Natsam Corporation has $291 million of excess cash. The firm has no debt and 526 million shares outstanding with a current market price of $16 per share. Natsam's board has decided to pay out this cash as a one-time divi a. What is the ex-dividend price of a share in a perfect capital market? b. If the board instead decided to use the cash to do a one-time share repurchase, in a perfect capital market, what is the price of the shares once the repurchase is complete? c. In a perfect capital market, which policy in part (a) or (b) makes investors in the firm better off? a. What is the ex-dividend price of a share in a perfect capital market? The ex-dividend price is $on a per share basis. (Round to the nearest cent.) b. If the board instead decided to use the cash to do a one-time share repurchase, in a perfect capital market, what is the price The price of the shares once the repurchase is complete is $ per share. (Round to the nearest cent.) c. In a perfect capital market, which policy in part (a) or (b) makes investors in the firm better off? (Select the best choice below.) OA. Investors are better off with policy in part (a). OB. Investors are better off with policy in part (b). OC. Investors are indifferent to either policy. COD the shares once the repurchase is complete?

Natsam Corporation has $291 million of excess cash. The firm has no debt and 526 million shares outstanding with a current market price of $16 per share. Natsam's board has decided to pay out this cash as a one-time divi a. What is the ex-dividend price of a share in a perfect capital market? b. If the board instead decided to use the cash to do a one-time share repurchase, in a perfect capital market, what is the price of the shares once the repurchase is complete? c. In a perfect capital market, which policy in part (a) or (b) makes investors in the firm better off? a. What is the ex-dividend price of a share in a perfect capital market? The ex-dividend price is $on a per share basis. (Round to the nearest cent.) b. If the board instead decided to use the cash to do a one-time share repurchase, in a perfect capital market, what is the price The price of the shares once the repurchase is complete is $ per share. (Round to the nearest cent.) c. In a perfect capital market, which policy in part (a) or (b) makes investors in the firm better off? (Select the best choice below.) OA. Investors are better off with policy in part (a). OB. Investors are better off with policy in part (b). OC. Investors are indifferent to either policy. COD the shares once the repurchase is complete?

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter14: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 12P: Bayani Bakerys most recent FCF was 48 million; the FCF is expected to grow at a constant rate of 6%....

Related questions

Question

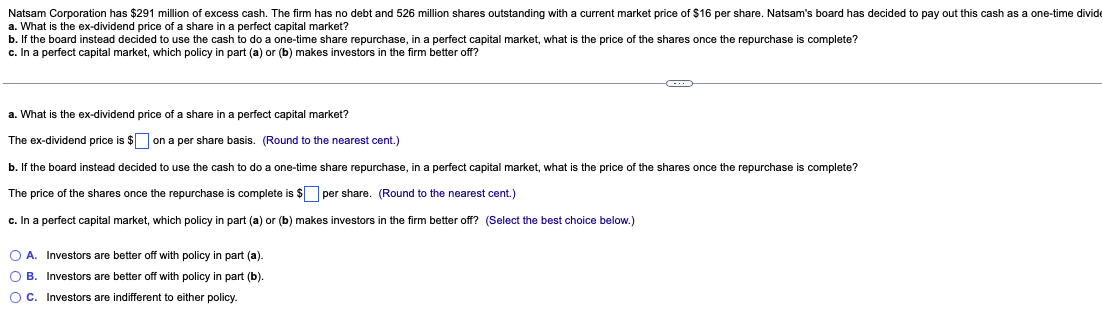

Transcribed Image Text:Natsam Corporation has $291 million of excess cash. The firm has no debt and 526 million shares outstanding with a current market price of $16 per share. Natsam's board has decided to pay out this cash as a one-time divide

a. What is the ex-dividend price of a share in a perfect capital market?

b. If the board instead decided to use the cash do a one-time share repurchase, in a perfect capital market, what is the price of the shares once the repurchase is complete?

c. In a perfect capital market, which policy in part (a) or (b) makes investors in the firm better off?

C

a. What is the ex-dividend price of a share in a perfect capital market?

The ex-dividend price is $ on a per share basis. (Round to the nearest cent.)

b. If the board instead decided to use the cash to do a one-time share repurchase, in a perfect capital market, what is the price of the shares once the repurchase is complete?

The price of the shares once the repurchase is complete is $ per share. (Round to the nearest cent.)

c. In a perfect capital market, which policy in part (a) or (b) makes investors in the firm better off? (Select the best choice below.)

O A. Investors are better off with policy in part (a).

OB. Investors are better off with policy in part (b).

OC. Investors are indifferent either policy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT