of the investments was

$200,000 at the date of the gift. The donor restricts the use of the gift for research

on TMJ surgical treatments. By March 31, 2021, the investment value has grown to

$226,000. On May 3, 2021 the Foundation sells the investments for $215,000. By

June 30, 2021, the Foundation had spent $175,000 on research related to TMJ

surgical treatments.

Record the following journal entries:

1. Donation on January 15, 2021.

2. Unrealized gain/loss on March 31, 2021.

3. Sale of investments on May 3, 2021.

4. Expenses for research on TMJ surgical treatments through June 30, 2021.

5. Satisfaction of donor restrictions on June 30, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you