ng, the per-share price, and the debt-to-equity ratio for Focus if it adopts the proposed recapitalization. nd the return on equity (ROE) for Focus under the current and proposed capital structures. e for both capital structures. both capital structures. ng for Focus if it adopts the proposed recapitalization is shares. (Round to the nearest whole number.) dopts the proposed recapitalization is $ (Round to the nearest dollar.) (Round to two decimal places.) it adopts the proposed recapitalization is r Focus under the current capital structure is $ (Round to the nearest cent.) Focus under the proposed capital structure is $ (Round to the nearest cent.)

ng, the per-share price, and the debt-to-equity ratio for Focus if it adopts the proposed recapitalization. nd the return on equity (ROE) for Focus under the current and proposed capital structures. e for both capital structures. both capital structures. ng for Focus if it adopts the proposed recapitalization is shares. (Round to the nearest whole number.) dopts the proposed recapitalization is $ (Round to the nearest dollar.) (Round to two decimal places.) it adopts the proposed recapitalization is r Focus under the current capital structure is $ (Round to the nearest cent.) Focus under the proposed capital structure is $ (Round to the nearest cent.)

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 4P

Related questions

Question

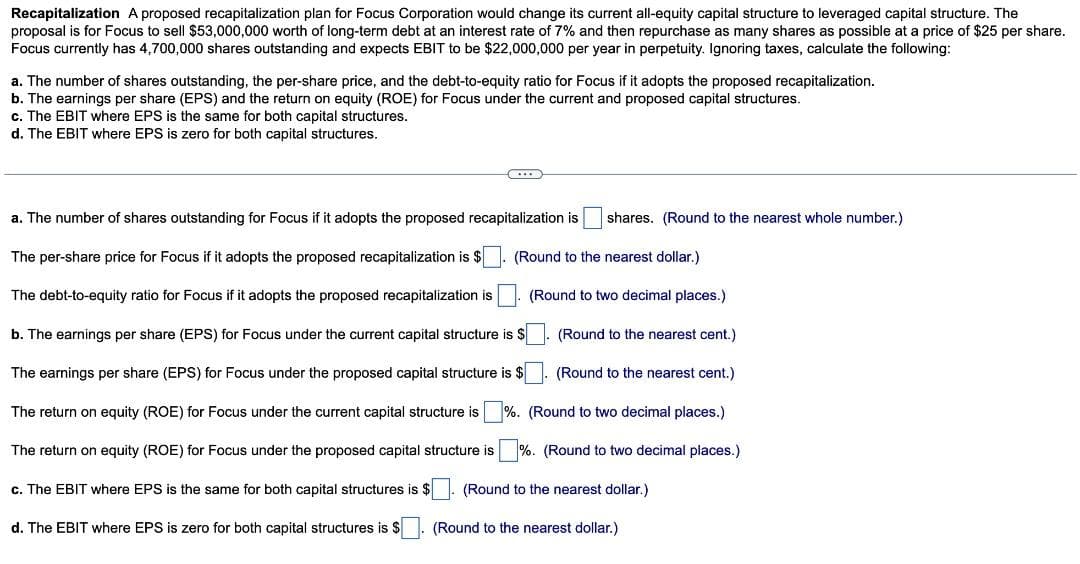

Transcribed Image Text:Recapitalization A proposed recapitalization plan for Focus Corporation would change its current all-equity capital structure to leveraged capital structure. The

proposal is for Focus to sell $53,000,000 worth of long-term debt at an interest rate of 7% and then repurchase as many shares as possible at a price of $25 per share.

Focus currently has 4,700,000 shares outstanding and expects EBIT to be $22,000,000 per year in perpetuity. Ignoring taxes, calculate the following:

a. The number of shares outstanding, the per-share price, and the debt-to-equity ratio for Focus if it adopts the proposed recapitalization.

b. The earnings per share (EPS) and the return on equity (ROE) for Focus under the current and proposed capital structures.

c. The EBIT where EPS is the same for both capital structures.

d. The EBIT where EPS is zero for both capital structures.

a. The number of shares outstanding for Focus if it adopts the proposed recapitalization is shares. (Round to the nearest whole number.)

(Round to the nearest dollar.)

(Round to two decimal places.)

The per-share price for Focus if it adopts the proposed recapitalization is $

The debt-to-equity ratio for Focus if it adopts the proposed recapitalization is

b. The earnings per share (EPS) for Focus under the current capital structure is $

The earnings per share (EPS) for Focus under the proposed capital structure is $

The return on equity (ROE) for Focus under the current capital structure is %.

The return on equity (ROE) for Focus under the proposed capital structure is

c. The EBIT where EPS is the same for both capital structures is $

(Round to the nearest cent.)

(Round to the nearest cent.)

(Round to two decimal places.)

%. (Round to two decimal places.)

(Round to the nearest dollar.)

d. The EBIT where EPS is zero for both capital structures is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Can you explain on how to find the calculations for all parts for B, C and D? This is where it gets confusing.

Solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning