Net Income: Assume that your starting salary will be $55,000 per year, and assume that you have no additional income sources. Also, assume that Federal income taxes are 27% of your gross income, and that there is not any state tax in Texas. What is your monthly net income?

Net Income: Assume that your starting salary will be $55,000 per year, and assume that you have no additional income sources. Also, assume that Federal income taxes are 27% of your gross income, and that there is not any state tax in Texas. What is your monthly net income?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.19E

Related questions

Concept explainers

Mortgages

A mortgage is a formal agreement in which a bank or other financial institution lends cash at interest in return for assuming the title to the debtor's property, on the condition that the obligation is paid in full.

Mortgage

The term "mortgage" is a type of loan that a borrower takes to maintain his house or any form of assets and he agrees to return the amount in a particular period of time to the lender usually in a series of regular equally monthly, quarterly, or half-yearly payments.

Question

PLEASE answer all using template attached.

PLEASE only answer if sure of SOLUTION.

WILL THUMBS UP IF CORRECT.

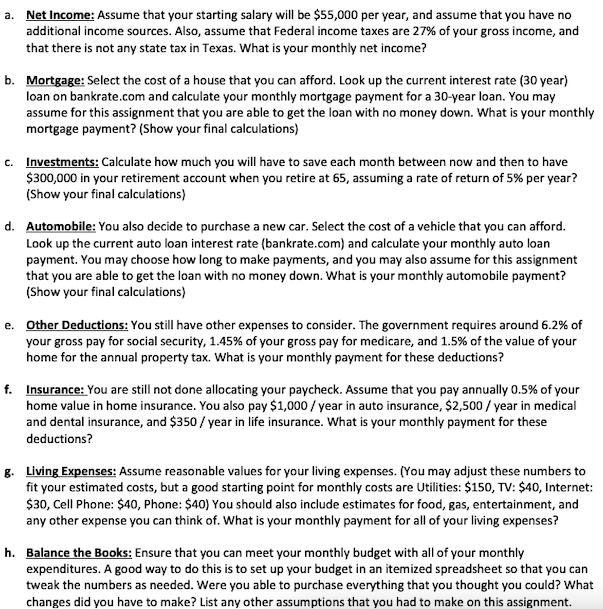

Transcribed Image Text:a.

Net Income: Assume that your starting salary will be $55,000 per year, and assume that you have no

additional income sources. Also, assume that Federal income taxes are 27% of your gross income, and

that there is not any state tax in Texas. What is your monthly net income?

b. Mortgage: Select the cost of a house that you can afford. Look up the current interest rate (30 year)

loan on bankrate.com and calculate your monthly mortgage payment for a 30-year loan. You may

assume for this assignment that you are able to get the loan with no money down. What is your monthly

mortgage payment? (Show your final calculations)

c. Investments: Calculate how much you will have to save each month between now and then to have

$300,000 in your retirement account when you retire at 65, assuming a rate of return of 5% per year?

(Show your final calculations)

d. Automobile: You also decide to purchase a new car. Select the cost of a vehicle that you can afford.

Look up the current auto loan interest rate (bankrate.com) and calculate your monthly auto loan

payment. You may choose how long to make payments, and you may also assume for this assignment

that you are able to get the loan with no money down. What is your monthly automobile payment?

(Show your final calculations)

e. Other Deductions: You still have other expenses to consider. The government requires around 6.2% of

your gross pay for social security, 1.45% of your gross pay for medicare, and 1.5% of the value of your

home for the annual property tax. What is your monthly payment for these deductions?

f. Insurance: You are still not done allocating your paycheck. Assume that you pay annually 0.5% of your

home value in home insurance. You also pay $1,000/year in auto insurance, $2,500 / year in medical

and dental insurance, and $350 / year in life insurance. What is your monthly payment for these

deductions?

g. Living Expenses: Assume reasonable values for your living expenses. (You may adjust these numbers to

fit your estimated costs, but a good starting point for monthly costs are Utilities: $150, TV: $40, Internet:

$30, Cell Phone: $40, Phone: $40) You should also include estimates for food, gas, entertainment, and

any other expense you can think of. What is your monthly payment for all of your living expenses?

h. Balance the Books: Ensure that you can meet your monthly budget with all of your monthly

expenditures. A good way to do this is to set up your budget in an itemized spreadsheet so that you can

tweak the numbers as needed. Were you able to purchase everything that you thought you could? What

changes did you have to make? List any other assumptions that you had to make on this assignment.

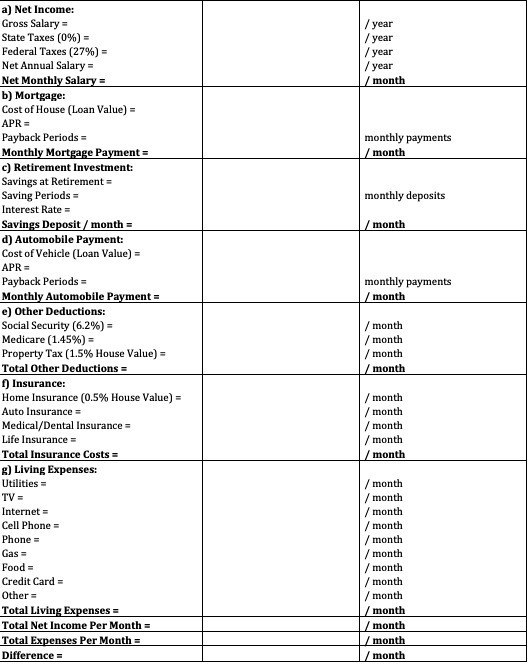

Transcribed Image Text:a) Net Income:

Gross Salary=

State Taxes (0%) =

Federal Taxes (27%) =

Net Annual Salary =

Net Monthly Salary =

b) Mortgage:

Cost of House (Loan Value) =

APR=

Payback Periods =

Monthly Mortgage Payment =

c) Retirement Investment:

Savings at Retirement =

Saving Periods =

Interest Rate =

Savings Deposit / month=

d) Automobile Payment:

Cost of Vehicle (Loan Value) =

APR =

Payback Periods =

Monthly Automobile Payment=

e) Other Deductions:

Social Security (6.2%) =

Medicare (1.45%) =

Property Tax (1.5% House Value) =

Total Other Deductions =

f) Insurance:

Home Insurance (0.5% House Value) =

Auto Insurance =

Medical/Dental Insurance =

Life Insurance =

Total Insurance Costs=

g) Living Expenses:

Utilities =

TV =

Internet =

Cell Phone=

Phone =

Gas =

Food =

Credit Card =

Other =

Total Living Expenses =

Total Net Income Per Month=

Total Expenses Per Month =

Difference =

/year

/year

/year

/year

month

monthly payments

month

monthly deposits

/month

monthly payments

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

month

/month

/month

/month

/month

/month

/month

/month

/month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,