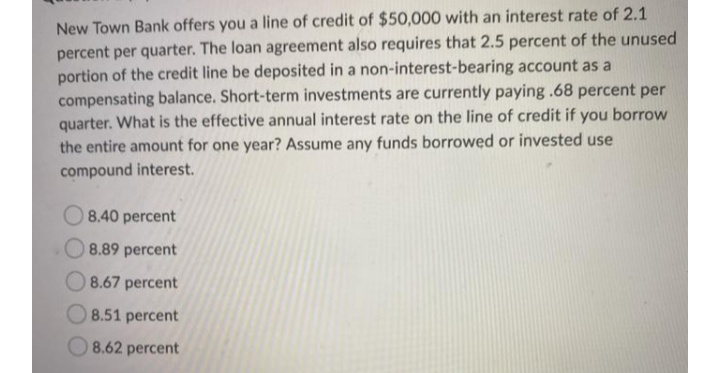

New Town Bank offers you a line of credit of $50,000 with an interest rate of 2.1 percent per quarter. The loan agreement also requires that 2.5 percent of the unused portion of the credit line be deposited in a non-interest-bearing account as a compensating balance. Short-term investments are currently paying.68 percent per quarter. What is the effective annual interest rate on the line of credit if you borrow the entire amount for one year? Assume any funds borrowed or invested use compound interest. O 8.40 percent 8.89 percent 08.67 percent 0 8.51 percent 8.62 percent

New Town Bank offers you a line of credit of $50,000 with an interest rate of 2.1 percent per quarter. The loan agreement also requires that 2.5 percent of the unused portion of the credit line be deposited in a non-interest-bearing account as a compensating balance. Short-term investments are currently paying.68 percent per quarter. What is the effective annual interest rate on the line of credit if you borrow the entire amount for one year? Assume any funds borrowed or invested use compound interest. O 8.40 percent 8.89 percent 08.67 percent 0 8.51 percent 8.62 percent

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 30P

Related questions

Question

Transcribed Image Text:New Town Bank offers you a line of credit of $50,000 with an interest rate of 2.1

percent per quarter. The loan agreement also requires that 2.5 percent of the unused

portion of the credit line be deposited in a non-interest-bearing account as a

compensating balance. Short-term investments are currently paying .68 percent per

quarter. What is the effective annual interest rate on the line of credit if you borrow

the entire amount for one year? Assume any funds borrowed or invested use

compound interest.

8.40 percent

8.89 percent

O 8.67 percent

8.51 percent

8.62 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College