Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders’ equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (400,000 shares authorized, 280,000 shares issued) $2,800,000 Paid-In Capital in Excess of Stated Value-Common Stock 550,000 Retained Earnings 6,360,000 Treasury Stock (28,000 shares, at cost) 392,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $35,280. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 55,000 shares of common stock for $880,000. June 14. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued shares of stock for the stock dividend declared on June 14. Oct. 30. Purchased 18,000 shares of treasury stock for $19 per share. Dec. 30. Declared a $0.17-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings. Required: 1. The January 1 balances have been entered in T accounts for the stockholders' equity accounts. Record the above transactions in the T accounts and provide the December 31 balance where appropriate. If required, round to one decimal place. Common Stock Jan. 1 Bal. 2,800,000 fill in the blank 2 fill in the blank 4 Dec. 31 Bal. fill in the blank 5 Paid-In Capital in Excess of Stated Value-Common Stock Jan. 1 Bal. 550,000 fill in the blank 7 fill in the blank 9 Dec. 31 Bal. fill in the blank 10 Retained Earnings fill in the blank 12 Jan. 1 Bal. 6,360,000 fill in the blank 14 Dec. 31 Bal. fill in the blank 15 Treasury Stock Jan. 1 Bal. 392,000 fill in the blank 17 fill in the blank 19 Dec. 31 Bal. fill in the blank 20 Paid-In Capital from Sale of Treasury Stock fill in the blank 22 Stock Dividends Distributable fill in the blank 24 fill in the blank 26 Stock Dividends fill in the blank 28 fill in the blank 30 Cash Dividends fill in the blank 32 fill in the blank 34 2. Journalize the entries to record the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $35,280. Date Account Debit Credit Jan. 15 fill in the blank 36 fill in the blank 37 fill in the blank 39 fill in the blank 40 Mar. 15. Sold all of the treasury stock for $17 per share. Date Account Debit Credit Mar. 15 fill in the blank 42 fill in the blank 43 fill in the blank 45 fill in the blank 46 fill in the blank 48 fill in the blank 49 Apr. 13. Issued 55,000 shares of common stock for $880,000 Date Account Debit Credit Apr. 13 fill in the blank 51 fill in the blank 52 fill in the blank 54 fill in the blank 55 fill in the blank 57 fill in the blank 58 June 14. Declared a 5% on common stock, to be capitalized at the market price of the stock, which is $18 per share. Date Account Debit Credit June 14 fill in the blank 60 fill in the blank 61 fill in the blank 63 fill in the blank 64 fill in the blank 66 fill in the blank 67 July 16. Issued stock for stock dividend declared on June 14. Date Account Debit Credit July 16 fill in the blank 69 fill in the blank 70 fill in the blank 72 fill in the blank 73 Oct. 30. Purchased 18,000 shares of treasury stock for $19 per share. Date Account Debit Credit Oct. 30 fill in the blank 75 fill in the blank 76 fill in the blank 78 fill in the blank 79 Dec. 30. Declared a $0.17-per-share dividend on common stock. Date Account Debit Credit Dec. 30 fill in the blank 81 fill in the blank 82 fill in the blank 84 fill in the blank 85 Dec. 31. Closed the two dividends accounts to Retained Earnings. Date Account Debit Credit Dec. 31 fill in the blank 87 fill in the blank 88 fill in the blank 90 fill in the blank 91 fill in the blank 93 fill in the blank 94 3. Prepare a statement of stockholders’ equity for the year ended December 31, 20Y1. Assume that net income was $6,614,000 for the year ended December 31, 20Y1. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If an amount box does not require an entry, leave it blank or enter “0”.

Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises'

| Common Stock, $10 stated value (400,000 shares authorized, 280,000 shares issued) | $2,800,000 |

| Paid-In Capital in Excess of Stated Value-Common Stock | 550,000 |

| Retained Earnings | 6,360,000 |

| 392,000 |

The following selected transactions occurred during the year:

| Jan. 15. | Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $35,280. |

| Mar. 15. | Sold all of the treasury stock for $17 per share. |

| Apr. 13. | Issued 55,000 shares of common stock for $880,000. |

| June 14. | Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. |

| July 16. | Issued shares of stock for the stock dividend declared on June 14. |

| Oct. 30. | Purchased 18,000 shares of treasury stock for $19 per share. |

| Dec. 30. | Declared a $0.17-per-share dividend on common stock. |

| 31. | Closed the two dividends accounts to Retained Earnings. |

Required:

1. The January 1 balances have been entered in T accounts for the stockholders' equity accounts. Record the above transactions in the T accounts and provide the December 31 balance where appropriate. If required, round to one decimal place.

| Common Stock | |||

|---|---|---|---|

| Jan. 1 Bal. | 2,800,000 | ||

| fill in the blank 2 | |||

| fill in the blank 4 | |||

| Dec. 31 Bal. | fill in the blank 5 |

| Paid-In Capital in Excess of Stated Value-Common Stock | |||

|---|---|---|---|

| Jan. 1 Bal. | 550,000 | ||

| fill in the blank 7 | |||

| fill in the blank 9 | |||

| Dec. 31 Bal. | fill in the blank 10 |

| Retained Earnings | |||

|---|---|---|---|

| fill in the blank 12 | Jan. 1 Bal. | 6,360,000 | |

| fill in the blank 14 | |||

| Dec. 31 Bal. | fill in the blank 15 |

| Treasury Stock | |||

|---|---|---|---|

| Jan. 1 Bal. | 392,000 | fill in the blank 17 | |

| fill in the blank 19 | |||

| Dec. 31 Bal. | fill in the blank 20 |

| Paid-In Capital from Sale of Treasury Stock | |||

|---|---|---|---|

| fill in the blank 22 |

| Stock Dividends Distributable | |||

|---|---|---|---|

| fill in the blank 24 | fill in the blank 26 |

| Stock Dividends | |||

|---|---|---|---|

| fill in the blank 28 | fill in the blank 30 |

| Cash Dividends | |||

|---|---|---|---|

| fill in the blank 32 | fill in the blank 34 |

2.

Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $35,280.

| Date | Account | Debit | Credit |

|---|---|---|---|

| Jan. 15 | fill in the blank 36 | fill in the blank 37 | |

| fill in the blank 39 | fill in the blank 40 |

Mar. 15. Sold all of the treasury stock for $17 per share.

| Date | Account | Debit | Credit |

|---|---|---|---|

| Mar. 15 | fill in the blank 42 | fill in the blank 43 | |

| fill in the blank 45 | fill in the blank 46 | ||

| fill in the blank 48 | fill in the blank 49 |

Apr. 13. Issued 55,000 shares of common stock for $880,000

| Date | Account | Debit | Credit |

|---|---|---|---|

| Apr. 13 | fill in the blank 51 | fill in the blank 52 | |

| fill in the blank 54 | fill in the blank 55 | ||

| fill in the blank 57 | fill in the blank 58 |

June 14. Declared a 5% on common stock, to be capitalized at the market price of the stock, which is $18 per share.

| Date | Account | Debit | Credit |

|---|---|---|---|

| June 14 | fill in the blank 60 | fill in the blank 61 | |

| fill in the blank 63 | fill in the blank 64 | ||

| fill in the blank 66 | fill in the blank 67 |

July 16. Issued stock for stock dividend declared on June 14.

| Date | Account | Debit | Credit |

|---|---|---|---|

| July 16 | fill in the blank 69 | fill in the blank 70 | |

| fill in the blank 72 | fill in the blank 73 |

Oct. 30. Purchased 18,000 shares of treasury stock for $19 per share.

| Date | Account | Debit | Credit |

|---|---|---|---|

| Oct. 30 | fill in the blank 75 | fill in the blank 76 | |

| fill in the blank 78 | fill in the blank 79 |

Dec. 30. Declared a $0.17-per-share dividend on common stock.

| Date | Account | Debit | Credit |

|---|---|---|---|

| Dec. 30 | fill in the blank 81 | fill in the blank 82 | |

| fill in the blank 84 | fill in the blank 85 |

Dec. 31. Closed the two dividends accounts to Retained Earnings.

| Date | Account | Debit | Credit |

|---|---|---|---|

| Dec. 31 | fill in the blank 87 | fill in the blank 88 | |

| fill in the blank 90 | fill in the blank 91 | ||

| fill in the blank 93 | fill in the blank 94 |

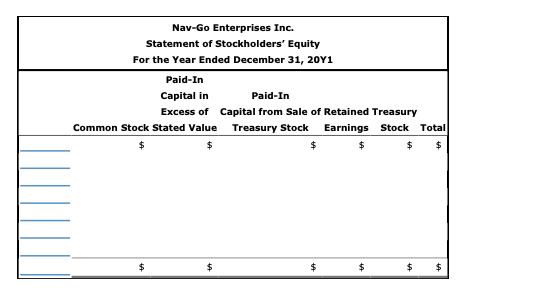

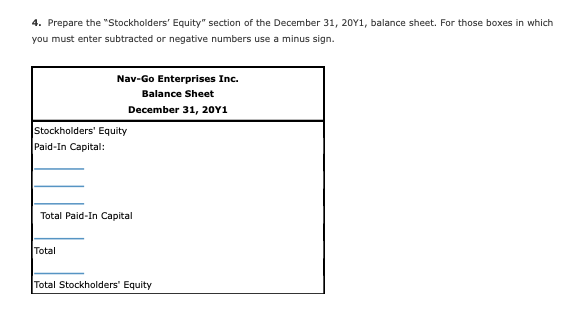

3. Prepare a statement of stockholders’ equity for the year ended December 31, 20Y1. Assume that net income was $6,614,000 for the year ended December 31, 20Y1. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If an amount box does not require an entry, leave it blank or enter “0”.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images