nase 100 snares of stock Tor $25 a snare. The stoCK pays a $1 per share dividend at year-end. a. What is the rate of return on your investment if the end-of-year stock price is (i) $24; (ii) $25; (iii) $28? (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers as a whole percent.) Stock Price Rate of Return 24 % 25 28 %

nase 100 snares of stock Tor $25 a snare. The stoCK pays a $1 per share dividend at year-end. a. What is the rate of return on your investment if the end-of-year stock price is (i) $24; (ii) $25; (iii) $28? (Leave no cells blank - be certain to enter "O" wherever required. Enter your answers as a whole percent.) Stock Price Rate of Return 24 % 25 28 %

Chapter12: The Cost Of Capital

Section: Chapter Questions

Problem 5P

Related questions

Question

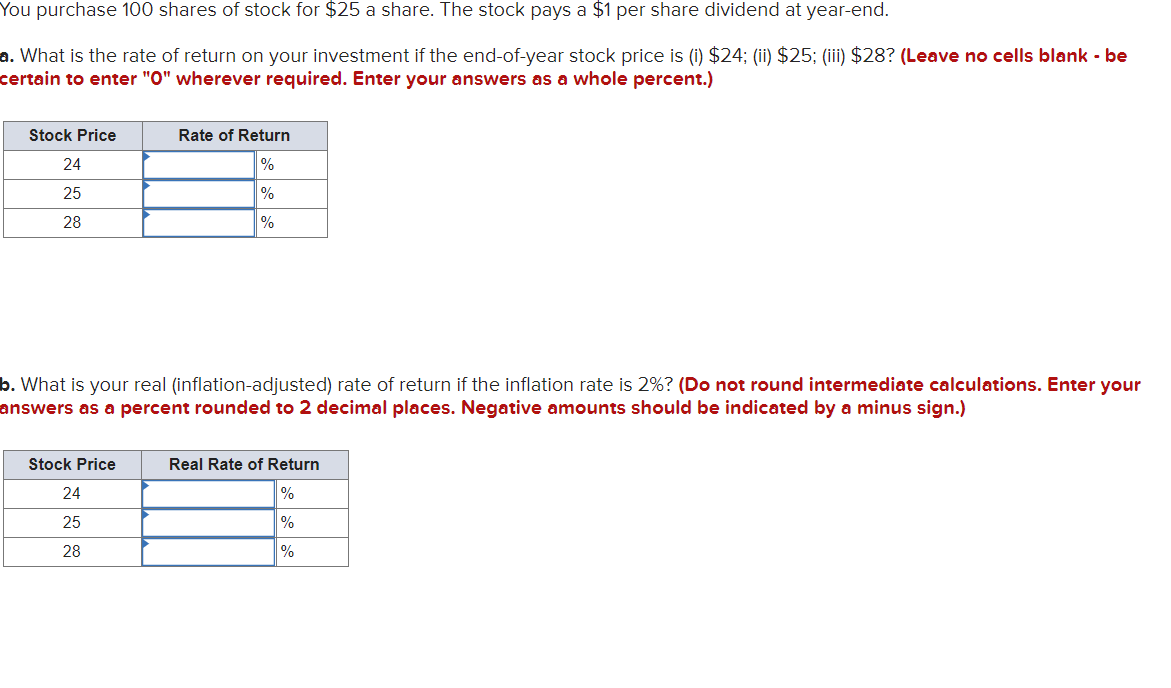

Transcribed Image Text:You purchase 100 shares of stock for $25 a share. The stock pays a $1 per share dividend at year-end.

a. What is the rate of return on your investment if the end-of-year stock price is (i) $24; (ii) $25; (ii) $28? (Leave no cells blank - be

certain to enter "O" wherever required. Enter your answers as a whole percent.)

Stock Price

Rate of Return

24

%

25

%

28

%

b. What is your real (inflation-adjusted) rate of return if the inflation rate is 2%? (Do not round intermediate calculations. Enter your

answers as a percent rounded to 2 decimal places. Negative amounts should be indicated by a minus sign.)

Stock Price

Real Rate of Return

24

%

25

%

28

%

Expert Solution

Step 1

As posted multiple independent questions we are answering only first question kindly repost the unanswered question as a separate question.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning