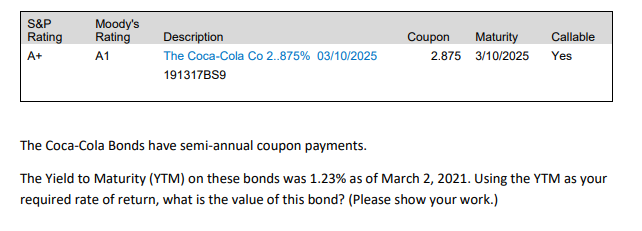

Moody's Rating S&P Rating Description Cou A+ A1 The Coca-Cola Co 2..875% 03/10/2025 191317BS9 The Coca-Cola Bonds have semi-annual coupon payments. The Yield to Maturity (YTM) on these bonds was 1.23% as of March 2

Q: INV3 P2a Independent Case A Your observations of the bond market have highlighted the following bond…

A: Bonds are referred to as the units of corporate debt which are issued by companies and securitized…

Q: A 1,000 par value nôn-callab has a maturity date of November 1, 2023. On May 1, 2016, this bond was…

A: Using the formula :Bond Price = C* (1-(1+r)-n/r ) + F/(1+r)n where, C = Coupon payment r = yield…

Q: dpb corporate bonds have a coupon rate of 9.2% APR (sa). The yeild to maturity is 8.5% APR (Sa). the…

A: Semi annual payments. Hence the period here is semi annual or half year. Hence, n = 2 x years to…

Q: A RM2,000 bond with 8% convertible semi-annually coupon matures at par on 15th October 2025. The…

A: Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only one…

Q: Bart Software has 9.1 percent coupon bonds on the market with 22 years to maturity. The bonds make…

A: Given, The coupon rate of bond is 9.1% Term to maturity is 22 years Let the face value of bond is…

Q: Elliot Enterprises’ bonds currently sell for $1,150; have an 11% coupon interest rate and a $1,000…

A: Given: Particulars Amount Current price(PV) 1150 Coupon rate 11% Par value(FV) 1000…

Q: Company XYZ's bonds have 12 years remaining to maturity. Interest is paid annually, the bonds have a…

A: Face value (F) = $1000 Coupon (C) = 10% of 1000 = $100 n = 12 years Selling price = $850 Let r = YTM…

Q: 13. A 10-year corporate bond has an annual coupon payment of 9 percent. The bond is currently…

A: 13. e. All of the statements above are correct.

Q: (Bond valuation) Doisneau 18-year bonds have an annual coupon interest of 13 percent, make…

A: Value of a bond refers to the right price of the bonds. The right price or intrinsic value helps in…

Q: 15. Scarlet Knight Corporation's bonds have a face value of $1.000 anda 9% coupon paid semiannually:…

A: The current yield of the bond is the Annual return paid by the bond divided by its current market…

Q: 1. The following table gives the prices of US Treasury securities (pic 87445408). 2. Fill in the…

A: Future Value = 100Coupon = 6Present Value = -103 (Negative since cash outflow to purchase the…

Q: lating to the bond issued by Legal nd General Finance Plc from Londe cock Exchange. Number of Coupon…

A: Price of bond is present value is present value of coupon payment and present value of par value=

Q: Q3) Referring to the two corporate bonds' data at below table, answer the following: If the…

A: Yield to maturity- It is the internal rate of return required for the present value of all the…

Q: au 18-year bonds have an annual coupon interest of

A: The answer is: D. the bonds should be selling at a discount because the bond's coupon rate is less…

Q: The following bond list is from the business section of a financial newspaper on January 1, 2016.…

A: Given, The Coupon rate of bond 4.13% Term is 5 years The bond pays semi annual coupons

Q: Question 3 a) Edward Enterprises bond currently sells for S1150, have an 11% coupon interest rate…

A: Answer a: Information Provided: PV = $1150 FV = $1000 Coupon rate = 11% Term = 18 years i.)…

Q: You are analyzing the cost of debt for a firm. You know that the firm’s 14-year maturity, 8.6…

A: A financial instrument with a fixed cost that helps a company to raise funds for business operations…

Q: Blue

A: Given: As the bond is semiannually compounded, n = 5*2 = 10, i = 6.26%/2 = 3.13%, PMT = 4.13%/2 =…

Q: Assume international company issued bonds with 2,500 OMR face value in muscat security market with…

A: Face Value of Bond = OMR 2500 Coupon Rate = 0.149 Coupon Amount =2500*0.149 =372.50 Interest Rate =…

Q: 6. [HW] $100,000 bond redeemable at par on October 1, 2038, is purchased on January 15, 2017.…

A: Solution a.Calculation of Cash Price Equation Cash Price = Quoted Price + Accrued Interest (Since…

Q: QUESTION 1 Kinetik Bhd issued bonds with 11 years remaining to maturity. Interest is paid…

A: Yield to maturity (YTM) It is the rate of return on a bond if the bond is held till its maturity. If…

Q: Dry Seal plans to issue bonds to expand operations. The bonds will have a par value of P1,000, a…

A: Par Value = 1000 Time Period = 10 years or 20 semi annual payments Coupon = Coupon Rate / 2 * Par…

Q: PC Bond Indices on 2015.02.26 Data provided by: National Post Index Level 1,000.21 683.94 1,084.71…

A: Bond price is the amount investors wants to pay for a bond. bond prices are measured in terms of…

Q: E Corp k America Corp 3.400 4.200 August 1, 2024 August 26, 2024 125.76 102.71 ach of the three…

A: In this problem we have to calculate price of each bond.

Q: D6) it is April 19th. The quoted price of a treasury bond with an actual/365-day count and a 2%…

A: A Bond refers to an instrument that represents the loan being made by the investor to the company…

Q: Treasury AAA Corporate BBB Corporate B Corporate Yield (%): 5.2 5.4 6.4 6.9 The above table shows…

A: Solution: Price of zero coupon corporate bond with BBB rating = Face value / (1+YTM) = $100 /…

Q: Sony company has zero-coupon bonds maturing in 2040. The yield to maturity for these bonds is 6%.…

A: The value of a bond is the present value of future earnings. Future earnings 100 rs at end of 20…

Q: Wonder World Ltd. outstanding bonds have a $1000 par value, a 9 percent semi-annual coupon, 8 years…

A: Bond price will be the sum of present value of all coupon payments and present value of face value.…

Q: A 6% semiannual coupon bond matures in 6 years. The bond has a face value of $1,000 and a current…

A: Bonds are issued by the government and corporations to raise finance. The lender pays the bondholder…

Q: The Omani Company has two bond issues outstanding. Both bonds pay OMR (100) annual interest plus OMR…

A: a) Computation as follows: Hence, the present value of bond L is $863.78 and bond S is $982.14.…

Q: A $1,000 3% convertible and callable corporate bond with exactly 10 years to maturity is currently…

A: Given, Conversion value exceeds by $70 Decrease in stock price by 1% Face value is $1,000

Q: 7A-1 ZERO COUPON BONDS A company has just issued 4-year zero Mw v w y coupon bonds with a maturity…

A: The cost of a Zero-coupon bond is the cost of debt. The yield to maturity of the zero-coupon bond is…

Q: Dry Seal plans to issue bonds to expand operations. The bonds will have a par value of P1,000, a…

A: The bonds have been issued at discount price. Therefore market rate is more than coupon rate.…

Q: 3. A $1,000 face value corporate bond with a 6.75 percent coupon (paid semiannually) has 10 years…

A: The price of bond has its effects with the market rate of interest and market rate of interest…

Q: Consider Bond CCC Ce Corny Coupon Fete: 10,5% per yea Vield to maturity: 7,955% per year Settlement…

A: Accrued interest is the interest that is calculated from the date of the bond to the settlement…

Q: The Saleemi Corporation's $1,000 bonds pay 7 percent interest annually and have 13 years until…

A: Bonds are the financial instruments that represent a debt taken by a corporation from the investors…

Q: A firm has just issued (January 1, 2019) a bond that has a face value of $1,000, a coupon rate of 6…

A: Bond Valuation is calculate by combination present value of annuity and present value of face value…

Q: Doisneau 22-year bonds have an annual coupon interest of 8 percent, make interest payments on a…

A: Term to maturity is 22 years Annual coupon rate is 8% Yield to maturity is 16%

Q: The market price of a semi-annual pay bond is $985.76. It has 18.00 years to maturity and a yield to…

A: Bonds are debt securities issued by Government or other companies, who seek to raise money from…

Q: The 11-year $1,000 par bonds of Vail Inc. pay 14 percent interest. The market's required yield to…

A: Here, Market's required yield to maturity on a comparable-risk bond = 11% To Find: Part A. Yield…

How do you solve for the

Step by step

Solved in 2 steps

- Ma4. 3. A $25000, 11.5% bond with semi-annual coupons redeemable at par March 1, 2025, was purchased on November 15, 2018, to yield 9.5% compounded semi-annually. (a) What was the purchase price of the bond? (b) Find the value of discount or premium. Mention whether the value is premium or discount.Problem5: OnJanuary1,2021,BLITZENCompanyissued10%bondsdatedJanuary1,2021withafaceamountof ₱8,000,000.ThebondsmatureonDecember31,2026.Forbondsofsimilarriskandmaturity,the marketyieldis14%.Interestispaidsemi-annuallyonJune30andDecember31.(Useatmost,4decimal placesforPVfactors) Preparethejournalentriesfor2021 Computeorprovidetheanswersforthefollowing: DeterminethepriceofthebondsonJanuary1,2021. Howmuchistheinterestexpensefortheyearended,December31,2021? Howmuchistheinterestexpensefortheyearended,December31,2022? WhatisthecarryingamountofthebondsonDecember31,2022?Unitedhealth care group set of bonds issued. Based on the bonds’ current YTM, calculate the average current yield. (US91324PBU57) 1. The UnitedHealth Group Inc.-Bond has a maturity date of 11/15/2041 and offers a coupon of 4.6250%. The payment of the coupon will take place 2.0 times per biannual on the 15.05.. At the current price of 126.62 USD this equals a annual yield of 3.00%. The UnitedHealth Group Inc.-Bond was issued on the 11/10/2011 with a volume of 600 M. USD. (US91324PBQ46) 2. The UnitedHealth Group Inc.-Bond has a maturity date of 2/15/2041 and offers a coupon of 5.9500%. The payment of the coupon will take place 2.0 times per biannual on the 15.08.. At the current price of 129.3 USD this equals a annual yield of 4.00%. The UnitedHealth Group Inc.-Bond was issued on the 2/17/2011 with a volume of 350 M. USD. (US91324PBK75 3. The UnitedHealth Group Inc.-Bond has a maturity date of 2/15/2038 and offers a coupon of 6.8750%. The payment of the coupon will take place 2.0 times…

- Homework MBC LO6 M7-23. to the $400,000 maturity Applying Time Value of Money Concepts Complete the missing information in the table below. Assume that all bonds pay interest semiannually. Firm 1... Firm 2... Firm 3... Firm 4... Firm 5... Annual Yield Years to Maturity Coupon Rate 8.00% 15 3.00% 6.50% 0.80% 10 ? 12 20 Concents 7.00% 0.00% 5.00% 3.50% 2.00% Face Value $ 300,000 ? $ 500,000 $1,000,000 $ 500,000 Issue Proceeds ? $ 556,853 $ 468,416 $1,147,822 ? honds Ozona Mineraldpb corporate bonds have a coupon rate of 9.2% APR (sa). The yeild to maturity is 8.5% APR (Sa). the bonds will mature in 19 years. calculate the price of the bond. n=38 pmt-46 fv=1000 i=.0425 pv= -1065.42Q. In 1998 Squasher Corp. issued bonds with an 8% coupon rate and a $1,000 face value. The bonds mature on March 1, 2023. If an investor purchased one of these bonds on March 1, 2008, determine the yield to maturity if the investor paid $1,050 for the bond.

- Bond QuoteDEERE, Inc.Current Price: $98.00Face Value: $100.00Annual Coupon Rate: 3%Coupons Per Year: 2Issue Price $99.77Issue Date: Jan 1, 2017Maturity Date: Jan 1, 2024Next Coupon Date: June 30, 2022Coupon Payments Remaining: 4Please fill in the following information to determine the current Yield to Maturity. The rate and YTM canbe estimated to two decimal places (i.e. 1.23%). Fill In N I PV FV PMT Yield to MaturityQ1. A firm has just issued (January 1, 2019) a bond that has a face value of $1,000, a coupon rate of 6 percent paid semi-annually (June 30, December 31), and matures in 8 years. The bonds were issued with a yield to maturity of 7%. What price were the bonds issued at? Assume that on July 1, 2021, the bond trades to earn an effective yield of 10%. At what price should this bond be trading for on July 1, 2021? PRICE WHEN ISSUED: PRICE ON JULY 1, 2021:Question a The following data relate to a corporate bond which pays coupons semi-annually:Settlement date 01 March 2020Maturity date 31 December 2040Coupon rate 12%Yield to maturity 10%Face value $1,000Percentage of face value paid back to the investor on maturity 100%Using the above data, calculatei. The flat price of the bondii. Accrued interestiii. Invoice price of the bond Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line. .

- 6. [HW] $100,000 bond redeemable at par on October 1, 2038, is purchased on January 15, 2017. Interest is 5.9% payable semi-annually and the yield is 9% compounded semi-annually. a) What is the cash price of the bond? b) What is the accrued interest? c) What is the purchase price? SDT = CPN = RDT = RV = ACT 2/Y YLD = PRI = AI = a) $70,634.65 b) $1718.13 c) 72,352.78Assume a firm issues a zero-coupon bond on 1/1/2021. The face value is $5,000,000, and the effective rate is 4.1%, compounded annually over the 20 years of the bond i. Make the amortization table ii. Make the journal entry to issue the bonds on 1/1/2021iii. Make the entry to record interest on 12/31/2021 and 12/31/2022 iv. Make the entry to retire the principle of the bonds on 12/31/2040v. For every entry, record the effectsQ1) He Omani Company has two bond issues outstanding. Both bonds pay OMR (100) annual interest plus OMR (1000) face value at maturity. Bond L has a maturity of 15 years, sell after three years issued, and Bond S has a maturity of 1 year. A. What will be the value of each of these bonds when the going rate of market interest is 12%? B. what can you conclude from the results of the above questions regarding the bond risks?