Neptune Corporation's bond has a 10% coupon rate, pays interest semiannually, and matures in 15 years. If the investors' annual required rate of return is 13%, the value of the bond is: O $859 O $1,000 O $1,220 O $1,231 O $804

Neptune Corporation's bond has a 10% coupon rate, pays interest semiannually, and matures in 15 years. If the investors' annual required rate of return is 13%, the value of the bond is: O $859 O $1,000 O $1,220 O $1,231 O $804

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter7: Bonds And Their Valuation

Section: Chapter Questions

Problem 16P: BOND VALUATION You are considering a 10-year, 1,000 par value bond. Its coupon rate is 8%, and...

Related questions

Question

2

Transcribed Image Text:Question 2

1 pts

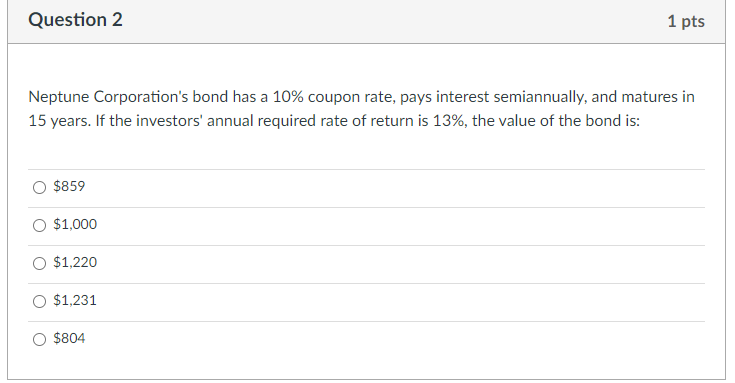

Neptune Corporation's bond has a 10% coupon rate, pays interest semiannually, and matures in

15 years. If the investors' annual required rate of return is 13%, the value of the bond is:

O $859

O $1,000

O $1,220

O $1,231

$804

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning