ncome taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan Corporation Income Statement (Partial) For the Year Ended December 31, 2021 come from Continuing Operations before Income Taxes 2$ 11 come Tax Expense rrent $

ncome taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Sheridan Corporation Income Statement (Partial) For the Year Ended December 31, 2021 come from Continuing Operations before Income Taxes 2$ 11 come Tax Expense rrent $

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 47P

Related questions

Question

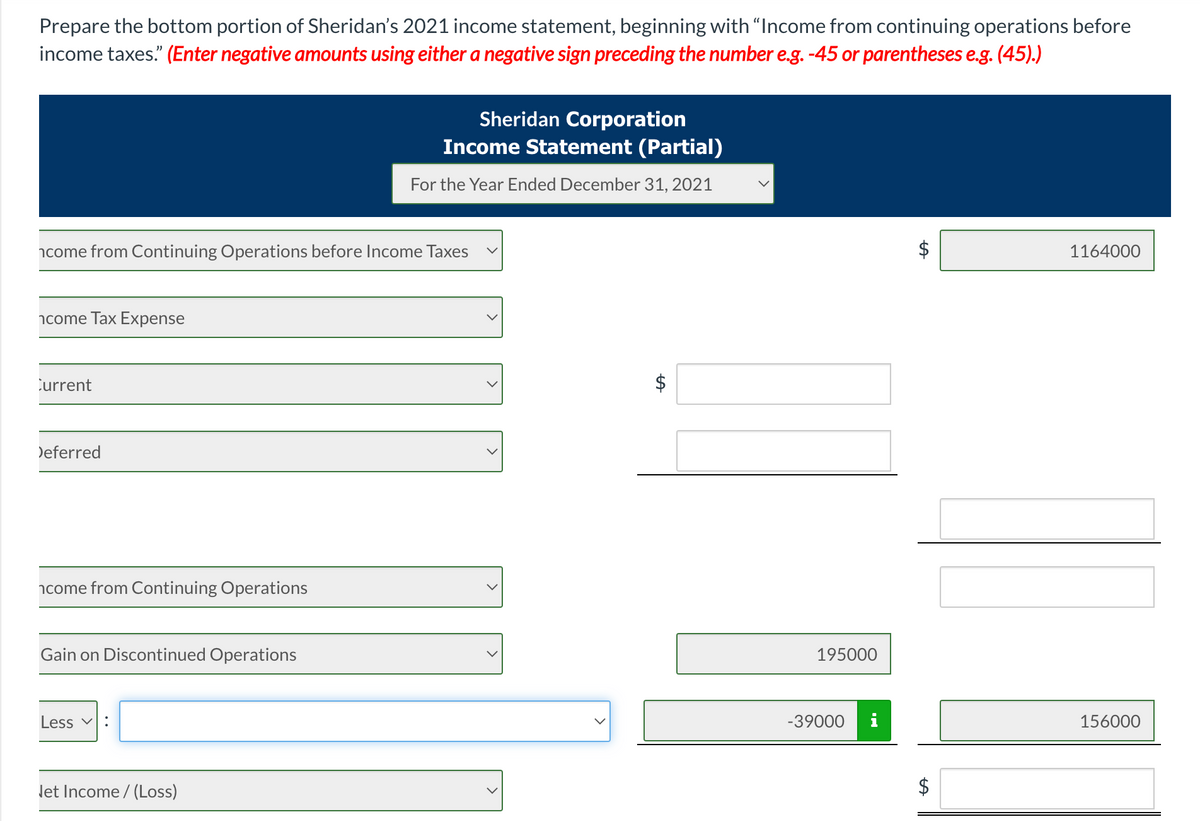

Transcribed Image Text:Prepare the bottom portion of Sheridan's 2021 income statement, beginning with "Income from continuing operations before

income taxes." (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Sheridan Corporation

Income Statement (Partial)

For the Year Ended December 31, 2021

icome from Continuing Operations before Income Taxes

1164000

ncome Tax Expense

Current

$

Deferred

ncome from Continuing Operations

Gain on Discontinued Operations

195000

Less v

-39000

i

156000

let Income / (Loss)

$

%24

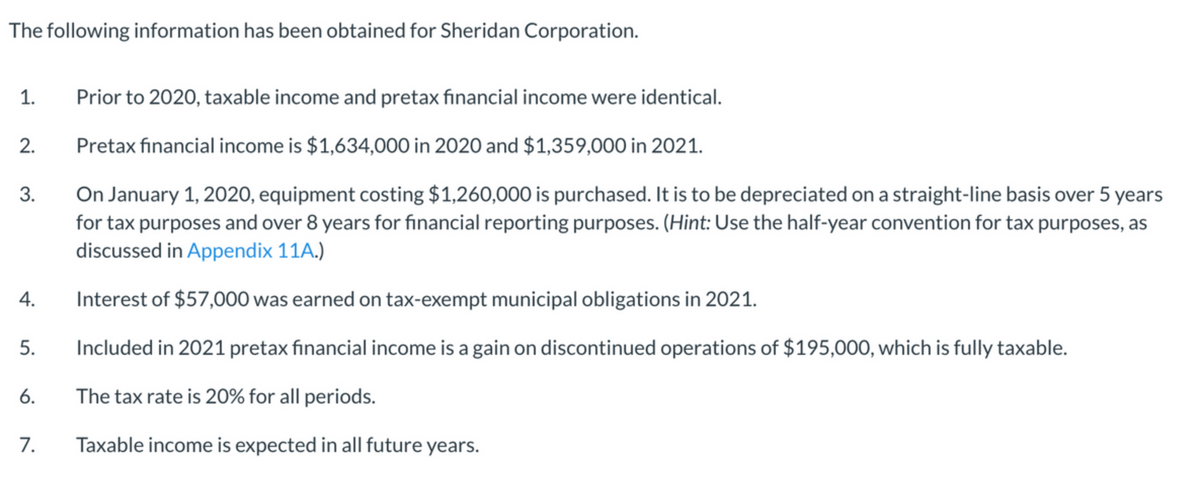

Transcribed Image Text:The following information has been obtained for Sheridan Corporation.

1.

Prior to 2020, taxable income and pretax financial income were identical.

2.

Pretax fınancial income is $1,634,000 in 2020 and $1,359,000 in 2021.

On January 1, 2020, equipment costing $1,260,000 is purchased. It is to be depreciated on a straight-line basis over 5 years

for tax purposes and over 8 years for financial reporting purposes. (Hint: Use the half-year convention for tax purposes, as

discussed in Appendix 11A.)

3.

Interest of $57,000 was earned on tax-exempt municipal obligations in 2021.

Included in 2021 pretax financial income is a gain on discontinued operations of $195,000, which is fully taxable.

6.

The tax rate is 20% for all periods.

7.

Taxable income is expected in all future years.

4.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning