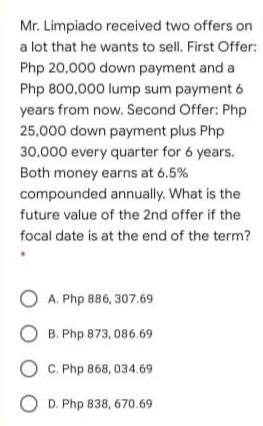

Mr. Limpiado received two offers on a lot that he wants to sell. First Offer: Php 20,000 down payment and a Php 800,000 lump sum payment 6 years from now. Second Offer: Php 25,000 down payment plus Php 30,000 every quarter for 6 years. Both money earns at 6.5% compounded annually. What is the future value of the 2nd offer if the focal date is at the end of the term? O A. Php 886, 307.69 O B. Php 873, 086.69 O C. Php 868, 034.69 O D. Php 838, 670.69

Mr. Limpiado received two offers on a lot that he wants to sell. First Offer: Php 20,000 down payment and a Php 800,000 lump sum payment 6 years from now. Second Offer: Php 25,000 down payment plus Php 30,000 every quarter for 6 years. Both money earns at 6.5% compounded annually. What is the future value of the 2nd offer if the focal date is at the end of the term? O A. Php 886, 307.69 O B. Php 873, 086.69 O C. Php 868, 034.69 O D. Php 838, 670.69

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

ChapterA: Appendix - Time Value Of Cash Flows: Compound Interest Concepts And Applications

Section: Chapter Questions

Problem 12E

Related questions

Question

Transcribed Image Text:Mr. Limpiado received two offers on

a lot that he wants to sell. First Offer:

Php 20,000 down payment and a

Php 800,000 lump sum payment 6

years from now. Second Offer: Php

25,000 down payment plus Php

30,000 every quarter for 6 years.

Both money earns at 6.5%

compounded annually. What is the

future value of the 2nd offer if the

focal date is at the end of the term?

O A. Php 886, 307.69

O B. Php 873, 086.69

O C. Php 868, 034.69

O D. Php 838, 670.69

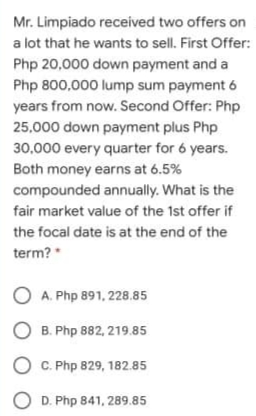

Transcribed Image Text:Mr. Limpiado received two offers on

a lot that he wants to sell. First Offer:

Php 20,000 down payment and a

Php 800,000 lump sum payment 6

years from now. Second Offer: Php

25,000 down payment plus Php

30,000 every quarter for 6 years.

Both money earns at 6.5%

compounded annually. What is the

fair market value of the 1st offer if

the focal date is at the end of the

term?

O A. Php 891, 228.85

O B. Php 882, 219.85

O C. Php 829, 182.85

O D. Php 841, 289.85

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT