ne 30 Deposits Balance Ju Payments Balance July 31 Bank statement amounts Deposits in transit June 30 July 31 Outstanding checks June 30 July 31 Unrecorded deposit Unrecorded disbursement General ledger amounts $

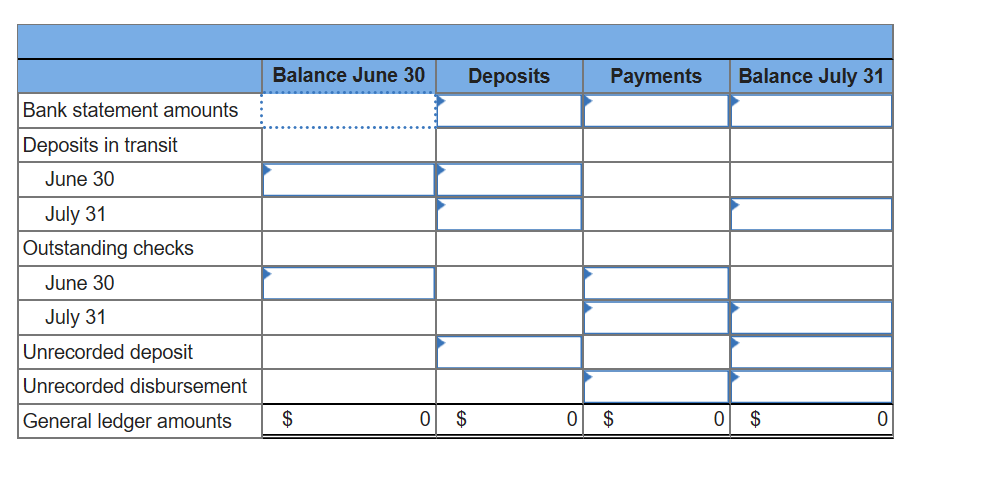

The auditors of Steffey Ltd., decided to study the cash receipts and disbursements for the month of July of the current year under audit. They obtained the bank reconciliations and the cash journals prepared by the company accountants, which revealed the following:

June 30: Bank balance, $355,001; deposits in transit, $86,899; outstanding checks, $42,690; general ledger cash balance, $399,210.

July 1: Cash receipts journal, $650,187; cash disbursements journal, $565,397. July 31: Bank balance, $506,100; deposits in transit, $51,240; outstanding checks, $73,340; general ledger cash balance, $484,000. Bank statement record of deposits: $835,846; of payments: $684,747.

Required:

-

Prepare a four-column proof of cash covering the month of July of the current year. (Negative amounts or amounts to be deducted should be indicated by a minus sign.)

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images