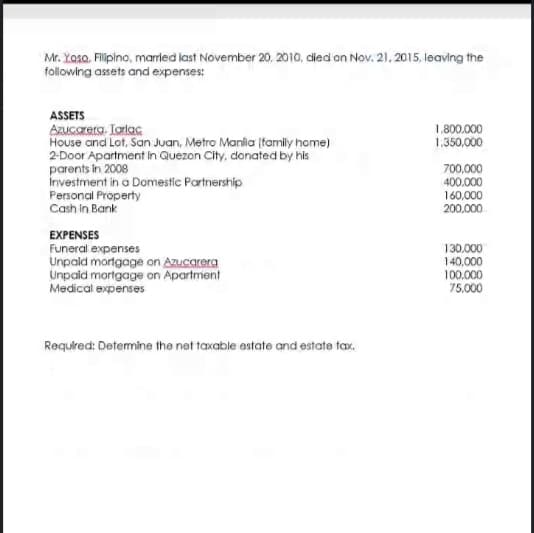

Mr. Xasa. Filipino, marted last November 20, 2010, cied on Nov. 21, 2015, leaving the following assets and expenses: ASSETS Azucarera. Iorlac House and Lot, San Juan, Metro Mania (tamily home) 2-Door Apartment In Quezon City, donated by his parents in 2008 Investment in a Domestic Partnership Personal Property Cash in Bank 1.800.000 1.350,000 700,000 400.000 160,000 200.000 EXPENSES Funeral expenses Unpald mortgage on Azucarera Unpald mortgage on Apartment Medical expenses 130.000 140,000 100.000 75.000 Required: Determine the net taxable estate and estate tax.

Mr. Xasa. Filipino, marted last November 20, 2010, cied on Nov. 21, 2015, leaving the following assets and expenses: ASSETS Azucarera. Iorlac House and Lot, San Juan, Metro Mania (tamily home) 2-Door Apartment In Quezon City, donated by his parents in 2008 Investment in a Domestic Partnership Personal Property Cash in Bank 1.800.000 1.350,000 700,000 400.000 160,000 200.000 EXPENSES Funeral expenses Unpald mortgage on Azucarera Unpald mortgage on Apartment Medical expenses 130.000 140,000 100.000 75.000 Required: Determine the net taxable estate and estate tax.

Chapter3: Tax Formula And Tax Determination; An Overview Of property Transactions

Section: Chapter Questions

Problem 49P

Related questions

Question

Subject: Transfer and business

Answer with explanation

Transcribed Image Text:Mr. Yosa, Fililpino, marted last November 20, 2010, died on Nov. 21, 2015, leaving the

following assets and expenses:

ASSETS

1.800.000

1,350,000

Azucarera. Tarlac

House and Lot, San Juan, Metro Manila (family home)

2-Door Apartment in Quezon City, donated by his

parents in 2008

Investment in a Domestic Partnership

700,000

400.000

Personal Property

Cash in Bank

160,000

200.000

EXPENSES

Funeral expenses

Unpaid mortgage on Azucarera

Unpaid mortgage on Apartment

Medical expenses

130,000

140,000

100.000

75,000

Required: Determine the net taxable estate and estate tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT