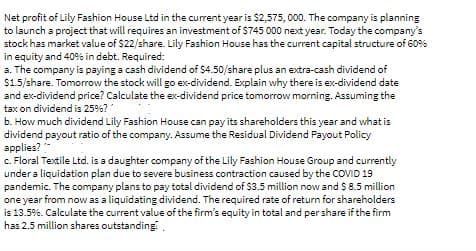

Net profit of Lily Fashion House Ltd in the current year is $2,575, 000. The company is planning to launch a project that will requires an investment of $745 000 next year. Today the company's stock has market value of $22/share. Lily Fashion House has the current capital structure of 60% in equity and 409% in debt. Required: a. The company is paying a cash dividend of $4.50/share plus an extra-cash dividend of $1.5/share. Tomorrow the stock will go ex-dividend. Explain why there is ex-dividend date and ex-dividend price? Calculate the ex-dividend price tomorrow morning. Assuming the tax on dividend is 25%? b. How much dividend Lily Fashion House can pay its shareholders this year and what is dividend payout ratio of the company. Assume the Residual Dividend Payout Policy applies? c. Floral Textile Ltd. is a daughter company of the Lily Fashion House Group and currently under a liquidation plan due to severe business contraction caused by the COVID 19 pandemic. The company plans to pay total dividend of $3.5 million now and S 8.5 million one year from now as a liquidating dividend. The required rate of return for shareholders is 13.5%. Calculate the current value of the firm's equity in total and per share if the firm has 2.5 million shares outstanding.

Net profit of Lily Fashion House Ltd in the current year is $2,575, 000. The company is planning to launch a project that will requires an investment of $745 000 next year. Today the company's stock has market value of $22/share. Lily Fashion House has the current capital structure of 60% in equity and 409% in debt. Required: a. The company is paying a cash dividend of $4.50/share plus an extra-cash dividend of $1.5/share. Tomorrow the stock will go ex-dividend. Explain why there is ex-dividend date and ex-dividend price? Calculate the ex-dividend price tomorrow morning. Assuming the tax on dividend is 25%? b. How much dividend Lily Fashion House can pay its shareholders this year and what is dividend payout ratio of the company. Assume the Residual Dividend Payout Policy applies? c. Floral Textile Ltd. is a daughter company of the Lily Fashion House Group and currently under a liquidation plan due to severe business contraction caused by the COVID 19 pandemic. The company plans to pay total dividend of $3.5 million now and S 8.5 million one year from now as a liquidating dividend. The required rate of return for shareholders is 13.5%. Calculate the current value of the firm's equity in total and per share if the firm has 2.5 million shares outstanding.

Chapter2: The Domestic And International Financial Marketplace

Section2.A: Taxes

Problem 5P

Related questions

Question

Transcribed Image Text:Net profit of Lily Fashion House Ltd in the current year is $2,575, 000. The company is planning

to launch a project that will requires an investment of $745 000 next year. Today the company's

stock has market value of $22/share. Lily Fashion House has the current capital structure of 60%

in equity and 409% in debt. Required:

a. The company is paying a cash dividend of $4.50/share plus an extra-cash dividend of

$1.5/share. Tomorrow the stock will go ex-dividend. Explain why there is ex-dividend date

and ex-dividend price? Calculate the ex-dividend price tomorrow morning. Assuming the

tax on dividend is 25%?

b. How much dividend Lily Fashion House can pay its shareholders this year and what is

dividend payout ratio of the company. Assume the Residual Dividend Payout Policy

applies?

c. Floral Textile Ltd. is a daughter company of the Lily Fashion House Group and currently

under a liquidation plan due to severe business contraction caused by the COVID 19

pandemic. The company plans to pay total dividend of $3.5 million now and S 8.5 million

one year from now as a liquidating dividend. The required rate of return for shareholders

is 13.5%. Calculate the current value of the firm's equity in total and per share if the firm

has 2.5 million shares outstanding.

Expert Solution

Step 1

Step 2

Step by step

Solved in 4 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning