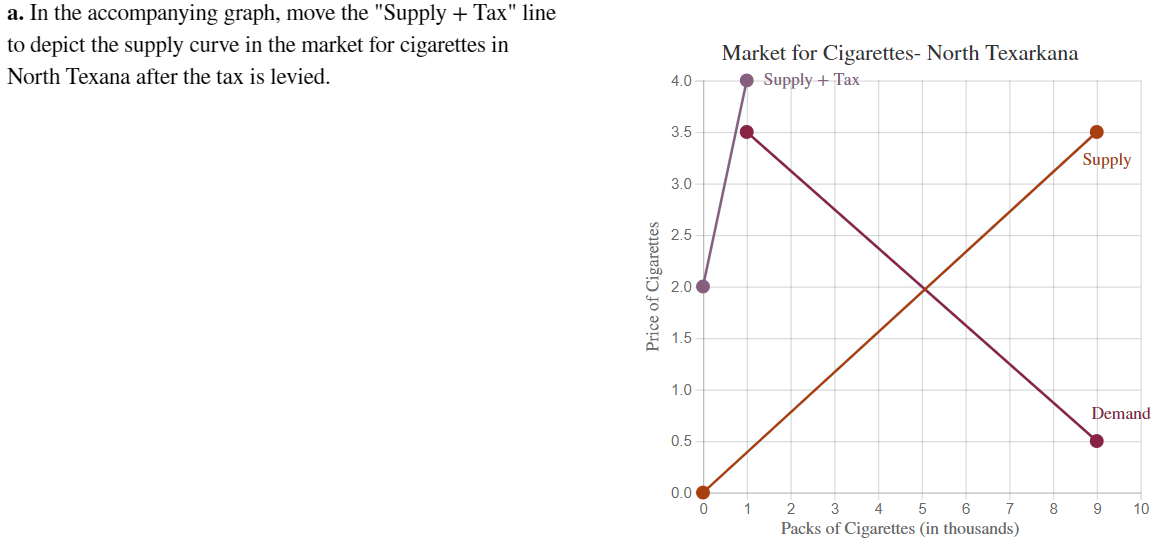

n the United States, each state government can impose its own excise tax on the sale of cigarettes. Suppose that in the state of North Texarkana, the state government imposes a tax of $2.00 per pack sold within the state. In contrast, the neighboring state of South Texarkana imposes no excise tax on cigarettes. Assume that in both states the pre-tax price of a pack of cigarettes is $2.00. Assume that the total cost to a resident of North Texarkana to smuggle a pack of cigarettes from South Texarkana is $3.50 per pack. (This includes the cost of time, gasoline, and so on.) Assume that the tax is levied on the supplier. Part b. first option (Yes or No), 2nd option (higher or Lower)

In the United States, each state government can impose its own excise tax on the sale of cigarettes. Suppose that in the state of North Texarkana, the state government imposes a tax of $2.00 per pack sold within the state. In contrast, the neighboring state of South Texarkana imposes no excise tax on cigarettes. Assume that in both states the pre-tax price of a pack of cigarettes is $2.00. Assume that the total cost to a resident of North Texarkana to smuggle a pack of cigarettes from South Texarkana is $3.50 per pack. (This includes the cost of time, gasoline, and so on.) Assume that the tax is levied on the supplier.

Part b. first option (Yes or No), 2nd option (higher or Lower).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images