Nathan Corporation's equipment had an original life of 140 months, and the straight-line depreciation method is used. As of January 1, the equipment was 40 months old. The equipment will be worthless at the end of its useful life. As of the end of the month, Asher Corporation has provided services to customers for which the earnings process is complete. Formal billings are normally sent out on the first day of cach month for the prior month's work. January's unbilled work is $75,000. Utilities used during January, for which bills will soon be forthcoming from providers, are estimated at $4,500. A review of supplies on hand at the end of the month revealed items costing $10,500. The $7,200 balance in prepaid insurance was for a 6-month policy running from January 1 to June 30. The unearned revenue was collected in December of 20X7. 60% of that amount was actually earned in January, with the remainder to be earned in February. The loan accrues interest at 1% per month. No interest was paid in January.

Nathan Corporation's equipment had an original life of 140 months, and the straight-line depreciation method is used. As of January 1, the equipment was 40 months old. The equipment will be worthless at the end of its useful life. As of the end of the month, Asher Corporation has provided services to customers for which the earnings process is complete. Formal billings are normally sent out on the first day of cach month for the prior month's work. January's unbilled work is $75,000. Utilities used during January, for which bills will soon be forthcoming from providers, are estimated at $4,500. A review of supplies on hand at the end of the month revealed items costing $10,500. The $7,200 balance in prepaid insurance was for a 6-month policy running from January 1 to June 30. The unearned revenue was collected in December of 20X7. 60% of that amount was actually earned in January, with the remainder to be earned in February. The loan accrues interest at 1% per month. No interest was paid in January.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter11: Accounting For Transactions Using A General Journal

Section: Chapter Questions

Problem 1AFE

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

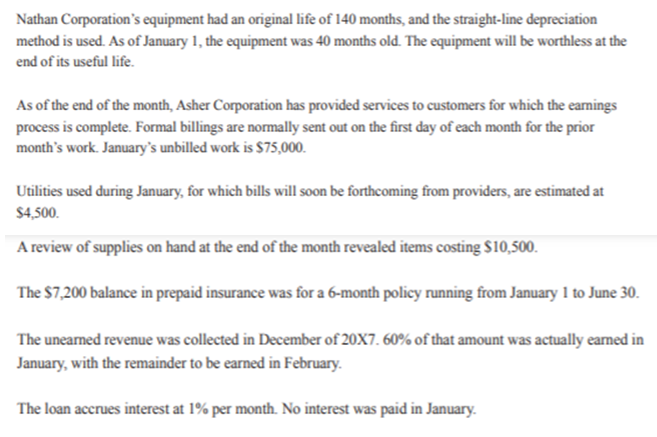

Transcribed Image Text:Nathan Corporation's equipment had an original life of 140 months, and the straight-line depreciation

method is used. As of January 1, the equipment was 40 months old. The equipment will be worthless at the

end of its useful life.

As of the end of the month, Asher Corporation has provided services to customers for which the earnings

process is complete. Formal billings are normally sent out on the first day of each month for the prior

month's work. January's unbilled work is $75,000.

Utilities used during January, for which bills will soon be forthcoming from providers, are estimated at

$4,500.

A review of supplies on hand at the end of the month revealed items costing $10,500.

The $7,200 balance in prepaid insurance was for a 6-month policy running from January 1 to June 30.

The unearned revenue was collected in December of 20X7. 60% of that amount was actually earned in

January, with the remainder to be earned in February.

The loan accrues interest at 1% per month. No interest was paid in January.

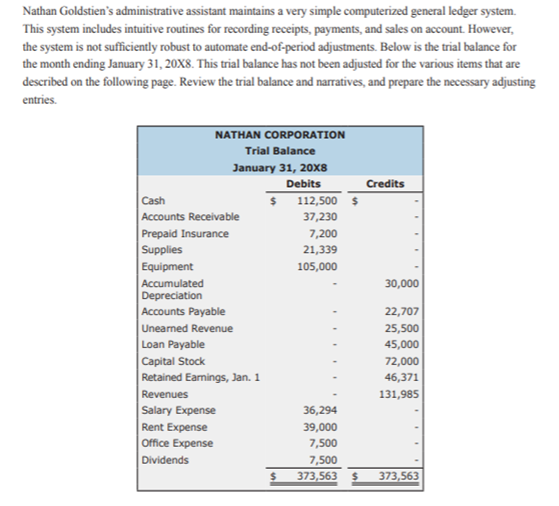

Transcribed Image Text:Nathan Goldstien's administrative assistant maintains a very simple computerized general ledger system.

This system includes intuitive routines for recording receipts, payments, and sales on account. However,

the system is not sufficiently robust to automate end-of-period adjustments. Below is the trial balance for

the month ending January 31, 20X8. This trial balance has not been adjusted for the various items that are

described on the following page. Review the trial balance and narratives, and prepare the necessary adjusting

entries.

NATHAN CORPORATION

Trial Balance

January 31, 20X8

Debits

Credits

112,500 $

Cash

|Accounts Receivable

Prepaid Insurance

Supplies

Equipment

Accumulated

Depreciation

Accounts Payable

Unearned Revenue

Loan Payable

37,230

7,200

21,339

105,000

30,000

22,707

25,500

45,000

72,000

46,371

Capital Stock

Retained Earmings, Jan. 1

Revenues

Salary Expense

Rent Expense

Office Expense

131,985

36,294

39,000

7,500

Dividends

7,500

373,563

373,563

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College