Ms. Benoit is a self-employed architect who earns $205,000 annual taxable income. For the past several years, her tax rate on this income has been 35 percent. Because of recent tax law changes, Ms. Benoit's tax rate for next year will decrease to 25 percent. Required: a. Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year? b. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by working more hours and earning $280,000 taxable income? c. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by working fewer hours and earning only $180,000 taxable income? Complete this question by entering your answers in the tabs below. Required A Required B Required C Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year? Decrease in revenue Required A Required B >

Ms. Benoit is a self-employed architect who earns $205,000 annual taxable income. For the past several years, her tax rate on this income has been 35 percent. Because of recent tax law changes, Ms. Benoit's tax rate for next year will decrease to 25 percent. Required: a. Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year? b. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by working more hours and earning $280,000 taxable income? c. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by working fewer hours and earning only $180,000 taxable income? Complete this question by entering your answers in the tabs below. Required A Required B Required C Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year? Decrease in revenue Required A Required B >

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 78TPC: Bonnie is married and has one child. She owns Bonnies Rib Joint, which produces a taxable income of...

Related questions

Question

Po

27.

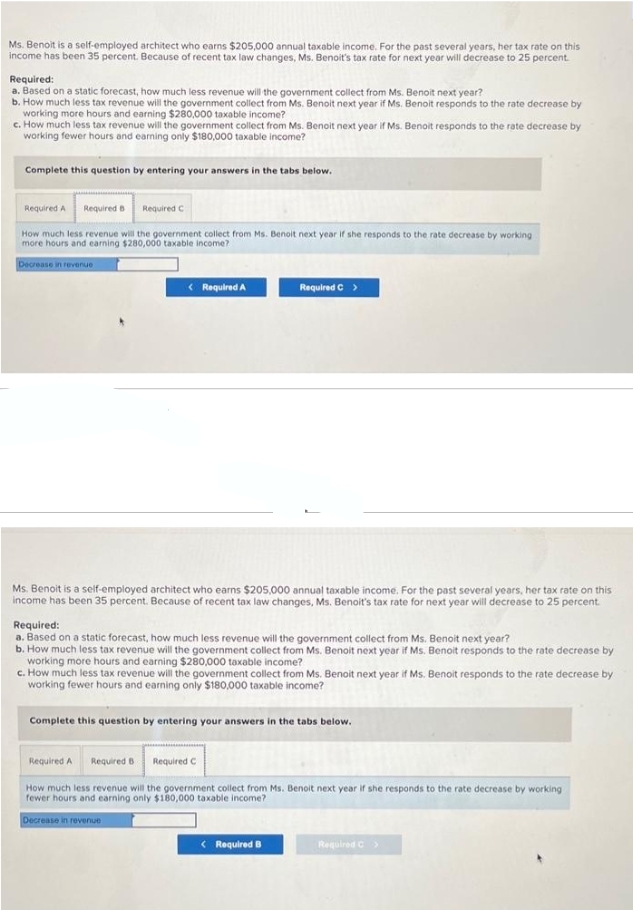

Transcribed Image Text:Ms. Benoit is a self-employed architect who earns $205,000 annual taxable income. For the past several years, her tax rate on this

income has been 35 percent. Because of recent tax law changes, Ms. Benoit's tax rate for next year will decrease to 25 percent.

Required:

a. Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year?

b. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by

working more hours and earning $280,000 taxable income?

c. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by

working fewer hours and earning only $180,000 taxable income?

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

How much less revenue will the government collect from Ms. Benoit next year if she responds to the rate decrease by working

more hours and earning $280,000 taxable income?

Decrease in revenue

< Required A

Required C

Ms. Benoit is a self-employed architect who earns $205,000 annual taxable income. For the past several years, her tax rate on this

income has been 35 percent. Because of recent tax law changes, Ms. Benoit's tax rate for next year will decrease to 25 percent.

Required:

a. Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year?

b. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by

working more hours and earning $280,000 taxable income?

c. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by

working fewer hours and earning only $180,000 taxable income?

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

How much less revenue will the government collect from Ms. Benoit next year if she responds to the rate decrease by working

fewer hours and earning only $180,000 taxable income?

Decrease in revenue

< Required B

Required C >

Transcribed Image Text:bok

int

rences

IW

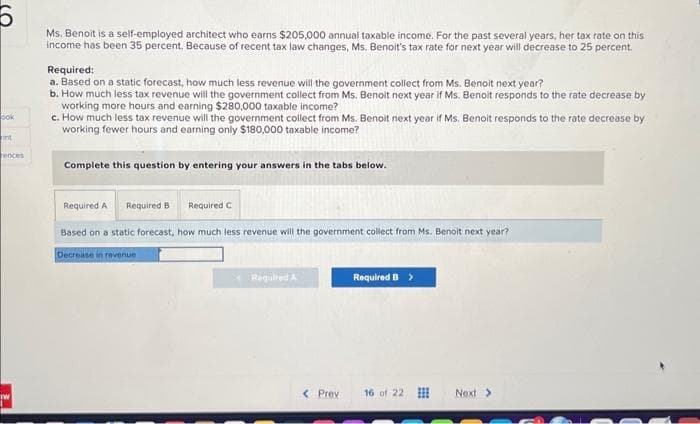

Ms. Benoit is a self-employed architect who earns $205,000 annual taxable income. For the past several years, her tax rate on this

income has been 35 percent. Because of recent tax law changes, Ms. Benoit's tax rate for next year will decrease to 25 percent.

Required:

a. Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year?

b. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by

working more hours and earning $280,000 taxable income?

c. How much less tax revenue will the government collect from Ms. Benoit next year if Ms. Benoit responds to the rate decrease by

working fewer hours and earning only $180,000 taxable income?

Complete this question by entering your answers in the tabs below.

Required C

Based on a static forecast, how much less revenue will the government collect from Ms. Benoit next year?

Decrease in revenue

Required A Required B

Required A

< Prev

Required B >

16 of 22

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT