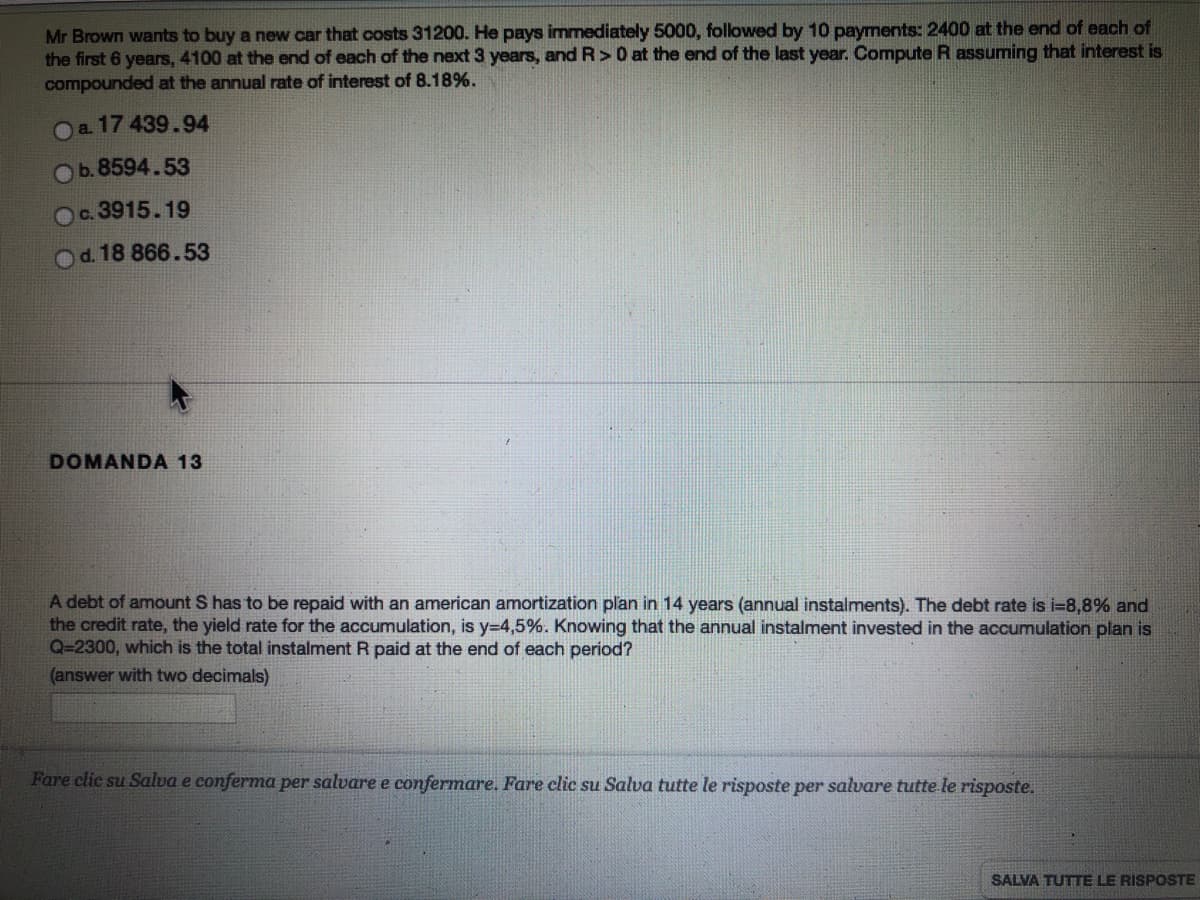

Mr Brown wants to buy a new car that costs 31200. He pays immediately 5000, followed by 10 payments: 2400 at the end of each of the first 6 years, 4100 at the end of each of the next 3 years, and R>0 at the end of the last year. Compute R assuming that interest is compounded at the annual rate of interest of 8.18%. Oa. 17 439.94 Ob.8594.53 Oc 3915.19 Od. 18 866.53

Mr Brown wants to buy a new car that costs 31200. He pays immediately 5000, followed by 10 payments: 2400 at the end of each of the first 6 years, 4100 at the end of each of the next 3 years, and R>0 at the end of the last year. Compute R assuming that interest is compounded at the annual rate of interest of 8.18%. Oa. 17 439.94 Ob.8594.53 Oc 3915.19 Od. 18 866.53

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 10MC: On August 1, 2019, Kern Company leased a machine to Day Company for a 6-year period requiring...

Related questions

Question

Can you answer these 4 questions (2 questions in each photo) please?

Transcribed Image Text:Mr Brown wants to buy a new car that costs 31200. He pays immediately 5000, followed by 10 payments: 2400 at the end of each of

the first 6 years, 4100 at the end of each of the next 3 years, and R> 0 at the end of the last year. Compute R assuming that interest is

compounded at the annual rate of interest of 8.18%.

Oa 17 439.94

Ob.8594.53

O. 3915.19

Od. 18 866.53

DOMANDA 13

A debt of amount S has to be repaid with an american amortization plan in 14 years (annual instalments). The debt rate is i=8,8% and

the credit rate, the yield rate for the accumulation, is y=4,5%. Knowing that the annual instalment invested in the accumulation plan is

Q=2300, which is the total instalment R paid at the end of each period?

(answer with two decimals)

Fare clic su Salva e conferma per salvare e confermare. Fare clic su Salva tutte le risposte per salvare tutte le risposte.

SALVA TUTTE LE RISPOSTE

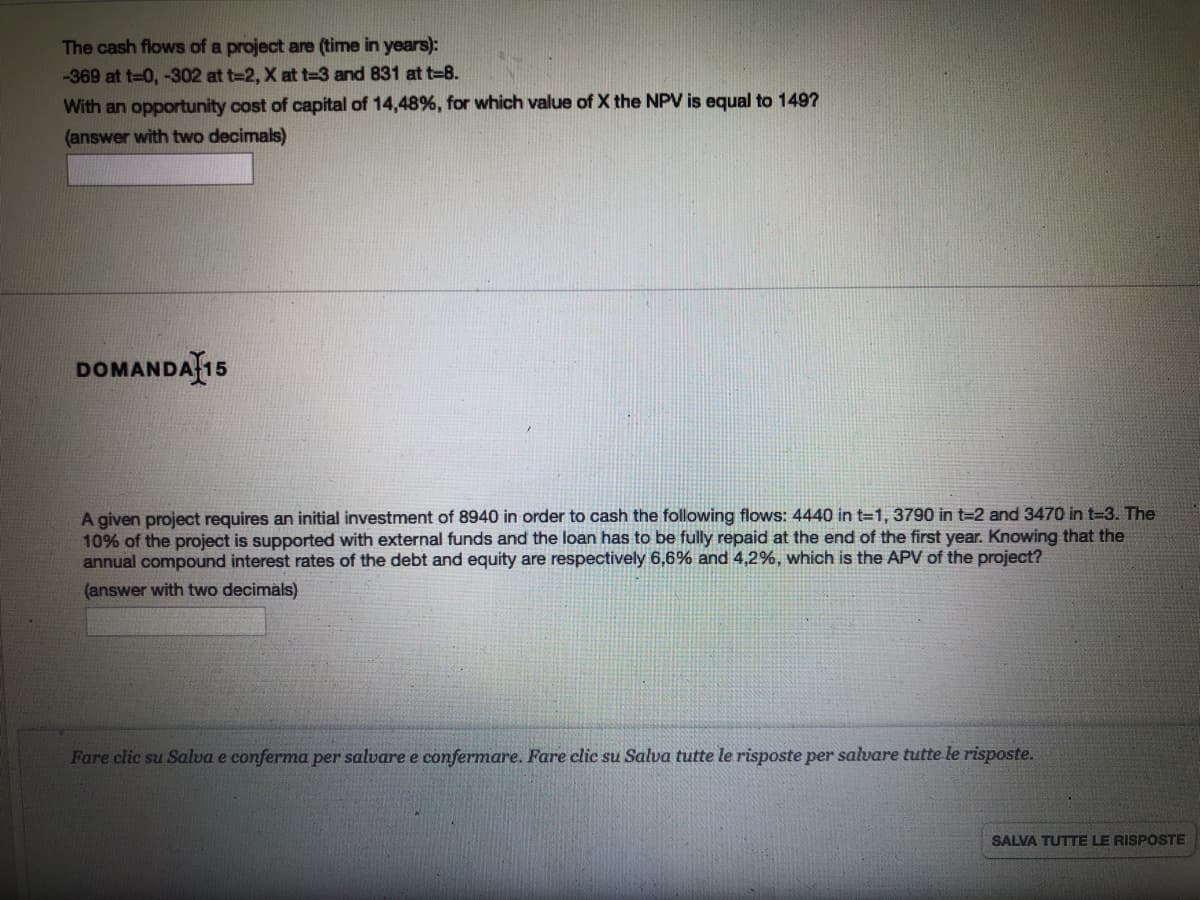

Transcribed Image Text:The cash flows of a project are (time in years):

-369 at t=0, -302 at t=2, X at t-3 and 831 at t=8.

With an opportunity cost of capital of 14,48%, for which value of X the NPV is equal to 1497

(answer with two decimals)

DOMANDAȚ15

A given project requires an initial investment of 8940 in order to cash the following flows: 4440 in t=1, 3790 in t=2 and 3470 in t-3. The

10% of the project is supported with external funds and the loan has to be fully repaid at the end of the first year. Knowing that the

annual compound interest rates of the debt and equity are respectively 6,6% and 4,2%, which is the APV of the project?

(answer with two decimals)

Fare clic su Salva e conferma per salvare e confermare. Fare clic su Salva tutte le risposte per salvare tutte le risposte.

SALVA TUTTE LE RISPOSTE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning