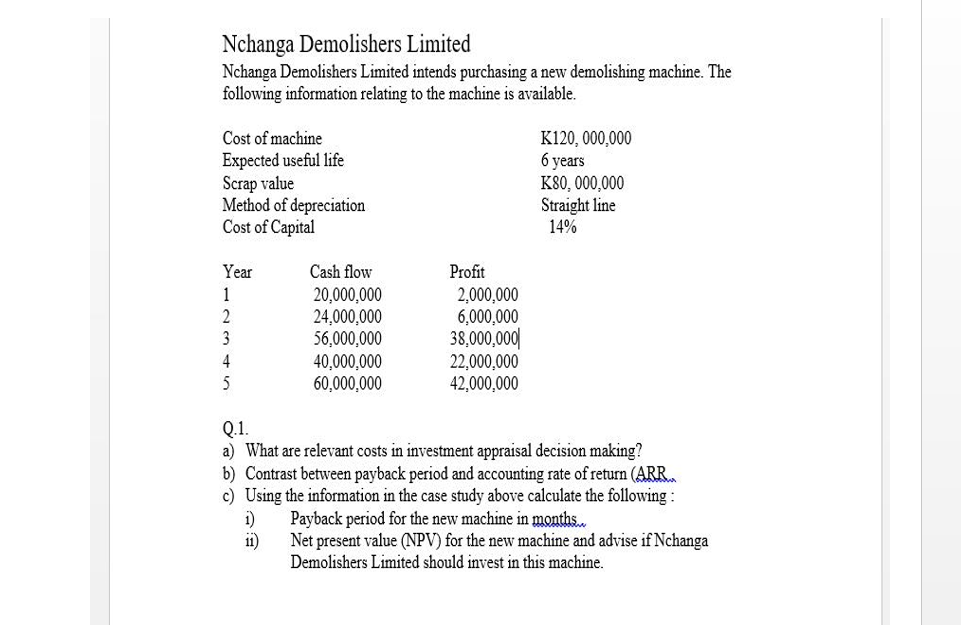

Nchanga Demolishers Limited Nchanga Demolishers Limited intends purchasing a new demolishing machine. The following information relating to the machine is available. K120, 000,000 6 years K80, 000,000 Straight line 14% Cost of machine Expected useful life Scrap value Method of depreciation Cost of Capital Year Cash flow Profit 20,000,000 24,000,000 56,000,000 40,000,000 60,000,000 2,000,000 6,000,000 38,000,000| 22,000,000 42,000,000 1 2 3 4 5 Q.1. a) What are relevant costs in investment appraisal decision making? b) Contrast between payback period and accounting rate of return (ARR. c) Using the information in the case study above calculate the following : i) Payback period for the new machine in months. i1) Net present value (NPV) for the new machine and advise if Nchanga Demolishers Limited should invest in this machine.

Nchanga Demolishers Limited Nchanga Demolishers Limited intends purchasing a new demolishing machine. The following information relating to the machine is available. K120, 000,000 6 years K80, 000,000 Straight line 14% Cost of machine Expected useful life Scrap value Method of depreciation Cost of Capital Year Cash flow Profit 20,000,000 24,000,000 56,000,000 40,000,000 60,000,000 2,000,000 6,000,000 38,000,000| 22,000,000 42,000,000 1 2 3 4 5 Q.1. a) What are relevant costs in investment appraisal decision making? b) Contrast between payback period and accounting rate of return (ARR. c) Using the information in the case study above calculate the following : i) Payback period for the new machine in months. i1) Net present value (NPV) for the new machine and advise if Nchanga Demolishers Limited should invest in this machine.

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE

Related questions

Question

Transcribed Image Text:Nchanga Demolishers Limited

Nchanga Demolishers Limited intends purchasing a new demolishing machine. The

following information relating to the machine is available.

Cost of machine

Expected useful life

Scrap value

Method of depreciation

Cost of Capital

K120, 000,000

6 years

K80, 000,000

Straight line

14%

Profit

2,000,000

6,000,000

38,000,000|

22,000,000

42,000,000

Year

Cash flow

1

20,000,000

24,000,000

56,000,000

40,000,000

60,000,000

3

5

Q1.

a) What are relevant costs in investment appraisal decision making?

b) Contrast between payback period and accounting rate of return (ARR

c) Using the information in the case study above calculate the following :

i)

Payback period for the new machine in months.

ii)

Net present value (NPV) for the new machine and advise if Nchanga

Demolishers Limited should invest in this machine.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT