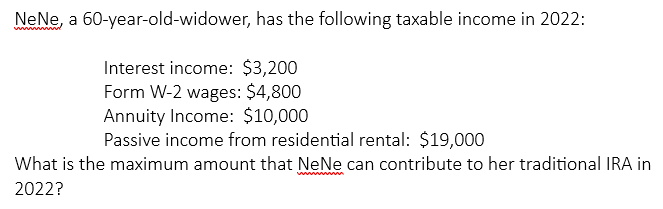

NeNe, a 60-year-old-widower, has the following taxable income in 2022: Interest income: $3,200 Form W-2 wages: $4,800 Annuity Income: $10,000 Passive income from residential rental: $19,000 What is the maximum amount that NeNe can contribute to her traditional IRA in 2022?

NeNe, a 60-year-old-widower, has the following taxable income in 2022: Interest income: $3,200 Form W-2 wages: $4,800 Annuity Income: $10,000 Passive income from residential rental: $19,000 What is the maximum amount that NeNe can contribute to her traditional IRA in 2022?

Chapter5: Deductions For And From Agi

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:NeNe, a 60-year-old-widower, has the following taxable income in 2022:

Interest income: $3,200

Form W-2 wages: $4,800

Annuity Income: $10,000

Passive income from residential rental: $19,000

What is the maximum amount that NeNe can contribute to her traditional IRA in

2022?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT