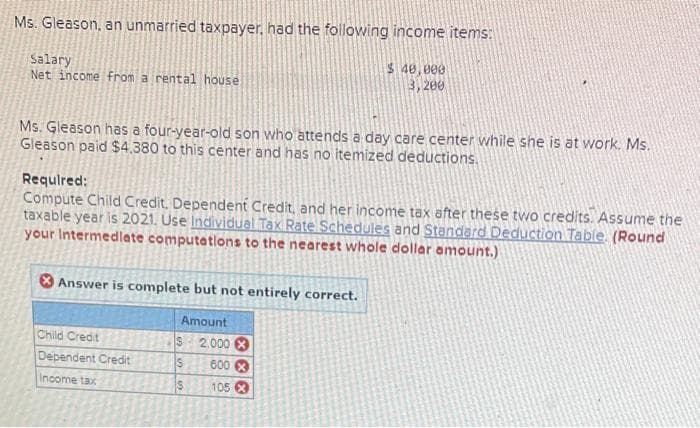

Ms. Gleason, an unmarried taxpayer, had the following income items: $ 40,000 3,200 Salary Net income from a rental house Ms. Gleason has a four-year-old son who attends a day care center while she is at work. Ms. Gleason paid $4.380 to this center and has no itemized deductions. Required: Compute Child Credit. Dependent Credit, and her income tax after these two credits. Assume the taxable year is 2021. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round your Intermediate computations to the nearest whole dollar amount.)

Ms. Gleason, an unmarried taxpayer, had the following income items: $ 40,000 3,200 Salary Net income from a rental house Ms. Gleason has a four-year-old son who attends a day care center while she is at work. Ms. Gleason paid $4.380 to this center and has no itemized deductions. Required: Compute Child Credit. Dependent Credit, and her income tax after these two credits. Assume the taxable year is 2021. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round your Intermediate computations to the nearest whole dollar amount.)

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:Ms. Gleason, an unmarried taxpayer, had the following income items:

$ 40,000

3,200

Salary

Net income from a rental house

Ms. Gleason has a four-year-old son who attends a day care center while she is at work. Ms.

Gleason paid $4.380 to this center and has no itemized deductions.

Required:

Compute Child Credit. Dependent Credit, and her income tax after these two credits. Assume the

taxable year is 2021. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round

your Intermediate computations to the nearest whole dollar amount.)

Answer is complete but not entirely correct.

Amount

Child Credit

Dependent Credit

Income tax

IS

2.000 X

600 x

105 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you