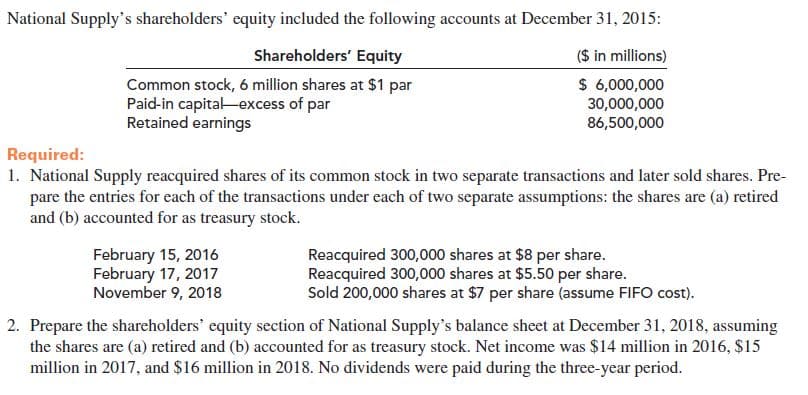

National Supply's shareholders' equity included the following accounts at December 31, 2015: ($ in millions) Shareholders' Equity $ 6,000,000 Common stock, 6 million shares at $1 par Paid-in capital-excess of par Retained earnings 30,000,000 86,500,000 Required: 1. National Supply reacquired shares of its common stock in two separate transactions and later sold shares. Pre- pare the entries for each of the transactions under each of two separate assumptions: the shares are (a) retired and (b) accounted for as treasury stock. February 15, 2016 February 17, 2017 November 9, 2018 Reacquired 300,000 shares at $8 per share. Reacquired 300,000 shares at $5.50 per share. Sold 200,000 shares at $7 per share (assume FIFO cost). 2. Prepare the shareholders' equity section of National Supply's balance sheet at December 31, 2018, assuming the shares are (a) retired and (b) accounted for as treasury stock. Net income was $14 million in 2016, $15 million in 2017, and $16 million in 2018. No dividends were paid during the three-year period.

National Supply's shareholders' equity included the following accounts at December 31, 2015: ($ in millions) Shareholders' Equity $ 6,000,000 Common stock, 6 million shares at $1 par Paid-in capital-excess of par Retained earnings 30,000,000 86,500,000 Required: 1. National Supply reacquired shares of its common stock in two separate transactions and later sold shares. Pre- pare the entries for each of the transactions under each of two separate assumptions: the shares are (a) retired and (b) accounted for as treasury stock. February 15, 2016 February 17, 2017 November 9, 2018 Reacquired 300,000 shares at $8 per share. Reacquired 300,000 shares at $5.50 per share. Sold 200,000 shares at $7 per share (assume FIFO cost). 2. Prepare the shareholders' equity section of National Supply's balance sheet at December 31, 2018, assuming the shares are (a) retired and (b) accounted for as treasury stock. Net income was $14 million in 2016, $15 million in 2017, and $16 million in 2018. No dividends were paid during the three-year period.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter12: Statement Of Stockholders’ Equity (stockeq)

Section: Chapter Questions

Problem 3R: Chen Corporation began 2012 with the following stockholders equity balances: The following selected...

Related questions

Question

100%

Transcribed Image Text:National Supply's shareholders' equity included the following accounts at December 31, 2015:

($ in millions)

Shareholders' Equity

$ 6,000,000

Common stock, 6 million shares at $1 par

Paid-in capital-excess of par

Retained earnings

30,000,000

86,500,000

Required:

1. National Supply reacquired shares of its common stock in two separate transactions and later sold shares. Pre-

pare the entries for each of the transactions under each of two separate assumptions: the shares are (a) retired

and (b) accounted for as treasury stock.

February 15, 2016

February 17, 2017

November 9, 2018

Reacquired 300,000 shares at $8 per share.

Reacquired 300,000 shares at $5.50 per share.

Sold 200,000 shares at $7 per share (assume FIFO cost).

2. Prepare the shareholders' equity section of National Supply's balance sheet at December 31, 2018, assuming

the shares are (a) retired and (b) accounted for as treasury stock. Net income was $14 million in 2016, $15

million in 2017, and $16 million in 2018. No dividends were paid during the three-year period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub