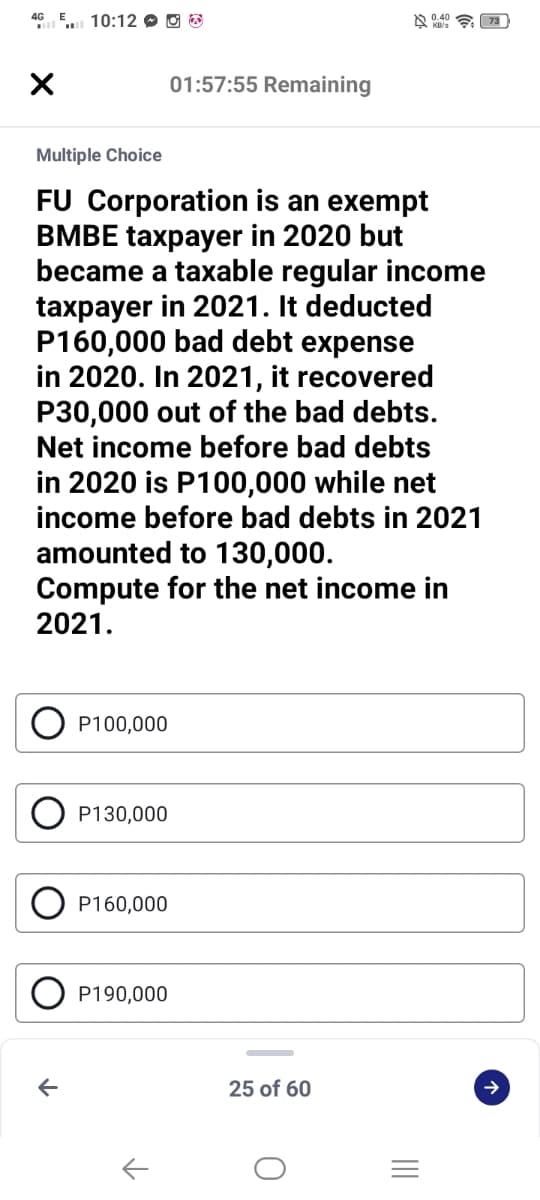

Multiple Choice FU Corporation is an exempt BMBE taxpayer in 2020 but became a taxable regular income taxpayer in 2021. It deducted P160,000 bad debt expense in 2020. In 2021, it recovered P30,000 out of the bad debts. Net income before bad debts in 2020 is P100,000 while net income before bad debts in 2021 amounted to 130,000. Compute for the net income in 2021. P100,000 P130,000 O P160,000 O P190,000

Multiple Choice FU Corporation is an exempt BMBE taxpayer in 2020 but became a taxable regular income taxpayer in 2021. It deducted P160,000 bad debt expense in 2020. In 2021, it recovered P30,000 out of the bad debts. Net income before bad debts in 2020 is P100,000 while net income before bad debts in 2021 amounted to 130,000. Compute for the net income in 2021. P100,000 P130,000 O P160,000 O P190,000

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 15DQ: LO.5 Beige Corporation has a fiscal year ending April 30. For the year ending April 30, 2018, Beige...

Related questions

Question

Transcribed Image Text:4G E 10:12 O O &

01:57:55 Remaining

Multiple Choice

FU Corporation is an exempt

BMBE taxpayer in 2020 but

became a taxable regular income

taxpayer in 2021. It deducted

P160,000 bad debt expense

in 2020. In 2021, it recovered

P30,000 out of the bad debts.

Net income before bad debts

in 2020 is P100,000 while net

income before bad debts in 2021

amounted to 130,000.

Compute for the net income in

2021.

P100,000

P130,000

P160,000

P190,000

25 of 60

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT