Mr. Joplin sells a line of computer software for a company in Western Canada. In 2023, he was paid a base salary of $56,000 and received sales commissions of $88,200. He did not an allowance, nor was he reimbursed by his employer for any of his expenses. During the year, Mr. Joplin has the following employment-related expenses. View the expenses. View the additional information. Required Determine Mr. Joplin's employment income for 2023. Ignore all GST/HST and PST implications. First, calculate the deductible CCA on the automobile used by Mr. Joplin. Enter the employment-related usage proportion as a percentage. Full capital cost allowance Employment-related usage proportion Deductible CCA on automobile Expenses Airline tickets - X $ 2,380 400 Additional Information - Assume that $390 of the client entertainment represented the cost of Mr. Joplin's meals with the remaining amounts attributable to clients. Further assume that all of the client entertainment was incurred while more than 12 consecutive hours away from the municipality where the employer's place of business is located. The new automobile was purchased on January 5, 2023, and replaced an automobile that Mr. Joplin had leased for several years. In 2023, Mr. Joplin drove a total of 48,000 kilometres of which 38,400 kilometres were for employment purposes and 9 600 kilometres were for personal use. The maximum capital cost

Mr. Joplin sells a line of computer software for a company in Western Canada. In 2023, he was paid a base salary of $56,000 and received sales commissions of $88,200. He did not an allowance, nor was he reimbursed by his employer for any of his expenses. During the year, Mr. Joplin has the following employment-related expenses. View the expenses. View the additional information. Required Determine Mr. Joplin's employment income for 2023. Ignore all GST/HST and PST implications. First, calculate the deductible CCA on the automobile used by Mr. Joplin. Enter the employment-related usage proportion as a percentage. Full capital cost allowance Employment-related usage proportion Deductible CCA on automobile Expenses Airline tickets - X $ 2,380 400 Additional Information - Assume that $390 of the client entertainment represented the cost of Mr. Joplin's meals with the remaining amounts attributable to clients. Further assume that all of the client entertainment was incurred while more than 12 consecutive hours away from the municipality where the employer's place of business is located. The new automobile was purchased on January 5, 2023, and replaced an automobile that Mr. Joplin had leased for several years. In 2023, Mr. Joplin drove a total of 48,000 kilometres of which 38,400 kilometres were for employment purposes and 9 600 kilometres were for personal use. The maximum capital cost

Chapter9: Deduct Ions: Employee And Self-employed - Related Expenses

Section: Chapter Questions

Problem 31P

Related questions

Question

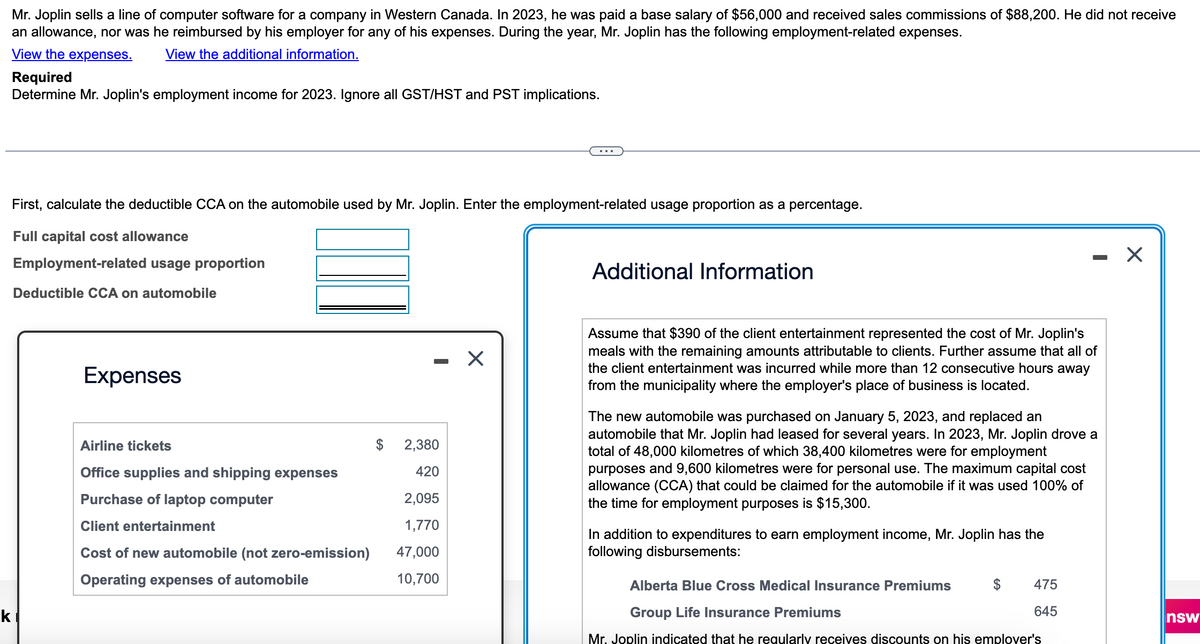

Transcribed Image Text:Mr. Joplin sells a line of computer software for a company in Western Canada. In 2023, he was paid a base salary of $56,000 and received sales commissions of $88,200. He did not receive

an allowance, nor was he reimbursed by his employer for any of his expenses. During the year, Mr. Joplin has the following employment-related expenses.

View the expenses. View the additional information.

k

Required

Determine Mr. Joplin's employment income for 2023. Ignore all GST/HST and PST implications.

First, calculate the deductible CCA on the automobile used by Mr. Joplin. Enter the employment-related usage proportion as a percentage.

Full capital cost allowance

Employment-related usage proportion

Deductible CCA on automobile

Expenses

Airline tickets

Office supplies and shipping expenses

Purchase of laptop computer

Client entertainment

Cost of new automobile (not zero-emission)

Operating expenses of automobile

$ 2,380

420

2,095

1,770

47,000

10,700

X

Additional Information

Assume that $390 of the client entertainment represented the cost of Mr. Joplin's

meals with the remaining amounts attributable to clients. Further assume that all of

the client entertainment was incurred while more than 12 consecutive hours away

from the municipality where the employer's place of business is located.

The new automobile was purchased on January 5, 2023, and replaced an

automobile that Mr. Joplin had leased for several years. In 2023, Mr. Joplin drove a

total of 48,000 kilometres of which 38,400 kilometres were for employment

purposes and 9,600 kilometres were for personal use. The maximum capital cost

allowance (CCA) that could be claimed for the automobile if it was used 100% of

the time for employment purposes is $15,300.

In addition to expenditures to earn employment income, Mr. Joplin has the

following disbursements:

475

645

Alberta Blue Cross Medical Insurance Premiums

Group Life Insurance Premiums

Mr. Joplin indicated that he regularly receives discounts on his emplover's

X

nsw

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you