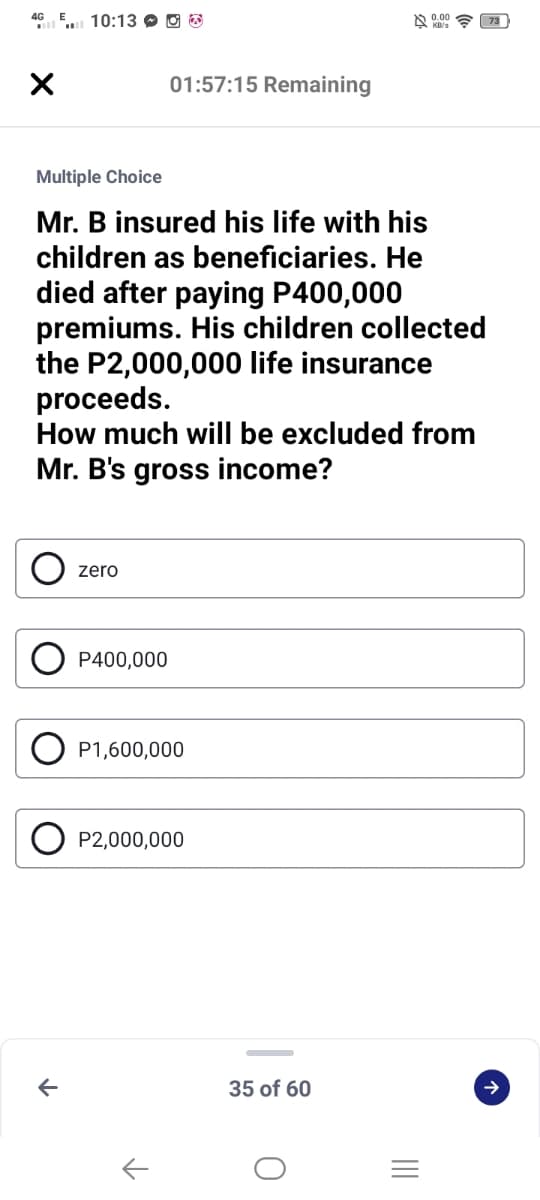

Mr. B insured his life with his children as beneficiaries. He died after paying P400,000 premiums. His children collected the P2,000,000 life insurance proceeds. How much will be excluded from Mr. B's gross income?

Q: Mrs. Sanchez Mira had a gross taxable compensation income ofP400,000. She also earned an additional…

A: Taxable income is described as that income which is chargeable to income tax. This amount is…

Q: derek was injured in a vehicular accident in 2018. He incurred and paid medical expenses of P20,000…

A: From the above info it seems the taxation case is of Philippines for the year…

Q: Cardo received the following items during the year: P200,000 donation from a girlfriend; P100,000…

A: Answer:- Taxable income meaning:- The part of total income used to compute how much tax someone owe…

Q: Mr. Ernesto dela Cruz, had the following during the taxable year: • P1,500,000 for outliving his…

A: According the Philippines taxation there are some rules and procedures which are involved while…

Q: How much is the estate tax?

A: The law states that one can withdraw the bank deposits of a deceased person after settling the…

Q: In 2020, Bongbong Jr. created two (2) trusts for his minor son, Chiz. During the year, the two…

A: Trust Here in trust which has subjective to the taxation which are determine by the total net income…

Q: Considering he left a will, how much of the free portion is to be received by the church?

A: Article 163 of the Family Code of the Philippines states that children conceived or born during the…

Q: David Davis died in 2019 and left an estate valued at $13,900,000 after the payment of his debts.…

A: Given : David Davis died in 2019 and left an estate valued at $13,900,000 after the payment of his…

Q: Becky purchased a P1,500,000 life insurance policy for P100,000. During the year, Becky died and her…

A: life insurance policy proceeds include premium paid. So in this case ,life insurance policy proceeds…

Q: Alice, a widow, elected to receive t of a $70,000 face value life insurar the life of her

A: Tax refers to the mandatory charge levied on the money or income gained by an entity.

Q: Bob died in 2020. He left an estate worth $20,000,000, a surviving spouse, and a two trust will…

A: CST termed as Credit Shelter Trust which is made to allow the affluent couples for decreasing or…

Q: Mr. Ernesto dela Cruz, had the following during the taxable year • P1,500,000 for outliving his…

A: According the Philippines taxation there are some rules and procedures which are involved while…

Q: Nicanor, single, received the following in 2022: Proceeds of his life insurance paid at annual…

A: Proceeds of his life insurance paid at an annual premium of P15,000 within 25 years - P2,000,000…

Q: Harmony, a citizen and resident of the Philippines, married, died, leaving the following properties:…

A: Correct option is p450,000.

Q: n 2020, Bongbong Jr. created two (2) trusts for his minor son, Chiz. During the year, the two trusts…

A: As per section 60 of CHAPTER X ESTATES AND TRUSTS of Tax code, In the case of two or more trusts…

Q: Jaylen made a charitable contribution to his church in the current year. He donated common stock…

A: Charitable Contribution ( Upto 60%) Paid ( by cash/ check or charged on credit card) or property…

Q: Nicanor is a married man with surviving spouse: Community properties: Real property located in…

A: Computation of Gross Estate: Particulars Exclusive Communal Total Exclusive Family House…

Q: After one year from the death of her husband, Nancy Matyas received the proceeds of life insurance…

A: Taxable Income:- It is the income on which one pays tax as per rate prescribed by the taxation…

Q: Which one of the following exclusion techniques would be the most appropriate to reduce the value of…

A: Gross estate is the total value of the assets of an individual at the time of their death. It does…

Q: d. On September 30, 2018, Ridge loaned $150,000 to his mother so that she could enter a nursing…

A: Taxable income is the amount of income computed to measure the amount of taxes to be paid to the…

Q: Vlad died on October 20, 2018. During his lifetime, upon knowing that he had Stage 4 cancer, sold…

A: Given Information: Sales value of Lamborghini car - P4,000,000 Fair market value at the time of…

Q: .Mrs. A took out a life insurance policy for 500,000 naming her son as beneficiary. Under the terms…

A: SOLUTION EVEN THOUGH MRS A OUTLIVED THE POLICY , THE ENTIRE PROCEEDS ARE NOT AUTOMATICALLY TAX…

Q: Linda bought a life insurance policy whereby she insured herself for 1 million for a period of 10…

A: The gross income from the insurance policy is the difference between the maturity amount received…

Q: Pedro, single received the following during the taxable year: Proceeds of his life insurance paid at…

A: Gross income refers to the income which comprises of wages and salary in addition to other forms of…

Q: Ricardo was married at the time of death and was survived by his wife and their five legitimate…

A: The net taxable estate is: Particulars Amount P Amount P Real and personal properties in the…

Q: Liz left the following bank deposits upon his death A bank - 1000000 B bank - 2000000 c bank…

A: Answer: Bank deposits A bank - 1000000 B bank - 2000000 C bank- 3000000 Total : 6,000,000

Q: a. This year Casey made a taxable gift of $1 million to Stephanie. Casey is not married, and the…

A: Gift tax due= $0

Q: What amount, if any, does Bob’s estate exceed the $11,000,000 exclusion amount?

A: Federal gift tax can be defined as the amount of tax to be paid by the transferor of the property to…

Q: Mary owns a home with a with a replacement value of $331,195. She purchased home insurance in the…

A: According to the "80% rule of home insurance", the replacement value of the house should be insured…

Q: Nicanor is a married man with surviving spouse: Community Properties: Real Property located in…

A: Taxable estate = Gross estate - deduction Gross estate includes all property, real or personal,…

Q: Anton creates an irrevocable trust for his children with a transfer of income-producing property and…

A: As per the tax laws income will be taxable in the hand of the person or entity who has earned it.

Q: Njabulo is a 72 year old accountant at an accounting firm.He earns a taxable income of R58 470 per…

A: Monthly salary is the amount, which a person get after one month of hard work and dedication, at the…

Q: 1. Martha has a net capital loss of $17,000 and other ordinary taxable income of $45,000 for the…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: Frank is a widower. He has a $15.3 million estate consisting primarily of undeveloped real estate…

A: Life insurance policies are the ones that an individual buys to use the funds invested for his…

Q: of her mother's life insurance resulting from her death. Premiums paid totaled P780,000. • Increase…

A: According the Philippines taxation there are some rules and procedures which are involved while…

Q: Nicanor is survived by the following: his legitimate parents, Mama Bear and Papa Bear, wife Inday,…

A: Tax is a charge which is levied on taxable income. Share by will is the portion of the property…

Q: Father dies in 2018 and leaves his entire estate of $6,350,000 to Son. Father’s estate pays…

A: Taxes paid on Father's estate is $250,000 federal estate tax & $100,000 Illinois estate tax.…

Q: Mrs. A took out a life insurance policy for 500,000 naming her son as beneficiary. Under the terms…

A: SOLUTION TAXABLE INCOME IS THE PORTION OF INDIVIDUALS OR A COMPANY'S INCOME USED TO CALCULATE HOW…

Q: Ricardo was married at the time of death and was survived by his wife and their five legitimate…

A: Distributable Estate Tax The calculation of the net distributable estate tax is to procedure for the…

Q: ral expenses and $1,500,000 of accounting and legal fees to settle the estate. Mr. Trebeck…

A: It is the percentage of our income collected by the government to fund its services and programs and…

Q: Kevin purchased a house 20 years ago for $100,000 and he has always lived in the house. Three years…

A: A. $ 0

Q: At the age of 50, Lala gave money to the insurance company with an agreement that Lala would receive…

A: Annual Amount = 2,000,000 End of year payments Assuming Interest Rate = 10%

Q: 0. Nicanor, single, received the following in 2022: Proceeds of his life insurance paid at annual…

A: Gross income refers to the income which involves the wages, retirement distributions, dividends,…

Q: Leon has a gross estate estimated at $14.3 million. He is not married but does have two adult…

A: Given in this question is the information regarding Leon whose, Gross estate is estimated = $14.3…

Q: Edward donated a lot worth P650,000 to his cousin Karl subject to the condition that Karl will…

A: Donor's tax, often known as gift tax or donation tax, is levied on gratuitous transfers of assets to…

Q: Val died on May 13, 2021. On July 3, 2018, she gave a $400,000 lite insurance policy on her own lite…

A: a. The amount of life insurance proceeds shall be included in the deceased gross estate if the…

Q: Under Megan's will, $10,000 a year is to be paid to his widow and $5,000 a year is to be paid to his…

A: Gross income (GI) refers to the income which involves the wages, retirement distributions,…

Q: a decedent died on nov. 1,2020 leaving a family home composed of the following: conjugal house worth…

A: deductible amount of family home: conjugal house worth = P 8,000,000 allowed deduction on conjugal…

Q: On 23 August 2015, Peter made a gift of a house valued at £420,000 to his son, John. This was a…

A: As per rules of Inheritence Tax of UK the zero tax limit i £ 325000. Above…

Step by step

Solved in 2 steps

- H6. Sarah is the beneficiary of her mother’s $100,000 life insurance policy. When her mother dies, Sarah is relying on the entire death benefit to pay expenses related to her mother’s funeral and end-of-life care. However, unbeknown to Sarah, her mother had outstanding policy loans totaling $60,000. How much can Sarah expect to receive in death benefits from her mother’s policy? a. $100,000 b. $60,000 c. $40,000 d. $20,0001. If John had deposited N$ 100 000 of his lump sum into a NamPost saving accountand earned interest on the savings account, the interest received by John would notbe taxable.a) Falseb) True2. Specifically included in John’s Gross Income should be any amount, excluding allvoluntary award, received or accrued in respect of services rendered or to berendered.a) Trueb) False 3. Desmond Xaweb 68-year old pensioner owns three tuck shops in Kunene Region. Hehas lived his whole life in Namibia and has never left the country. Desmond is alsothe owner of a house located a few kilometres outside Okahandja. After his death inJanuary this year, Desmond’s grandson, Dion, inherited the house. The house wasvalued at N$ 2 500 000 by an independent real estate evaluator. After facing cashflow problems, Dion decided to sell the house for N$ 2 000 000 during the sameyear. Will the proceeds from the sale of house by Dion be considered of incomenature?a) Trueb) False 4.24. Lisa Kutako, a property developer…68. How much is to be included in the gross estate from the proceeds of life insurance? MoonLife Insurance - Inday (wife) irrevocably designated as beneficiary - Php 1 Million PhilCam Insurance - Executr of Nicanor is revocably designated as beneficiary - Php 1 Million ProLife OK Insurance - Estate of Nicanor is the revocably designated as beneficiary - Php 1 Million SunDeath Insurance - Junior (son) revocably designated as beneficiary - Php 1 Million Answer:_____________

- Question #59 of 85 Question ID: 1251855 Your client is terminally ill. Her potential gross estate, valued at $12.9 million, includes the following assets: A life insurance policy on her life, with a death benefit of $500,000; her deceased husband is the named beneficiary A general power of appointment (valued at $500,000) over the assets of a trust established by her husband; her children are the designated remaindermen of the trust A $500,000 retained life estate in the family residence Your client also expects to receive a $500,000 bequest within the next four months from her deceased sister's estate; the client's children are the contingent beneficiaries of the bequest. Your client would like to transfer a portion of her estate to her two children while she is alive to reduce her potential estate tax liability to the greatest extent possible. Which one of the following exclusion techniques would be the most appropriate to reduce the value of your client's potential gross…Pm.7 Pat recognized the following capital gains and losses this year. Short-term capital gain $ 3,800 Short-term capital loss $ (9,700) Long-term capital gain $ 39,000 Long-term capital loss $ (35,100) Her AGI before consideration of these gains and losses was $240,000. Compute her AGI and any capital loss carryforward into future years. Group of answer choices $237,000 AGI and $0 capital loss carryforward $238,000 AGI and $0 capital loss carryforward $240,000 AGI and $2,000 capital loss carryforward $240,000 AGI and $3,000 capital loss carryforwardHw.48. Larry recorded the following donations this year: $620 cash to a family in need $2520 to a church $620 cash to a political campaign To the Salvation Army household items that originally cost $1320, but are worth $420. What is Larry's maximum allowable charitable deduction if his AGI is $61,200?

- LO.2, 3, 7, 11 Kristin Graf (123 Baskerville Mill Road, Jamison, PA 18929) is trying to decide how to invest a 10,000 inheritance. One option is to make an additional investment in Rocky Road Excursions in which she has an at-risk basis of 0, suspended losses under the at-risk rules of 7,000, and suspended passive activity losses of 1,000. If Kristin makes this investment, her share of the expected profits this year will be 8,000. If her investment stays the same, her share of profits from Rocky Road Excursions will be 1,000. Another option is to invest 10,000 as a limited partner in the Ragged Mountain Winery; this investment will produce passive activity income of 9,000. Write a letter to Kristin to review the tax consequences of each alternative. Kristin is in the 24% tax bracket.LO.2 Belinda spent the last 60 days of 2019 in a nursing home. The cost of the services provided to her was 18,000 (300 per day). Medicare paid 8,500 toward the cost of her stay. Belinda also received 5,500 of benefits under a long-term care insurance policy she purchased. Assume that the Federal daily excludible amount is 370. What is the effect on Belindas gross income?Harry's wife Lila passes away in January of the current year. Fortunately, Lila had a $1 million life insurance policy. Harry elects to receive all $1 million in the current year and spends $200,000 of it on a luxury around-the-world trip with his new girlfriend. Harry's gross income from the life insurance is: $0 $200,000 $800,000 $1,000,000

- ESTIMATING TAXABLE INCOME, TAX LIABILITY, AND POTENTIAL REFUND. Hannah Owens is 24 years old and single, lives in an apartment, and has no dependents. Last year she earned 55,000 as a sales assistant for Business Solutions: 3,910 of her wages was withheld for federal income taxes. In addition, she had interest income of 142. She takes the standard deduction. Calculate her taxable income, tax liability, and tax refund or tax owed for 2015.N6. Account Net Operating Losses (LO 4.9) Tyler, a single taxpayer, generates business income of $3,000 in 2016. In 2017, he generates an NOL of $2,000. In 2018, he incurs another NOL of $5,000. In 2019, he generates a modest business income of $6,000 and then in 2020, the COVID-19 pandemic results in an NOL of $13,000. Assume that in all years, Tyler adopts the NOL treatment that results in the earliest and greatest refund. Provide a chronological analysis of Tyler’s treatment of NOLs through 2020. In 2017, Tyler carries back his $2,000 NOL against his 2016 income leaving $fill in the blank 3 1,000 of 2016 income. In 2018, Tyler carries forward the NOL to 2019 In 2019, Tyler can offset 80% of his 2019 income with the 2018 NOL and he has a $fill in the blank 8 carryforward from 2018 . In 2020, the COVID provisions allows him to carryback $fill in the blank 10 1,000 to 2016 He can now use all of the remaining $fill in the blank 12 2018 loss against the 2019 income and then can use…50. If John purchases a new car for $18,500 and, according to research, itstraight line depreciates to zero value after 10 years, how much will his car beworth after 99 months? A. $0B. $3,237.50C. $186.87D. $3,150.25