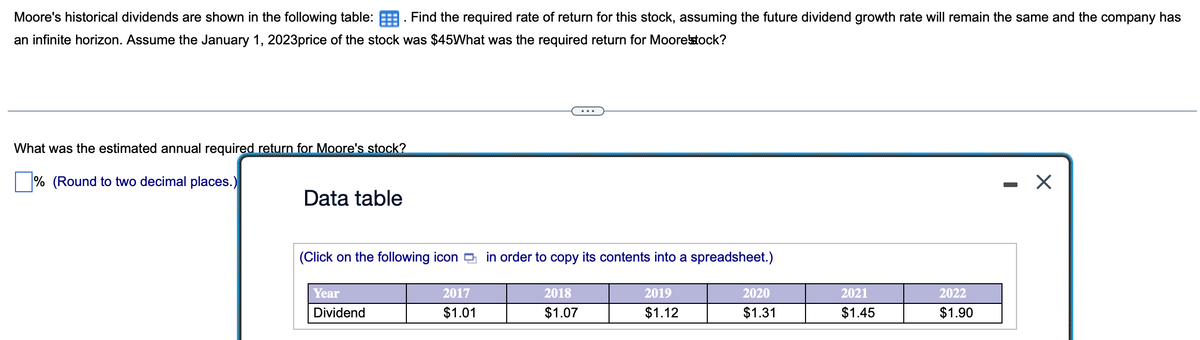

Moore's historical dividends are shown in the following table:. Find the required rate of return for this stock, assuming the future dividend growth rate will remain the same and the company has an infinite horizon. Assume the January 1, 2023price of the stock was $45What was the required return for Moorestock? What was the estimated annual required return for Moore's stock? % (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year Dividend 2017 $1.01 2018 $1.07 2019 $1.12 2020 $1.31 2021 $1.45 2022 $1.90 - X

Moore's historical dividends are shown in the following table:. Find the required rate of return for this stock, assuming the future dividend growth rate will remain the same and the company has an infinite horizon. Assume the January 1, 2023price of the stock was $45What was the required return for Moorestock? What was the estimated annual required return for Moore's stock? % (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year Dividend 2017 $1.01 2018 $1.07 2019 $1.12 2020 $1.31 2021 $1.45 2022 $1.90 - X

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 14MC

Related questions

Question

Transcribed Image Text:Moore's historical dividends are shown in the following table:. Find the required rate of return for this stock, assuming the future dividend growth rate will remain the same and the company has

an infinite horizon. Assume the January 1, 2023price of the stock was $45What was the required return for Moorestock?

What was the estimated annual required return for Moore's stock?

% (Round to two decimal places.)

Data table

(Click on the following icon in order to copy its contents into a spreadsheet.)

Year

Dividend

2017

$1.01

2018

$1.07

2019

$1.12

2020

$1.31

2021

$1.45

2022

$1.90

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning