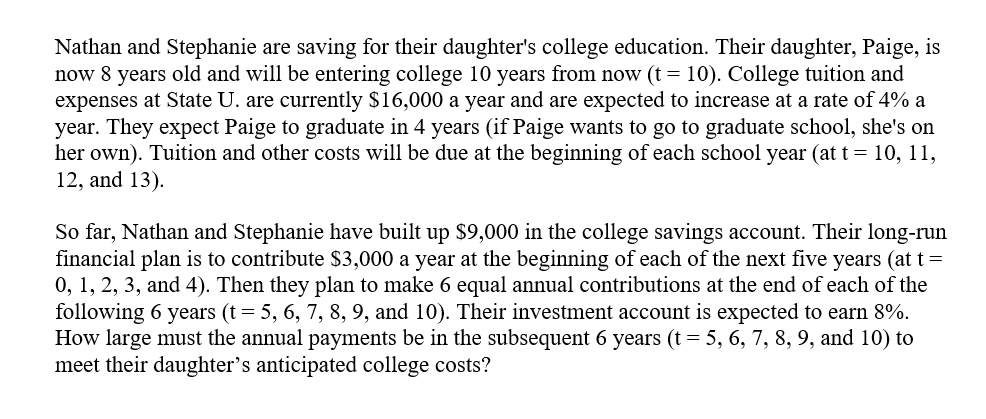

Nathan and Stephanie are saving for their daughter's college education. Their daughter, Paige, is now 8 years old and will be entering college 10 years from now (t = 10). College tuition and expenses at State U. are currently $16,000 a year and are expected to increase at a rate of 4% a year. They expect Paige to graduate in 4 years (if Paige wants to go to graduate school, she's on her own). Tuition and other costs will be due at the beginning of each school year (at t = 10, 11, 12, and 13). So far, Nathan and Stephanie have built up $9,000 in the college savings account. Their long-run financial plan is to contribute $3,000 a year at the beginning of each of the next five years (at t 0, 1, 2, 3, and 4). Then they plan to make 6 equal annual contributions at the end of each of the following 6 years (t = 5, 6, 7, 8, 9, and 10). Their investment account is expected to earn 8%. How large must the annual payments be in the subsequent 6 years (t = 5, 6, 7, 8, 9, and 10) to meet their daughter’s anticipated college costs?

Nathan and Stephanie are saving for their daughter's college education. Their daughter, Paige, is now 8 years old and will be entering college 10 years from now (t = 10). College tuition and expenses at State U. are currently $16,000 a year and are expected to increase at a rate of 4% a year. They expect Paige to graduate in 4 years (if Paige wants to go to graduate school, she's on her own). Tuition and other costs will be due at the beginning of each school year (at t = 10, 11, 12, and 13). So far, Nathan and Stephanie have built up $9,000 in the college savings account. Their long-run financial plan is to contribute $3,000 a year at the beginning of each of the next five years (at t 0, 1, 2, 3, and 4). Then they plan to make 6 equal annual contributions at the end of each of the following 6 years (t = 5, 6, 7, 8, 9, and 10). Their investment account is expected to earn 8%. How large must the annual payments be in the subsequent 6 years (t = 5, 6, 7, 8, 9, and 10) to meet their daughter’s anticipated college costs?

Chapter9: Sequences, Probability And Counting Theory

Section9.4: Series And Their Notations

Problem 57SE: Karl has two years to save $10000 to buy a used car when he graduates. To the nearest dollar, what...

Related questions

Question

*CALCULATE THIS QUESTION WITHOUT USING EXCEL

Transcribed Image Text:Nathan and Stephanie are saving for their daughter's college education. Their daughter, Paige, is

now 8 years old and will be entering college 10 years from now (t = 10). College tuition and

expenses at State U. are currently $16,000 a year and are expected to increase at a rate of 4% a

year. They expect Paige to graduate in 4 years (if Paige wants to go to graduate school, she's on

her own). Tuition and other costs will be due at the beginning of each school year (at t = 10, 11,

12, and 13).

So far, Nathan and Stephanie have built up $9,000 in the college savings account. Their long-run

financial plan is to contribute $3,000 a year at the beginning of each of the next five years (at t=

0, 1, 2, 3, and 4). Then they plan to make 6 equal annual contributions at the end of each of the

following 6 years (t = 5, 6, 7, 8, 9, and 10). Their investment account is expected to earn 8%.

How large must the annual payments be in the subsequent 6 years (t = 5, 6, 7, 8, 9, and 10) to

meet their daughter's anticipated college costs?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

Elementary Algebra

Algebra

ISBN:

9780998625713

Author:

Lynn Marecek, MaryAnne Anthony-Smith

Publisher:

OpenStax - Rice University