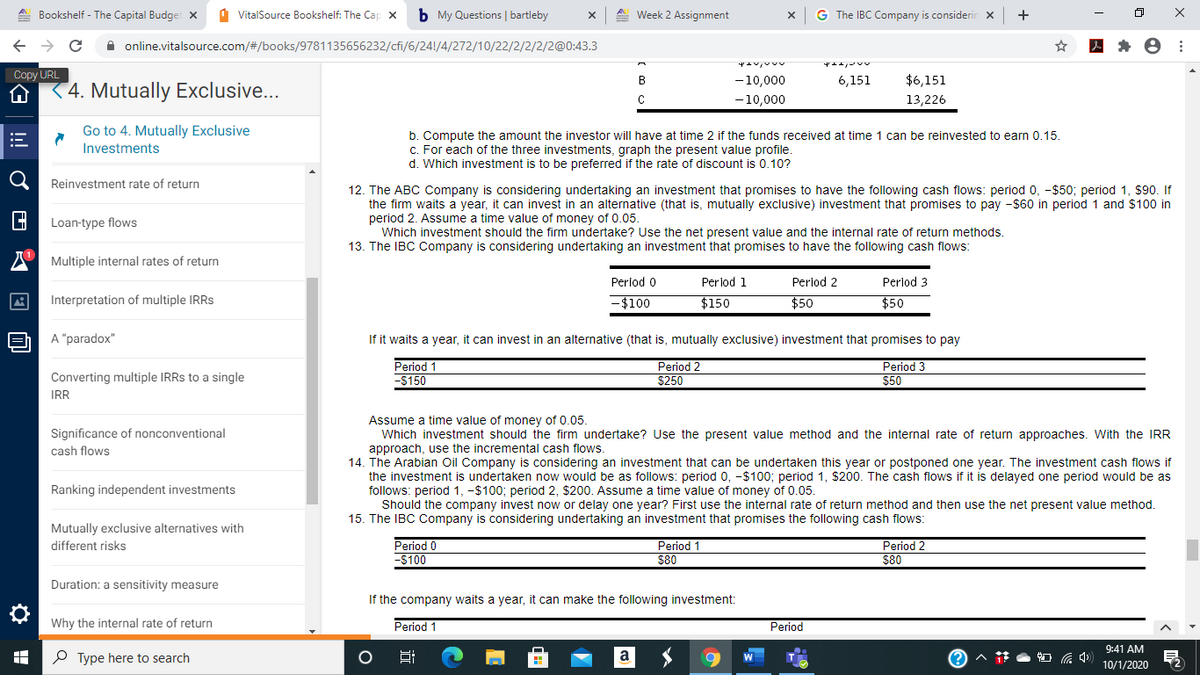

13. The IBC Company is considering undertaking an investment that promises to have the following cash flows: Perlod 0 Perlod 1 Perlod 2 Perlod 3 -$100 $150 $50 $50 If it waits a year, it can invest in an alternative (that is, mutually exclusive) investment that promises to pay Period 1 -$150 Period 2 $250 Period 3 $50 Assume a time value of money of 0.05. Which investment should the firm undertake? Use the present value method and the internal rate of return approaches. With the IRR approach, use the incremental cash flows.

13. The IBC Company is considering undertaking an investment that promises to have the following cash flows: Perlod 0 Perlod 1 Perlod 2 Perlod 3 -$100 $150 $50 $50 If it waits a year, it can invest in an alternative (that is, mutually exclusive) investment that promises to pay Period 1 -$150 Period 2 $250 Period 3 $50 Assume a time value of money of 0.05. Which investment should the firm undertake? Use the present value method and the internal rate of return approaches. With the IRR approach, use the incremental cash flows.

Chapter8: Budgets And Bank Reconciliations

Section: Chapter Questions

Problem 3.5C

Related questions

Question

#13 is the question

Transcribed Image Text:A. Bookshelf - The Capital Budget x

1 VitalSource Bookshelf: The Cap x

b My Questions | bartleby

Week 2 Assignment

G The IBC Company is consideri

+

A online.vitalsource.com/#/books/9781135656232/cfi/6/24!/4/272/10/22/2/2/2/2@0:43.3

Copy URL

-10,000

6,151

$6,151

B

4. Mutually Exclusive...

-10,000

13,226

Go to 4. Mutually Exclusive

Investments

b. Compute the amount the investor will have at time 2 if the funds received at time 1 can be reinvested to earn 0.15.

C. For each of the three investments, graph the present value profile.

d. Which investment is to be preferred if the rate of discount is 0.10?

Reinvestment rate of return

12. The ABC Company is considering undertaking an investment that promises to have the following cash flows: period 0, -$50; period 1, $90. If

the firm waits a year, it can invest in an alternative (that is, mutually exclusive) investment that promises to pay -$60 in period 1 and $100 in

period 2. Assume a time value of money of 0.05.

Which investment should the firm undertake? Use the net present value and the internal rate of return methods.

13. The IBC Company is considering undertaking an investment that promises to have the following cash flows:

Loan-type flows

Multiple internal rates of return

Perlod 0

Perjod 1

Perlod 2

Perlod 3

Interpretation of multiple IRRS

-$100

$150

$50

$50

A "paradox"

If it waits a year, it can invest in an alternative (that is, mutually exclusive) investment that promises to pay

Period 1

-$150

Period 2

$250

Period 3

$50

Converting multiple IRRS to a single

IRR

Assume a time value of money of 0.05.

Which investment should the firm undertake? Use the present value method and the internal rate of return approaches. With the IRR

approach, use the incremental cash flows.

14. The Arabian Oil Company is considering an investment that can be undertaken this year or postponed one year. The investment cash flows if

the investment is undertaken now would be as follows: period 0, -$100; period 1, $200. The cash flows if it is delayed one period would be as

follows: period 1, -$100; period 2, $200. Assume a time value of money of 0.05.

Should the company invest now or delay one year? First use the internal rate of return method and then use the net present value method.

15. The IBC Company is considering undertaking an investment that promises the following cash flows:

Significance of nonconventional

cash flows

Ranking independent investments

Mutually exclusive alternatives with

Period 0

-5100

Period 1

$80

Period 2

$80

different risks

Duration: a sensitivity measure

If the company waits a year, it can make the following investment:

Why the internal rate of return

Period 1

Period

9:41 AM

P Type here to search

10/1/2020

!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Today is January 1, 2020. On the first day of the years 2021, 2022, 2023, and 2024, you will invest $12,000. If your expected

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning