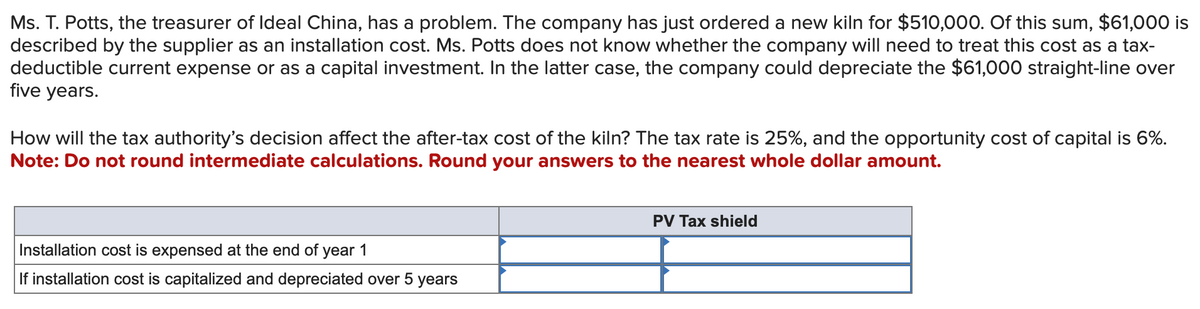

Ms. T. Potts, the treasurer of Ideal China, has a problem. The company has just ordered a new kiln for $510,000. Of this sum, $61,000 described by the supplier as an installation cost. Ms. Potts does not know whether the company will need to treat this cost as a tax- deductible current expense or as a capital investment. In the latter case, the company could depreciate the $61,000 straight-line ove five years. How will the tax authority's decision affect the after-tax cost of the kiln? The tax rate is 25%, and the opportunity cost of capital is 6%. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Installation cost is expensed at the end of year 1 If installation cost is capitalized and depreciated over 5 years PV Tax shield

Ms. T. Potts, the treasurer of Ideal China, has a problem. The company has just ordered a new kiln for $510,000. Of this sum, $61,000 described by the supplier as an installation cost. Ms. Potts does not know whether the company will need to treat this cost as a tax- deductible current expense or as a capital investment. In the latter case, the company could depreciate the $61,000 straight-line ove five years. How will the tax authority's decision affect the after-tax cost of the kiln? The tax rate is 25%, and the opportunity cost of capital is 6%. Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Installation cost is expensed at the end of year 1 If installation cost is capitalized and depreciated over 5 years PV Tax shield

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 44P

Related questions

Question

Transcribed Image Text:Ms. T. Potts, the treasurer of Ideal China, has a problem. The company has just ordered a new kiln for $510,000. Of this sum, $61,000 is

described by the supplier as an installation cost. Ms. Potts does not know whether the company will need to treat this cost as a tax-

deductible current expense or as a capital investment. In the latter case, the company could depreciate the $61,000 straight-line over

five years.

How will the tax authority's decision affect the after-tax cost of the kiln? The tax rate is 25%, and the opportunity cost of capital is 6%.

Note: Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.

Installation cost is expensed at the end of year 1

If installation cost is capitalized and depreciated over 5 years

PV Tax shield

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT