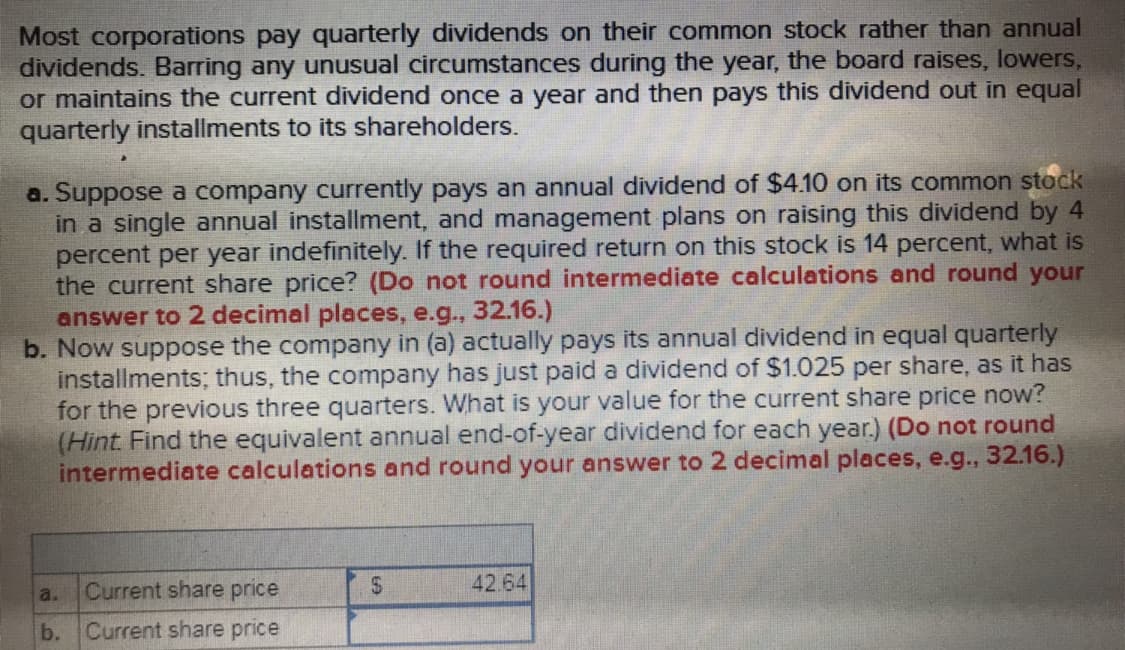

Most corporations pay quarterly dividends on their common stock rather than annual dividends. Barring any unusual circumstances during the year, the board raises, lowers, or maintains the current dividend once a year and then pays this dividend out in equal quarterly installments to its shareholders. a. Suppose a company currently pays an annual dividend of $410 on its common stock in a single annual installment, and management plans on raising this dividend by 4 percent per year indefinitely. If the required return on this stock is 14 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Now suppose the company in (a) actually pays its annual dividend in equal quarterly installments; thus, the company has just paid a dividend of $1.025 per share, as it has for the previous three quarters. What is your value for the current share price now? (Hint Find the equivalent annual end-of-year dividend for each year.) (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Current share price b. Current share price 42.64

Most corporations pay quarterly dividends on their common stock rather than annual dividends. Barring any unusual circumstances during the year, the board raises, lowers, or maintains the current dividend once a year and then pays this dividend out in equal quarterly installments to its shareholders. a. Suppose a company currently pays an annual dividend of $410 on its common stock in a single annual installment, and management plans on raising this dividend by 4 percent per year indefinitely. If the required return on this stock is 14 percent, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Now suppose the company in (a) actually pays its annual dividend in equal quarterly installments; thus, the company has just paid a dividend of $1.025 per share, as it has for the previous three quarters. What is your value for the current share price now? (Hint Find the equivalent annual end-of-year dividend for each year.) (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Current share price b. Current share price 42.64

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:Most corporations pay quarterly dividends on their common stock rather than annual

dividends. Barring any unusual circumstances during the year, the board raises, lowers,

or maintains the current dividend once a year and then pays this dividend out in equal

quarterly installments to its shareholders.

a. Suppose a company currently pays an annual dividend of $410 on its common stock

in a single annual installment, and management plans on raising this dividend by 4

percent per year indefinitely. If the required return on this stock is 14 percent, what is

the current share price? (Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.)

b. Now suppose the company in (a) actually pays its annual dividend in equal quarterly

installments; thus, the company has just paid a dividend of $1.025 per share, as it has

for the previous three quarters. What is your value for the current share price now?

(Hint Find the equivalent annual end-of-year dividend for each year.) (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

a. Current share price

b. Current share price

42.64

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning