Net income at the end of the year is P100,000. Partners, A, B, C and D, share profits and losses in the ratio of average capital. Interest will be allowed at 5% of average capital for the year which is P10,000, P20,000, P30,000, P40,000, respectively. Salary of P3,000 per month will be allowed for A, the managing partner. Bonus shall be provided at 25% of net income but shall not exceed P20,000 and will be divided based on the ratio of 10%, 20%, 25%, 45%. 1. The net loss for the year is P8,000. Partners, A and Z, share profits and losses in the ratio of 60%, 40%. Annual salary will be given to Z for P14,000 and partners are provided 20% bonus on net income to be divided equally. Income for the year is P12,000. The division of income/loss is based on the ratio of 3:2:1. Bonus will be given to partners for P3,000 each. The partners are X, Y and Z. 3. 2.

Net income at the end of the year is P100,000. Partners, A, B, C and D, share profits and losses in the ratio of average capital. Interest will be allowed at 5% of average capital for the year which is P10,000, P20,000, P30,000, P40,000, respectively. Salary of P3,000 per month will be allowed for A, the managing partner. Bonus shall be provided at 25% of net income but shall not exceed P20,000 and will be divided based on the ratio of 10%, 20%, 25%, 45%. 1. The net loss for the year is P8,000. Partners, A and Z, share profits and losses in the ratio of 60%, 40%. Annual salary will be given to Z for P14,000 and partners are provided 20% bonus on net income to be divided equally. Income for the year is P12,000. The division of income/loss is based on the ratio of 3:2:1. Bonus will be given to partners for P3,000 each. The partners are X, Y and Z. 3. 2.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 20E

Related questions

Question

NOTE: please do not do the devision of net income. Just the other subparts. Thank you.

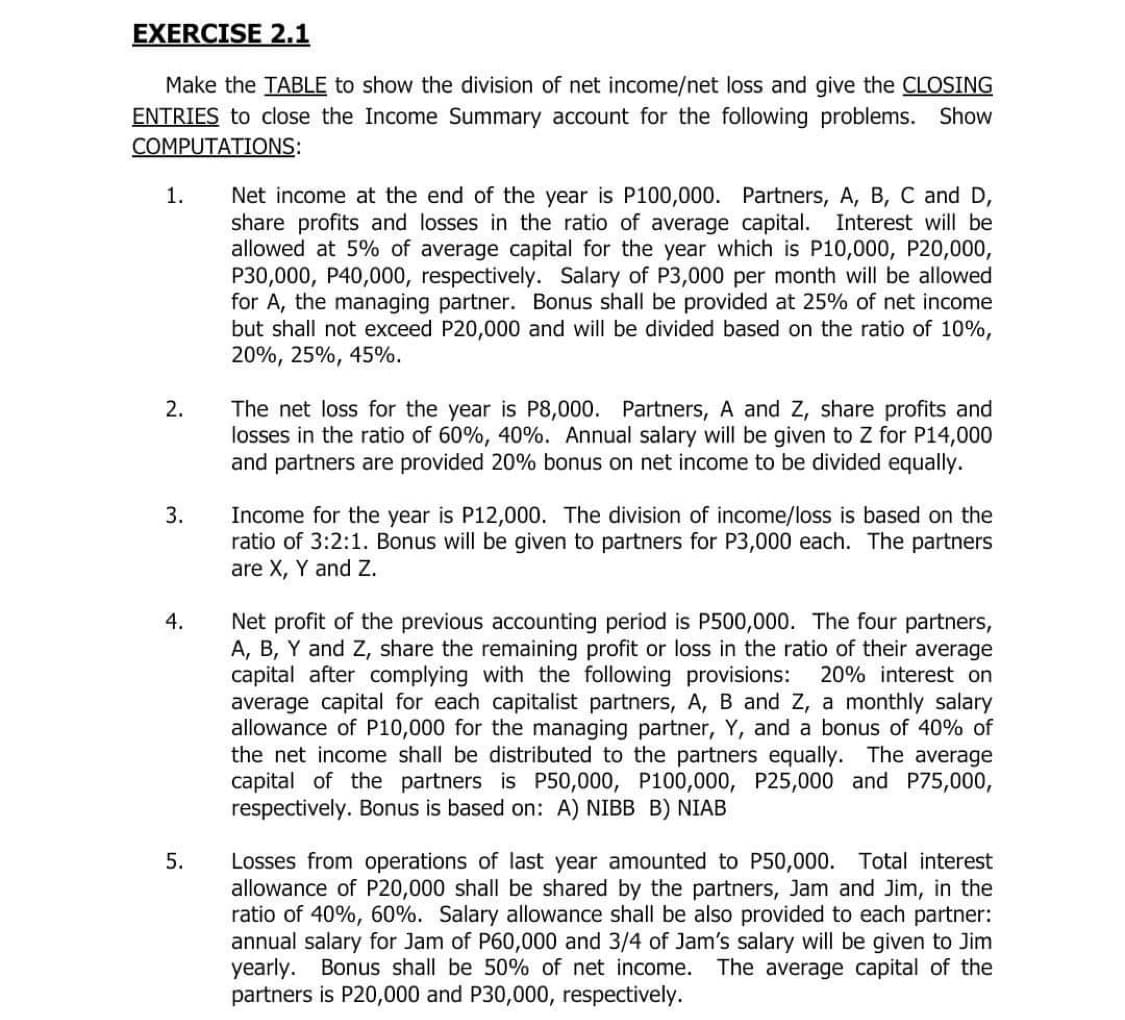

Transcribed Image Text:EXERCISE 2.1

Make the TABLE to show the division of net income/net loss and give the CLOSING

ENTRIES to close the Income Summary account for the following problems. Show

COMPUTATIONS:

Net income at the end of the year is P100,000. Partners, A, B, C and D,

share profits and losses in the ratio of average capital. Interest will be

allowed at 5% of average capital for the year which is P10,000, P20,000,

P30,000, P40,000, respectively. Salary of P3,000 per month will be allowed

for A, the managing partner. Bonus shall be provided at 25% of net income

but shall not exceed P20,000 and will be divided based on the ratio of 10%,

20%, 25%, 45%.

1.

2.

The net loss for the year is P8,000. Partners, A and Z, share profits and

losses in the ratio of 60%, 40%. Annual salary will be given to Z for P14,000

and partners are provided 20% bonus on net income to be divided equally.

Income for the year is P12,000. The division of income/loss is based on the

ratio of 3:2:1. Bonus will be given to partners for P3,000 each. The partners

are X, Y and Z.

3.

4.

Net profit of the previous accounting period is P500,000. The four partners,

A, B, Y and Z, share the remaining profit or loss in the ratio of their average

capital after complying with the following provisions:

average capital for each capitalist partners, A, B and Z, a monthly salary

allowance of P10,000 for the managing partner, Y, and a bonus of 40% of

the net income shall be distributed to the partners equally. The average

capital of the partners is P50,000, P100,000, P25,000 and P75,000,

respectively. Bonus is based on: A) NIBB B) NIAB

20% interest on

Losses from operations of last year amounted to P50,000. Total interest

allowance of P20,000 shall be shared by the partners, Jam and Jim, in the

ratio of 40%, 60%. Salary allowance shall be also provided to each partner:

annual salary for Jam of P60,000 and 3/4 of Jam's salary will be given to Jim

yearly. Bonus shall be 50% of net income. The average capital of the

partners is P20,000 and P30,000, respectively.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,