Net present value c. The internal rate of return is between what two whole discount rates (e.g., between 10 % and 11%, between 11% and 125 and 13%, between 13% and 14%, etc.)? The internal rate of return is between and %

Net present value c. The internal rate of return is between what two whole discount rates (e.g., between 10 % and 11%, between 11% and 125 and 13%, between 13% and 14%, etc.)? The internal rate of return is between and %

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 4PROB

Related questions

Question

2.

Transcribed Image Text:ces

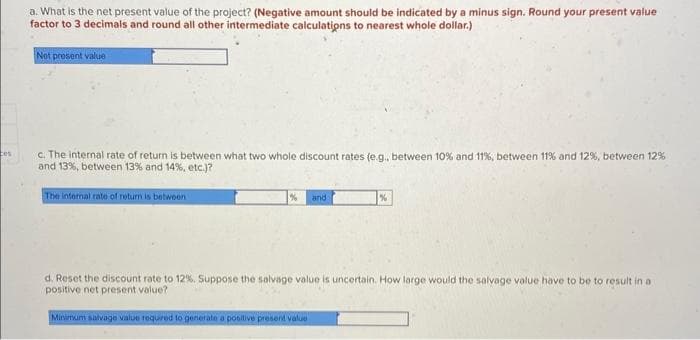

a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value

factor to 3 decimals and round all other intermediate calculations to nearest whole dollar.)

Net present value

c. The internal rate of return is between what two whole discount rates (e.g., between 10% and 11%, between 11% and 12 %, between 12%

and 13%, between 13% and 14%, etc.)?

The internal rate of return is between

and

Minimum salvage value required to generate a positive present value

%

d. Reset the discount rate to 12%. Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a

positive net present value?

Transcribed Image Text:es

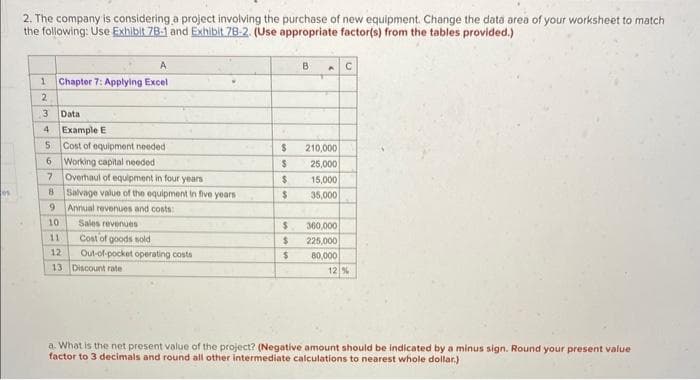

2. The company is considering a project involving the purchase of new equipment. Change the data area of your worksheet to match

the following: Use Exhibit 78-1 and Exhibit 78-2. (Use appropriate factor(s) from the tables provided.)

A

1 Chapter 7: Applying Excel

2

3

4

Data

Example E

Cost of equipment needed

Working capital needed

Overhaul of equipment in four years

8 Salvage value of the equipment in five years.

9

Annual revenues and costs:

5

6

7

Sales revenues

Cost of goods sold

Out-of-pocket operating costs

10

11

12

13 Discount rate

$

$

$

$

$

$

$

B

210,000

25,000

15,000

35,000

360,000

225,000

80,000

C

12 %

a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value

factor to 3 decimals and round all other intermediate calculations to nearest whole dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning