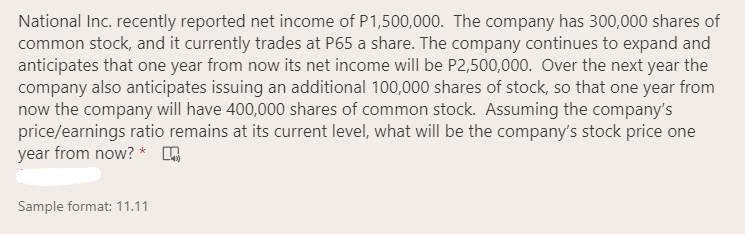

National Inc. recently reported net income of P1,500,000. The company has 300,000 shares of common stock, and it currently trades at P65 a share. The company continues to expand and anticipates that one year from now its net income will be P2,500,000. Over the next year the company also anticipates issuing an additional 100,000 shares of stock, so that one year from now the company will have 400,000 shares of common stock. Assuming the company's price/earnings ratio remains at its current level, what will be the company's stock price one year from now? * Q

National Inc. recently reported net income of P1,500,000. The company has 300,000 shares of common stock, and it currently trades at P65 a share. The company continues to expand and anticipates that one year from now its net income will be P2,500,000. Over the next year the company also anticipates issuing an additional 100,000 shares of stock, so that one year from now the company will have 400,000 shares of common stock. Assuming the company's price/earnings ratio remains at its current level, what will be the company's stock price one year from now? * Q

Chapter7: Stocks (equity) - Characterstics And Valuation

Section: Chapter Questions

Problem 13PROB

Related questions

Question

100%

34

Transcribed Image Text:National Inc. recently reported net income of P1,500,000. The company has 300,000 shares of

common stock, and it currently trades at P65 a share. The company continues to expand and

anticipates that one year from now its net income will be P2,500,000. Over the next year the

company also anticipates issuing an additional 100,000 shares of stock, so that one year from

now the company will have 400,000 shares of common stock. Assuming the company's

price/earnings ratio remains at its current level, what will be the company's stock price one

year from now? *

Sample format: 11.11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning