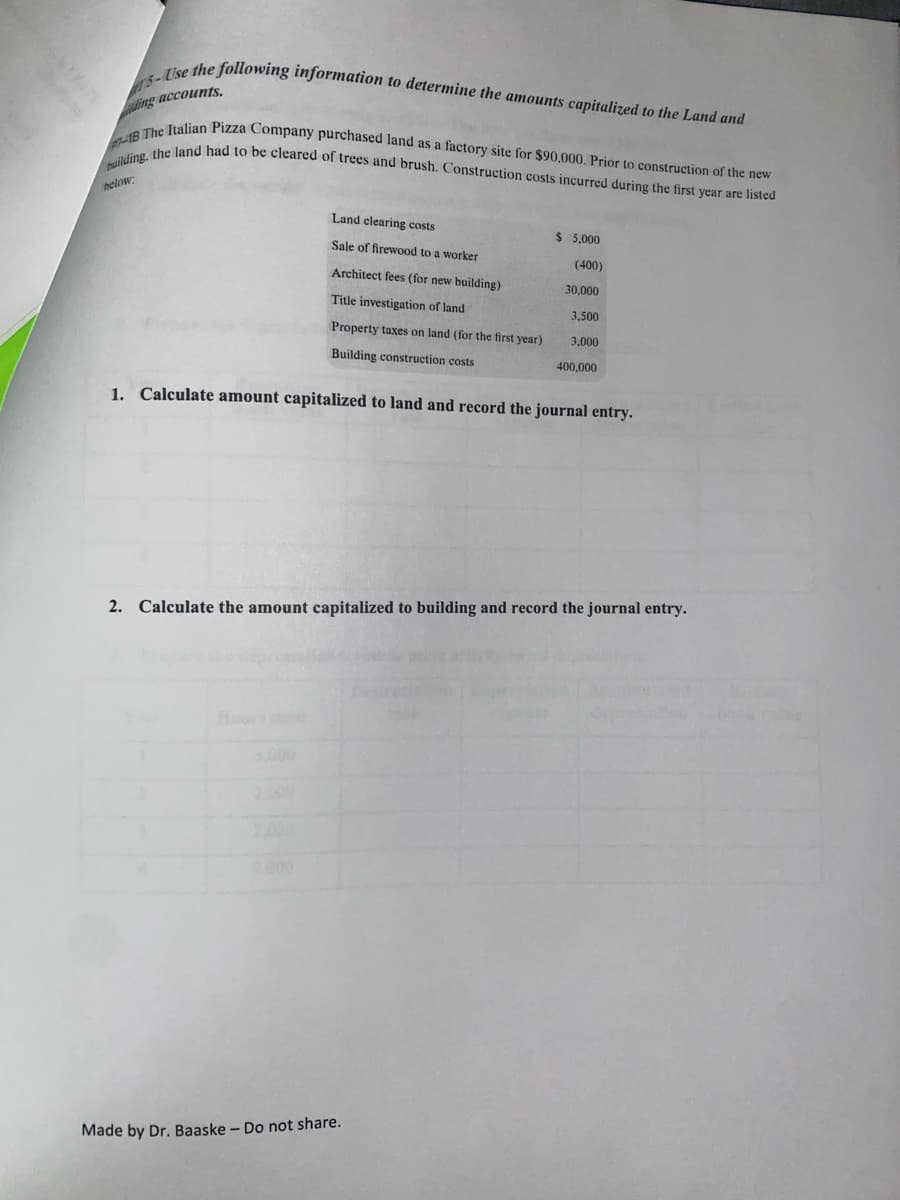

nd and puilding. the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed -1B The Italian Pizza Company purchased land as a factory site for $90,000. Prior to construction of the new Ihelow: Land clearing costs $ 5,000 Sale of firewood to a worker (400) Architect fees (for new building) 30,000 Title investigation of land 3,500 Property taxes on land (for the first year) 3,000 Building construction costs 400,000 1. Calculate amount capitalized to land and record the journal entry.

nd and puilding. the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed -1B The Italian Pizza Company purchased land as a factory site for $90,000. Prior to construction of the new Ihelow: Land clearing costs $ 5,000 Sale of firewood to a worker (400) Architect fees (for new building) 30,000 Title investigation of land 3,500 Property taxes on land (for the first year) 3,000 Building construction costs 400,000 1. Calculate amount capitalized to land and record the journal entry.

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 45P

Related questions

Question

complete the following question

Transcribed Image Text:puilding, the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed

p-1B The Italian Pizza Company purchased land as a factory site for $90,000. Prior to construction of the new

T5-Use the following information to determine the amounts capitalized to the Land and

ding accounts,

helow:

Land clearing costs

$ 5,000

Sale of firewood to a worker

(400)

Architect fees (for new building)

30,000

Title investigation of land

3,500

Property taxes on land (for the first year)

3,000

Building construction costs

400,000

1. Calculate amount capitalized to land and record the journal entry.

2. Calculate the amount capitalized to building and record the journal entry.

Hoos

3.000

2.000

000

Made by Dr. Baaske – Do not share.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College