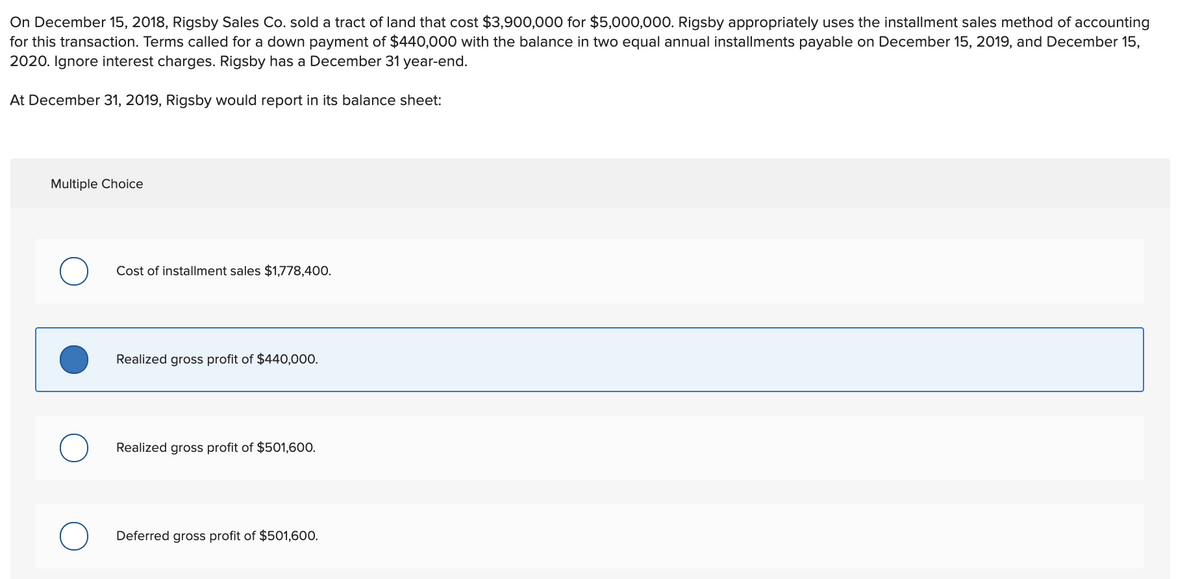

n December 15, 2018, Rigsby Sales Co. sold a tract of land that cost $3,900,000 for $5,000,000. Rigsby appropriately uses the installment sales method of accounting or this transaction. Terms called for a down payment of $440,000 with the balance in two equal annual installments payable on December 15, 2019, and December 15, 020. Ignore interest charges. Rigsby has a December 31 year-end. t December 31, 2019, Rigsby would report in its balance sheet: Multiple Choice Cost of installment sales $1,778,400. Realized gross profit of $440,000. Realized gross profit of $501,600. Deferred gross profit of $501,600.

n December 15, 2018, Rigsby Sales Co. sold a tract of land that cost $3,900,000 for $5,000,000. Rigsby appropriately uses the installment sales method of accounting or this transaction. Terms called for a down payment of $440,000 with the balance in two equal annual installments payable on December 15, 2019, and December 15, 020. Ignore interest charges. Rigsby has a December 31 year-end. t December 31, 2019, Rigsby would report in its balance sheet: Multiple Choice Cost of installment sales $1,778,400. Realized gross profit of $440,000. Realized gross profit of $501,600. Deferred gross profit of $501,600.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:On December 15, 2018, Rigsby Sales Co. sold a tract of land that cost $3,900,000 for $5,000,000. Rigsby appropriately uses the installment sales method of accounting

for this transaction. Terms called for a down payment of $440,000 with the balance in two equal annual installments payable on December 15, 2019, and December 15,

2020. Ignore interest charges. Rigsby has a December 31 year-end.

At December 31, 2019, Rigsby would report in its balance sheet:

Multiple Choice

Cost of installment sales $1,778,400.

Realized gross profit of $440,000.

Realized gross profit of $501,600.

Deferred gross profit of $501,600.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College