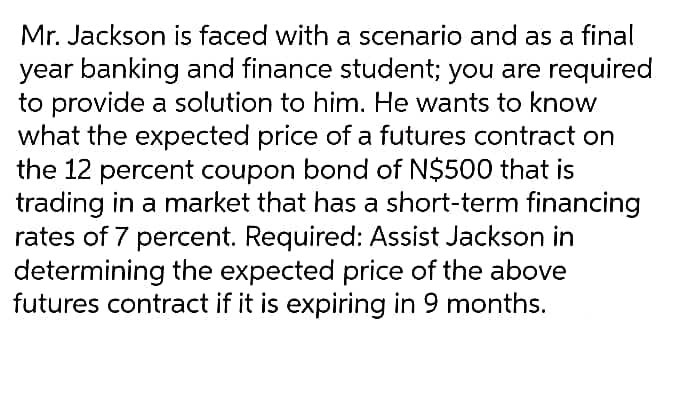

Mr. Jackson is faced with a scenario and as a final year banking and finance student; you are required to provide a solution to him. He wants to know what the expected price of a futures contract on the 12 percent coupon bond of N$500 that is trading in a market that has a short-term financing rates of 7 percent. Required: Assist Jackson in determining the expected price of the above futures contract if it is expiring in 9 months.

Q: The FFR is an important influence on other interest rates, like those on car loans and home loans, b...

A: Future Value: The future value is the amount that will be received at the end of a certain period. T...

Q: In order to overcome the differences in the preferences of surplus units and deficit usnits, it may ...

A: The large institution takes funds from the small investors and they prepare large amount of funds an...

Q: cost of capital f

A: The current cost of capital refers to the amount of return which company required in order to achiev...

Q: Task 1. Compute the interest of the following: 1. P25,000 at 6% simple interest for 1 year. 2. P30,0...

A: 1) Principal (P) = P 25000 r = 6% n = 1 year

Q: Find the amount accumulated FV in the given annuity account. HINT [See Quick Example 1 and Example 1...

A: The value of current payment or upcoming flow of payments at any future date when flow of payment te...

Q: Return on equity b. Total assets turnover c. Return on assets

A: “Since you have posted a question with multiple sub-parts, we will solve the first three subparts ...

Q: William's student loan of $24,500 at 3.22% compounded quarterly was amortized over 6 years with paym...

A: The present value of loan is equal to the sum of the present values of all future monthly installmen...

Q: A stock does not currently pay a dividend, but you expect to sell the stock for $41 in 3 years. The ...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: z is planning to attend college when she graduates from high school four years from now. She has mad...

A: Money deposited in the account grow with the time according to the interest rate and time of money. ...

Q: Mr. Sanchez's new machine has been installed. Based on the contract and warranty, there will be no m...

A: Here, Life of Machine is 16 years Maintenance Cost for first 2 years is $0 Maintenance Cost from 3rd...

Q: 6. I plan to borrow $350,000 from a bank to buy an apartment. The interest rate is a nominal 4% comp...

A: Loan amortization refers to a schedule which is prepared to shows the periodic loan payments, amount...

Q: PROBLEM 1: A man borrowed P3 000 to be paid after 18 months with interest at 12% compounded semi-ann...

A: First borrowed amount (B1) = P 3000 after 18 months (3 semiannual periods) n1 = 3 semiannual periods...

Q: A 5-year project will require an investment of $100 million. This comprises of plant and machinery w...

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first ...

Q: Compute the present value for each of the following bonds a. Priced at the end of its fifth year, a ...

A: To Find: Present Value of Bonds

Q: How can we reduce this risk in financial reporting process? "Are redundant and out-of-date informat...

A: Financial reporting is a typical accounting approach that uses financial statements to convey a comp...

Q: Assuming the forward contract entered in at the price of $285 and the price of the underlying asset ...

A: Solution:- Buying a forward contract means agreement to buy the underlying asset at maturity at the ...

Q: r expected return on this investment?

A: Expected return on investment refers to the rate of return that an investor is expecting on an inves...

Q: Mortgages, loans taken to purchase a property, involve regular payments at fixed intervals and are t...

A: As per our guidelines, we are supposed to answer only 3 sub-parts (if there are multiple sub-parts a...

Q: Lupé made a down payment of $5000 toward the purchase of a new car. To pay the balance of the purcha...

A: Present Value can be calculated using PV function in excel PV (rate, nper, pmt, [Fv], [type]) Rat...

Q: The generator set requires no maintenance until the end of 2 years when P60,000 will be needed for r...

A: Here, At the end of year 2 , maintenance cost is P60,000 From Year 3 to Year 7, Maintenance Cost is ...

Q: Carbon Corporation has a policy of paying out 70% of its earnings. The growth rate of the company re...

A: Here, Dividend Pay-out Ratio is 70% Growth Rate is 7% Other Details are as follows: Debt ratio ...

Q: )A stock currently trades at $37. The continuously compounded risk-free rate of interest is 5%, and ...

A: The European call option refers to that option that gives the holder the right to buy a stock at a p...

Q: 1. Malinao Bakery forecast sales 2100 loaves of bread for the month of January. The owner would like...

A: As per Bartleby Honor Code, when multiple questions are asked, the expert is required only to solve ...

Q: You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend...

A: The stock price which is the maximum price to be paid for share consists of dividends and terminal v...

Q: Task 5. Compute the present value of the following annuity investments: 1. P5,000 quarterly investme...

A: Part 1 Quarterly Investment = P 5,000 Interest rate = 6% Time Period = 5 Years Part 2 Annual Investm...

Q: Penny Pincher Discount Grocers has issued a bond with a coupon rate of 11%. It recently closed at a ...

A: Current yield = Face value of bond * Coupon rate / Current stock price

Q: The CFO of the company believes that an appropriate annual interest rate on this investment is 6.5%....

A: An annuity is usually a series of even cash flows. There can also be cases of a growing annuity in w...

Q: Capi of PHP 1.5M. The manufacturing company can produce an annua evenue of PHP250,000 for 7 years, b...

A: If the net present value is positive than project is acceptable and if the net present value is nega...

Q: A project starts with an initial capital outflow of RM450,000 in exchange for the following likely c...

A:

Q: I'm stuck in Question 4

A: Since Question 4 is specifically asked, so the following solution is for Question 4. Solution 4:- Ca...

Q: Why do maximizing EPS and maximizing value not necessarily lead to the same conclusion about the opt...

A: Earning per share or EPS is referred as the net profit of the corporation, which are divided through...

Q: LO 1 8.3 Payback Period Concerning payback: Describe how the payback period is calculated and descri...

A: Cash flow statement is referred as the summarized cash and cash equivalents amount that enters as we...

Q: Forward Dividend Price 1T Target Est $75.20 $0.80 $87.76 Given the information in the table, ift he ...

A: Given Price of stock = $75.20 Forward dividend = $0.80 1T Target Est = $87.76 Required Return = 5.5%

Q: Dan is contemplating trading in his car for a new one. He can afford a monthly payment of at most $5...

A: The most expensive car that Dan might be able to afford shall be: = Amount received on trade-in + Pr...

Q: Bank A pays 8% interest, compounded quarterly, on its money market account. The managers of Bank B w...

A: Nominal rate of return is also called stated rate of return on an account. It does not take into acc...

Q: A bank makes a 30 year Fully Amortizing FRM for $2,000,000 at an annual interest rate of 4.125% comp...

A: Here, Annual Interest Rate on Loan is 4.125% Time Period of Loan is 30 years FRM Amount is $2,000,00...

Q: Ronnie invests $55,000 in a food truck (which has a lifespan of two years) , the net cash flows of ...

A: In order to find net present value, subtract the present worth of cash outflows (or initial investme...

Q: 8. An education fund will offer a P40, 000 annual scholarship for the first five years, a P60, 000 s...

A: Present value (PV) of all the cash flows is the sum of the money deposited now. It is an example of ...

Q: An investment has an initial cost of $3.2 million. This investment will be depreciated by $900,000 a...

A: The average accounting return or average rate of return is an accounting metric which helps in calcu...

Q: Markowitz Portfolio Theory

A: Modern portfolio theory states that the investor can choose the mix of low-risk and riskier investme...

Q: For this question the inflation rates are actual inflation levels ( so a 6 month inflation rate incr...

A: Treasury Inflation Protection Securities: Treasury Inflation Protection Securities, or TIPS, in shor...

Q: Mr. James Lubay working in the United States planned of returning to the Philippines at the end of 2...

A: To Find: Principal in the fund at the end of 2001

Q: ared borrowed Charging 3.6 070 cONpornded Monthly interest.

A: Loans are paid by equal monthly payments that carry the payment of principal amount and payment of i...

Q: A stock costs $80 and pays a $2 annual dividend. If you expect to sell the stock after four years fo...

A: The required return on the stock represents the total return earned on the stock. This return is con...

Q: The estimated cost of the long-term investment project is P50 million. The expected dividend on ordi...

A: The cost of ordinary share can be calculated using the Gordon Model. Cost of ordinary share using Go...

Q: Macrohard Software is considering a new project whose data are shown below. The equipment that would...

A: Operating cash flow means the total amount of cash flow generated by the company from its business o...

Q: in a page long or 2 define debt and equity financing and the advantages and disadvantages of both. A...

A: Applying for a loan from a lender is what debt entails. It can be temporary, long-term, or revolving...

Q: Eight years ago, Ohio Valley Trucking purchased a large-capacity dump truck for $110,000 to provide ...

A: Purchase price of truck is $110,000 Time period 8 years Per year maintainance cost is $12,200 Resale...

Q: Draw a cash flow diagram of any investment that exhibits both of the following properties: The inve...

A: Cash flow diagrams are used to depict the inflows and outflows of cash over the lifetime of a projec...

Q: Rose Gardens is looking into investing opportunities. The following are potential opportunities: Zi...

A: Dividend is the amount which is paid as a reward to the shareholders of the company for the risk the...

Step by step

Solved in 2 steps

- In order to reduce risk when financing his new business, Linda intends to use a 3-month index futures contract. Assume that the index's current value is 2,040, the constantly compounded risk-free interest rate is 7.5% annually, and the dividend yield of that stock is 1% annually. Later, Linda believes that futures contracts on currencies can offer a greater return than futures contracts on indices. Consider storing a 3-year futures contract at a cost of MYR 6 per unit. Assume that the risk-free rate is 6% per year for all maturities and that the current price is MYR 760 per unit. Estimate the predicted price in the future. What will Linda do if she is an arbitrageur, and the real future price is higher than the predicted future price?You are a financial manager and you have bonds worth $3,000,000 in your portfolio which have a 7 % coupon rate and will be maturing in 10 years from now. What type of risk exposure do you face on these bonds? Suppose a futures contract on these bonds is available with a standard contract size of US$300,000 per contract. How will you hedge your exposure? If the market interest rates change to 9 %, what will be your position? Kindly, show calculations on how you arrive at your answer.Maria VanHusen, CFA, suggests that using forward contracts on fixed-income securities can be used to protect the value of the Star Hospital Pension Plan’s bond portfolio against the possibility of rising interest rates. VanHusen prepares the following example to illustrate how such protec-tion would work:∙ A 10-year bond with a face value of $1,000 is issued today at par value. The bond pays an annual coupon.∙ An investor intends to buy this bond today and sell it in 6 months.∙ The 6-month risk-free interest rate today is 5% (annualized).∙ A 6-month forward contract on this bond is available, with a forward price of $1,024.70.∙ In 6 months, the price of the bond, including accrued interest, is forecast to fall to $978.40 as a result of a rise in interest rates.a. Should the investor buy or sell the forward contract to protect the value of the bond against rising interest rates during the holding period?b. Calculate the value of the forward contract for the investor at the maturity of…

- As corporate treasurer, you will purchase K1 million of bonds for the sinking fund in three months you believe rates will soon fall and would like to repurchase the company’s sinking fund bonds, which currently are selling below par, in advance of requirements. Unfortunately, you have to obtain approval from the board of directors for such a purchase, and this could take up to two months. What action can you take in the futures market to hedge any adverse movements in bond yields and prices until you actually can buy the bonds? Will you be long, or short? Why?You are a financial manager and you have bonds worth $3,000,000 in your portfolio which have a 7 percent coupon rate and will be maturing in 10 years from now. What type of risk exposure do you face on these bonds? Suppose a futures contract on these bonds is available with a standard contract size of US$300,000 per contract. How will you hedge your exposure? If the market interest rates change to 9 percent, what will be your position?You are a financial manager and you have bonds worth $3,000,000 in your portfolio which have a 7 percent coupon rate and will be maturing in 10 years from now. The market rate is also 7 percent. Suppose a futures contract on these bonds is available with a standard contract size of $300,000 per contract.i) What type of risk are you exposed to and how will you hedge your exposure?

- You are a corporate treasurer who will purchase $1 million of bonds for the sinking fund in 3 months. You believe rates will soon fall, and you would like to repurchase the company’s sinking fund bonds (which currently are selling below par) in advance of requirements. Unfortunately, you must obtain approval from the board of directors for such a purchase, and this can take up to 2 months. What action can you take in the futures market to hedge any adverse movements in bond yields and prices until you can actually buy the bonds? Will you be long or short? Why? A qualitative answer is fine.You are a financial manager and you have bonds worth $3,000,000 in your portfolio which have a 7 percent coupon rate and will be maturing in 10 years from now. The market rate is also 7 percent. Suppose a futures contract on these bonds is available with a standard contract size of $300,000 per contract. a) If the market interest rates change to 9 percent, show through relevant calculations, how your hedge will protect you from loss. What if the interest rate in the market went down to 5%?Bruce bought a bank bill with a face value of $1 million, priced to yield 3.30 per cent per annum over the remaining 200 days until it matures. Bruce also sold a futures contract on a 90-day bank bill that expires in 110 days' time for the futures price of 96.55. Noting that the face value of the bill underlying these contracts is also $1 million, and that at the maturity of the futures contracts, the bank bill he holds will have 90-days to maturity, he decides to deliver the bank bill to close his short futures position. i) Identify the amount and timing of Bruce's net cash payments and receipts and ii) calculate the yield (simple interest, in percent per annum) he will achieve on his investment in the bank bill. (Ignore any cash flows from marking-to-market.)

- Lynn Parsons is considering investing in either of two outstanding bonds. The bonds both have $1,000 par values and 13% coupon interest rates and pay annual interest. Bond A has exactly 6 years to maturity, and bond B has 16 years to maturity. b.Calculate the present value of bond B if the required rate of return is: (1) 10%, (2) 13%, and (3) 16%. c. From your findings in parts a and b, discuss the relationship between time to maturity and changing required returns. d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? I need all parts and the sub parts answeredAn engineer planning for retirement is considering purchasing a bond that has a face value of$50,000, a coupon rate of 8% per year, payable annually, and a maturity date 10 years from now. (a) The engineer’s MARR is 12%. Is the bond a good investment if the purchase price is $40,000?Explain why or why not. (b) What is the most that the engineer should pay to purchase the bond? (c) Repeat part (b) when the bond’s coupon rate is 8% per year payable semiannually and theengineer’s MARR is 12% per year compounded seminannually.Answer the following question and show all working using a financial calculator. DO NOT use excel: a.The face value for WICB Limited bonds is $250,000 and has a 6 percent annual coupon. The 6 percent annual coupon bonds matures in 2035, and it is now 2020. Interest on these bonds is paid annually on December 31 of each year, and new annual coupon bonds with similar risk and maturity are currently yielding 10 percent. How much should Karen sell her bonds today?